The markets are a sea of red this morning…

I’ve been warning for weeks that a collapse was coming… and now it is here.

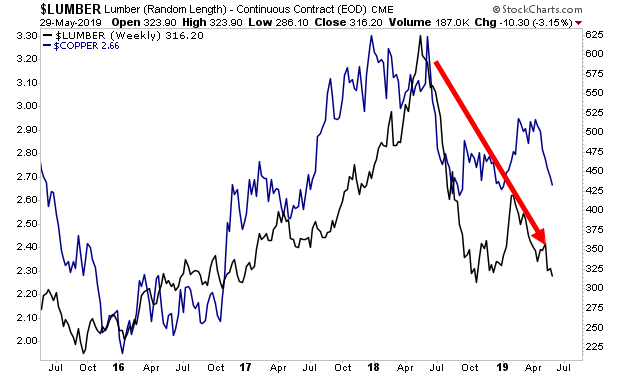

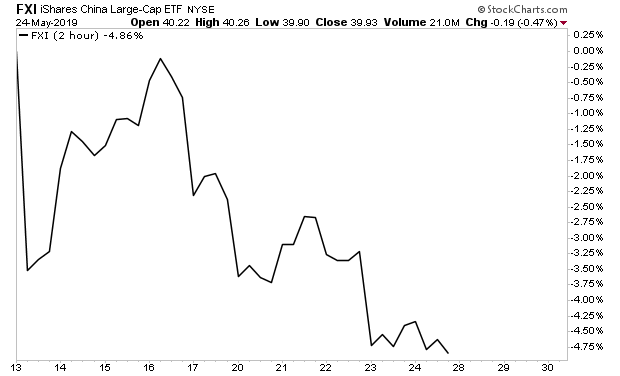

The markets have finally woken up to the fact that the US and China will NOT be reaching a trade deal… and that the global economy is contracting.

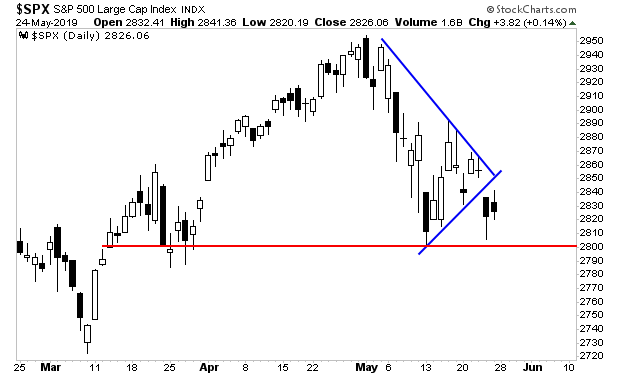

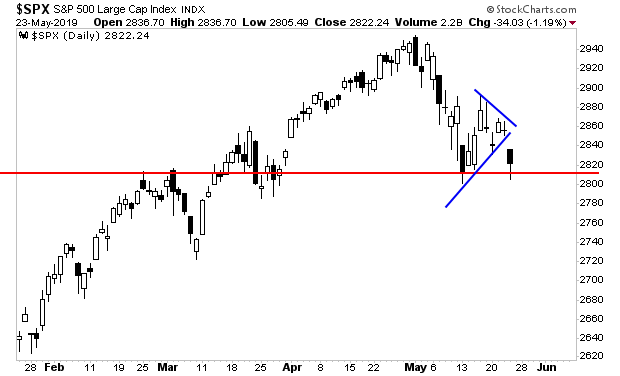

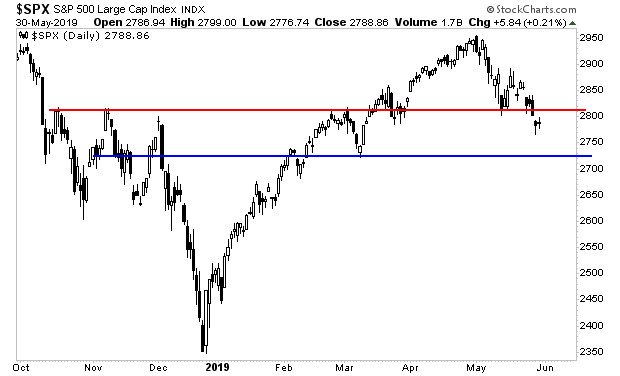

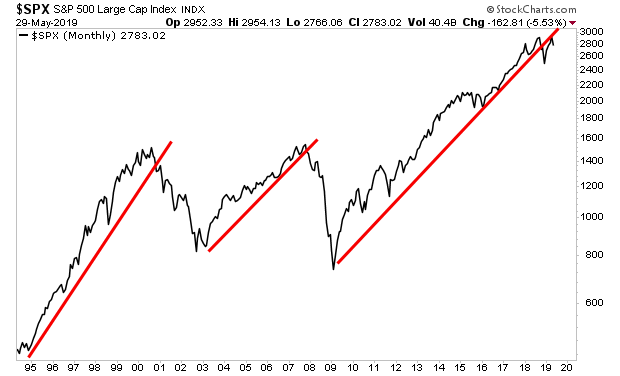

Stocks have taken out critical support (red line). The next stop will be in the lower 2,700s (blue line).

