The following tweet tells you everything you need to know about the state of the US financial system today…

The media will focus on ridiculing President Trump for being “un-Presidential” or some such thing.

They are missing the bigger picture here.

The bigger picture is an implicit admission, by the most powerful person in the world, that the stock market is directly linked to GDP growth… and that the Fed HAS to inflate both for the system to properly function.

What President Trump is really tweeting about is this:

In a financial system as leveraged as this, the single most important thing is to avoid the dreaded “d” word…debt deflation.

Debt deflation is the process through which debt falls in value. When it hits, the entire financial system experiences a kind of “margin call” and begins to implode.

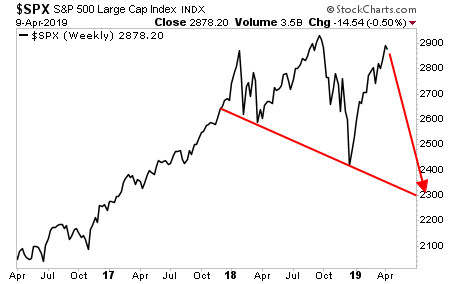

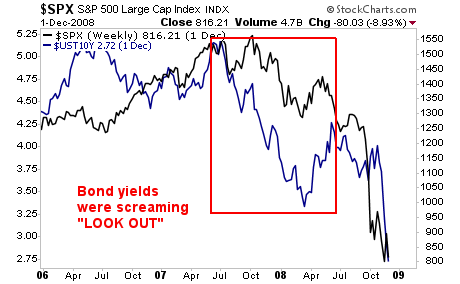

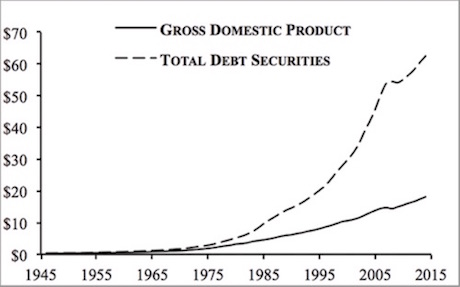

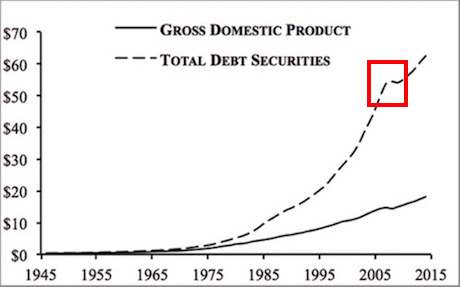

If you think I’m being dramatic here, consider that the debt deflation that triggered 2008 crisis, the crisis in which the entire financial system nearly went under, is that tiny dip in the red square below:

THIS is why debt deflation is so terrifying to powerful people, the President included: in a system as leveraged as the US financial system today, even tiny amount of debt deflation can trigger a systemic reset.

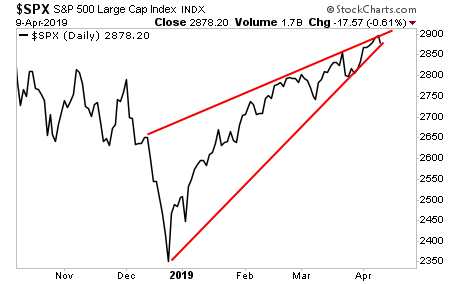

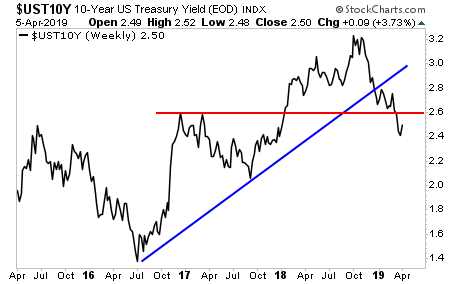

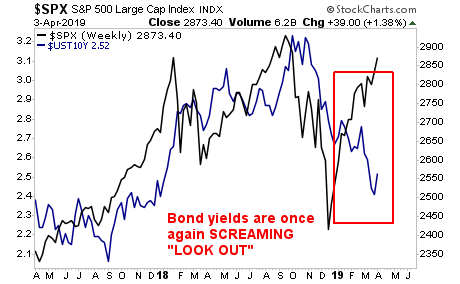

The dirty little secret is President Trump didn’t mention in his tweet is that we just began to experience another bout of debt deflation in December 2018.

This is why the Fed panicked and abandoned its attempts at raising rates or shrinking is balance sheet.

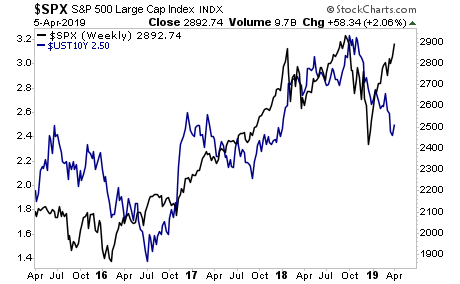

It’s also why everyone at the top of the financial/ political pyramid (the Secretary of the Treasury, the President’s economic advisors, even the President himself, is urging the Fed to start printing money aggressively now.

They know that something truly horrific is unfolding “behind the scenes” right now.

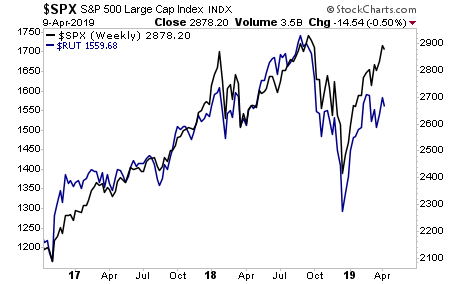

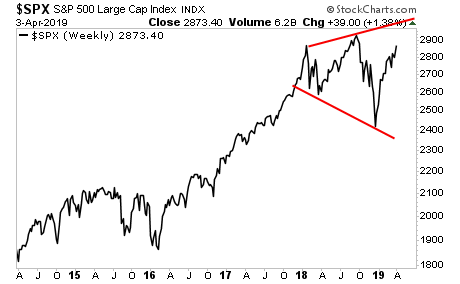

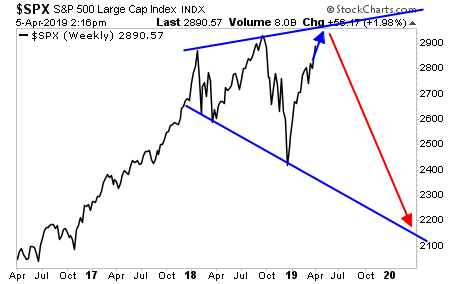

The market knows it too… though the media is doing its best to avoid showing you this chart:

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research