The trade deal is dead… stocks just don’t know it yet.

Stocks continue to cling to hope that somehow, the US and China will come to an agreement. There will be no agreement for two simple reasons:

1) China will not allow itself to look weak by making concessions.

2) The Trump administration is not comprised of the usual weak-willed DC bureaucrats.

You can argue with me on either of those points, but the “smart” assets in the financial system already have told us what’s coming.

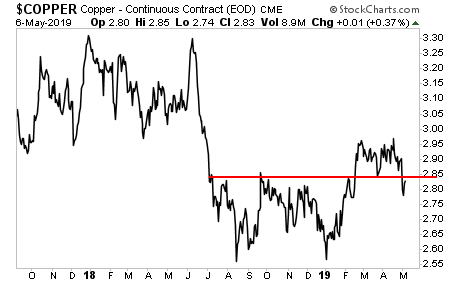

Coppers which is closely aligned to economic growth, has shown us that global peace… and prosperity are not just around the corner. Unlike stocks, Copper never even came close to reclaiming its former high. It is now trapped beneath major resistance.

————————————————-

This Might Be the Best Options Trading System on the Planet

Since 2015, this trading system has produced average annual gains of OVER 50%

I’m not talking about a over 50% gain on a single trade… I’m talking gains of OVER 50% per year on the ENTIRE portfolio.

Just yesterday we locked in a 20% gain on a trade we held for only two days.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 3 slots left for potential subscribers.

To lock in one of the last slots…

————————————————-

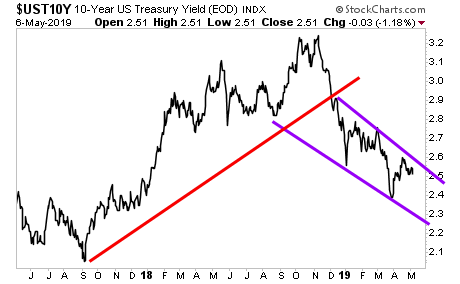

Bond yields are another “smart” asset class that is telling us to get defensive and NOW. The yield on the 10-Year Us Treasury has broken the uptrend formed by the “global synchronized growth” of 2018 (red line). It is now in a clear downtrend (purple lines).

Bond yields fall when economic growth is contracting. The fact that Treasury yields are now even lower than they were during the December 2018 meltdown tells us that globally the world is in a truly precarious state.

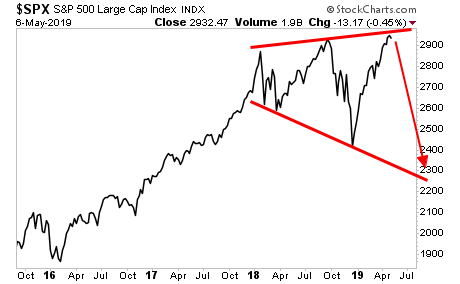

So what happens to stocks when they wake up to what Copper and Bond Yields have already figured out?

A crash is coming. And smart investors are preparing for it now before it hits.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 33 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research