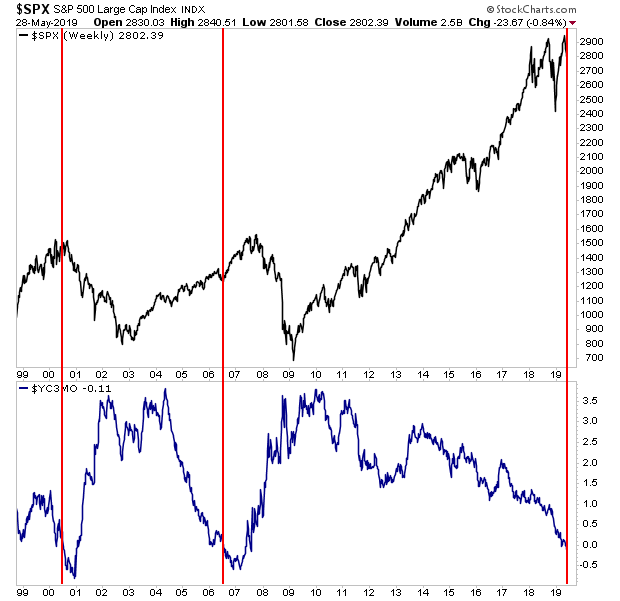

Yes, we will get bounces here and there, but the bull market is officially OVER.

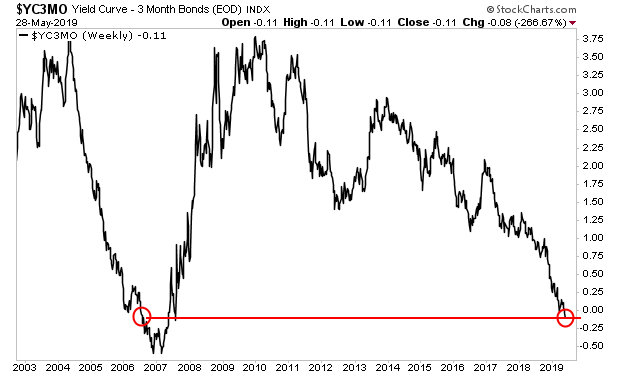

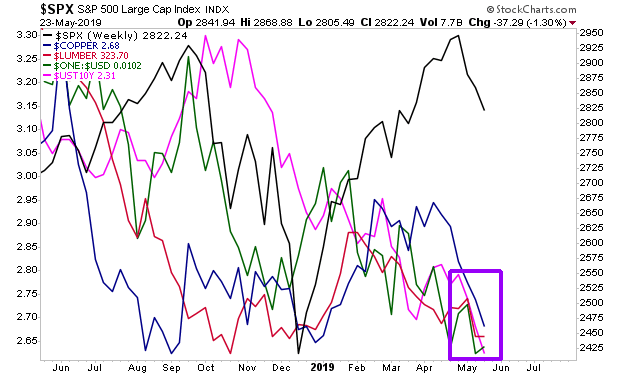

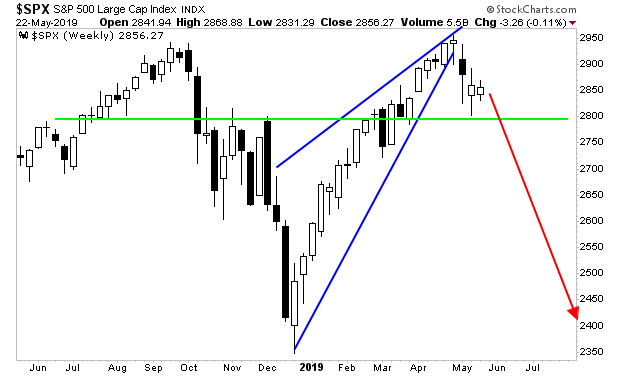

Stocks have been warning about this for months, but everyone was too short-sighted… focusing on the last 12 months’ performance… to see the BIG PICTURE.

Here it is…

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 11 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research