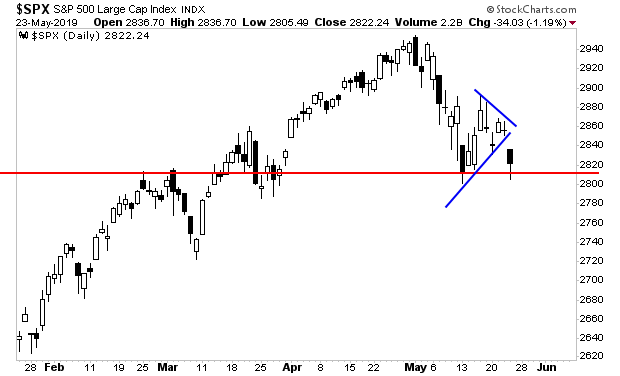

Stocks dropped hard out of their triangle formation (blue lines) yesterday, but the bears couldn’t finish the job… and the S&P 500 held support (red line).

This opens the door to a bounce into early next week… but I wouldn’t count on much other than a dead cat bounce to the 2,880s or so.

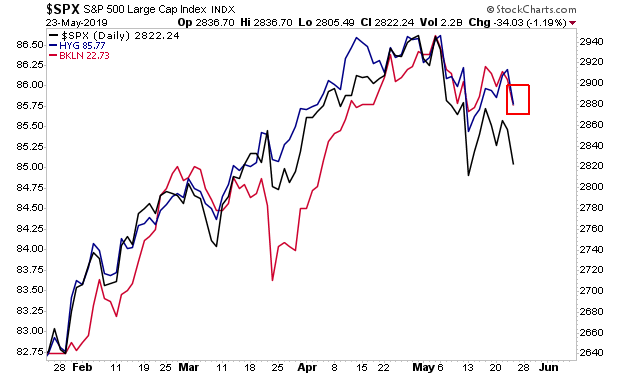

This is where Junk Bonds and Leveraged Loans (two other risk measures that usually lead stocks) are hanging out (red box in chart below).

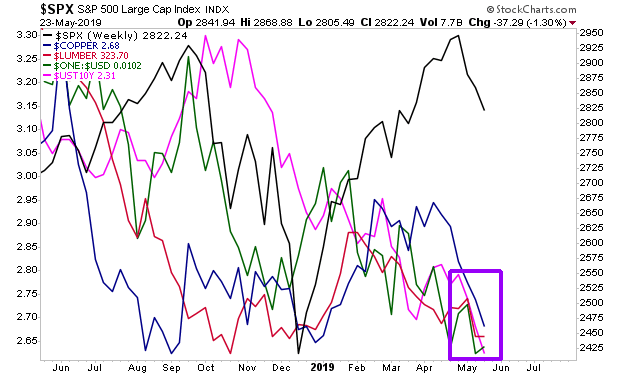

Indeed, Copper, Lumber, the $USD (inverted) and the yield on the 10-Year Treasury, ALL suggest fair value for the S&P 500 is down around the 2,400s.

I’m not saying we’ll get there next week… but that is coming sometime in June.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 9 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research