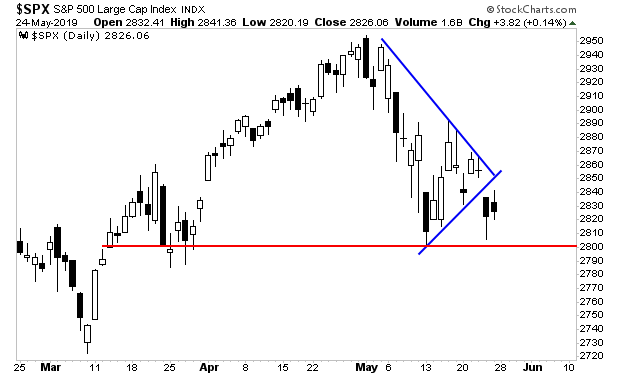

The market remains in “no man’s land.”

The S&P 500 has broken its triangle formation (blue lines)… but the bears just can’t take out support (red line).

Part of this is because the Trump administration continues to “dangle the carrot” of a possible China deal in front of the markets… the other part is that the bulls are not ready to fully capitulate.

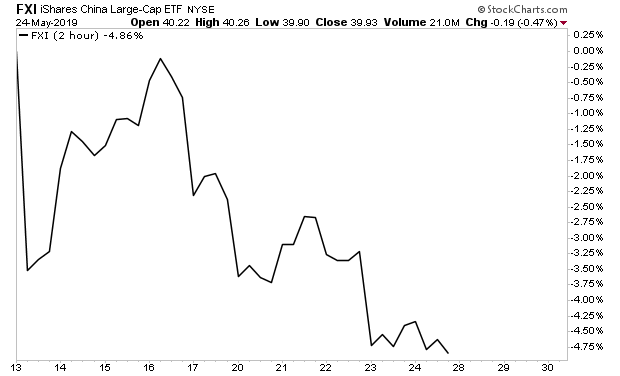

However, the fact is… if a China deal was coming, Chinese stocks sure don’t know it… they’ve fallen nearly 5% in the last two weeks alone… the trend here is sharply down with few bounces…

The truth is… no trade deal is coming… the markets simply aren’t ready to accept it yet…

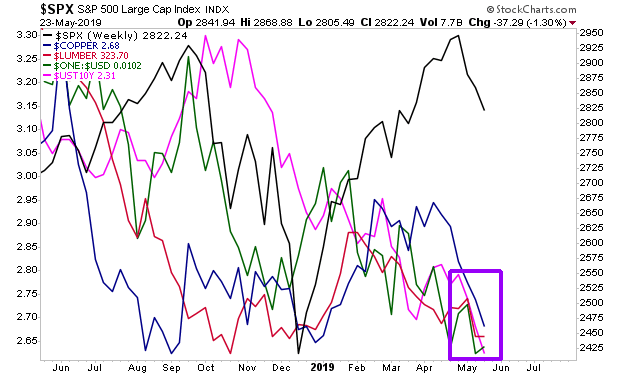

How do I know?

Copper, Lumber, the $USD (inverted) and the yield on the 10-Year Treasury, are ALL telling us…

Stocks (the black line) are the only asset class that continue hang on to hype and hope… everything else knows there will be NO trade deal… and the global economy is contracting…

Stocks are in for a SHARP collapse…

I’m not saying we’ll get there next week… but that is coming sometime in June.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 19 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research