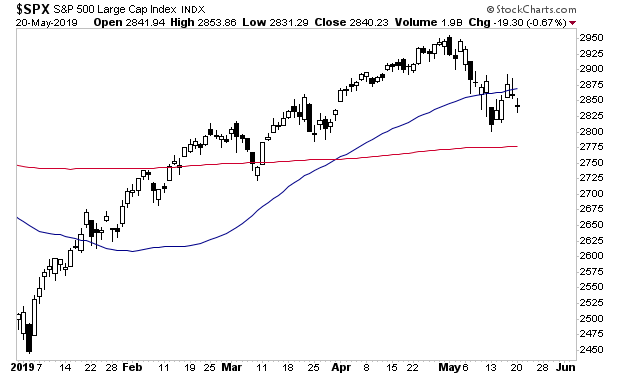

Stocks continue to struggle below their 50-day moving average (DMA).

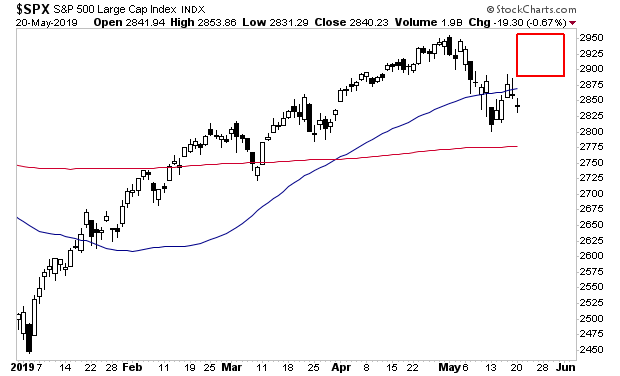

I still think we’ve got a bit higher to go in the near-term… most likely the S&P 500 will top out somewhere in that red box later this month/ early June.

After that, it’s DOWN we go… as deflation takes hold of the financial system.

Most asset classes have already begun their deflationary moves. It’s a little known fact that stocks are ALWAYS the last to “get it.”

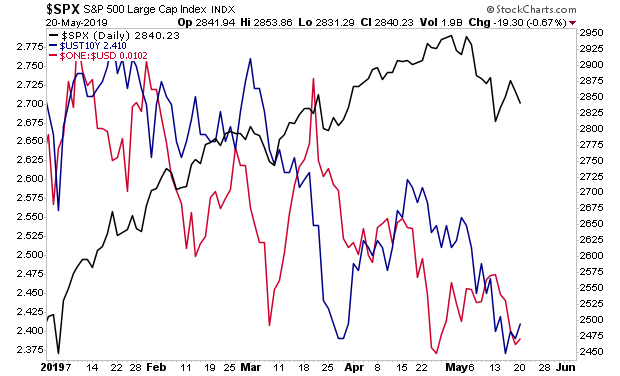

Indeed, both the currency and bond markets are telling us a MAJOR meltdown is coming.

The $USD (inverted in the chart below) and bond yields (blue line) both show us where the market is ultimately heading… for the S&P 500, it’s somewhere in the 2,400s.

You’ve got, at most, 2-3 weeks to prepare for this…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 7 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research