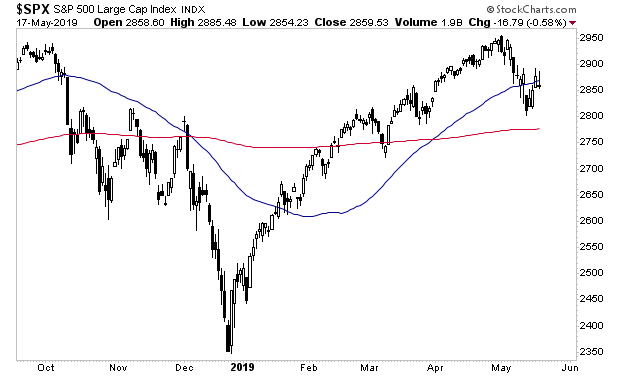

Now comes the “depression stage”

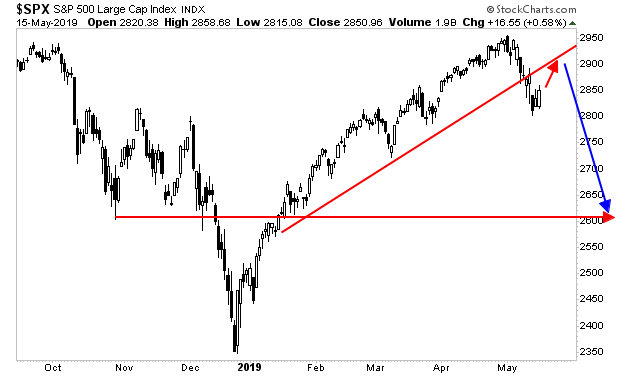

Earlier this month I noted that the market is following the five stages of grieving regarding the US/ China trade deal. Those stages are: denial, anger, bargaining, depression and acceptance.

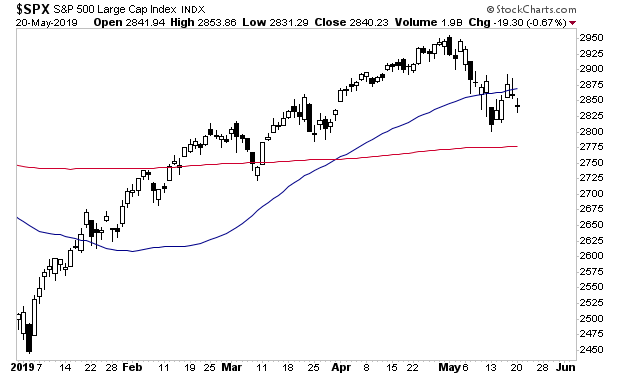

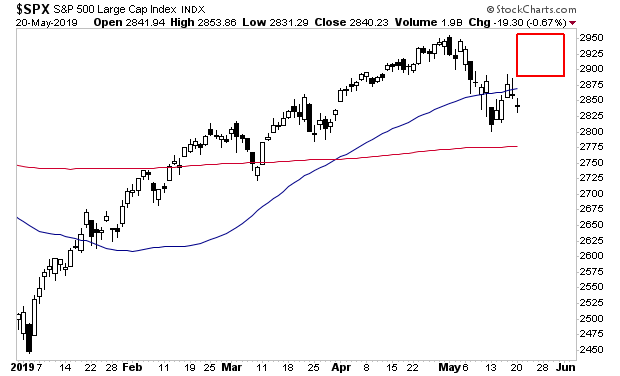

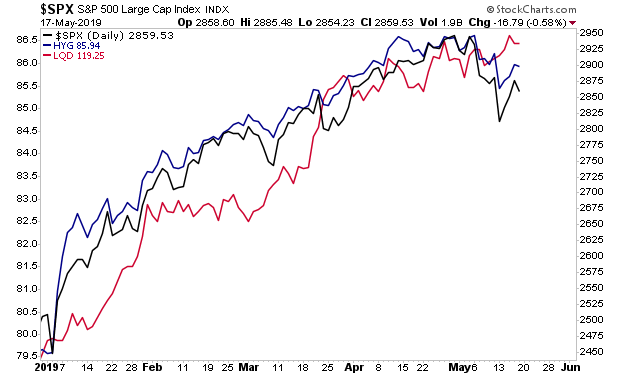

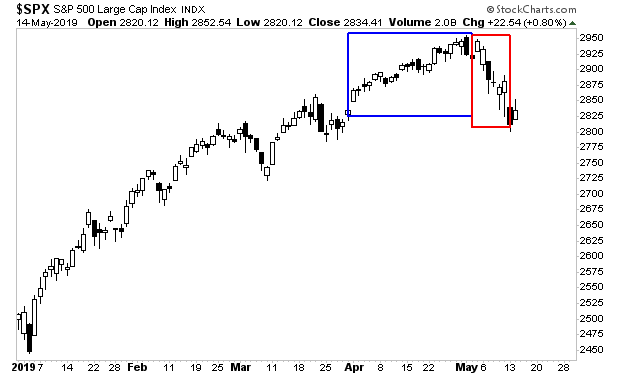

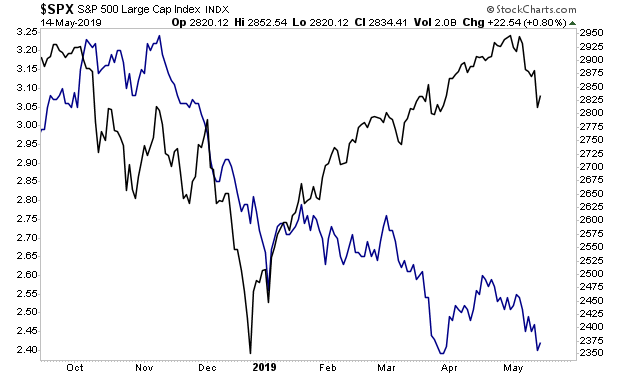

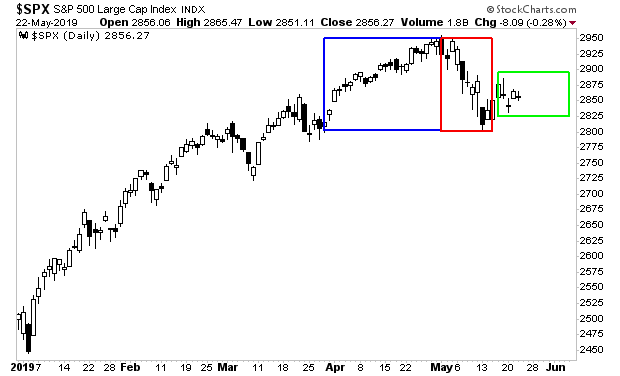

The “denial stage” was most of April… when it was plain as day a trade deal was not coming… but stocks kept holding up… that is represented by the blue square in the chart below.

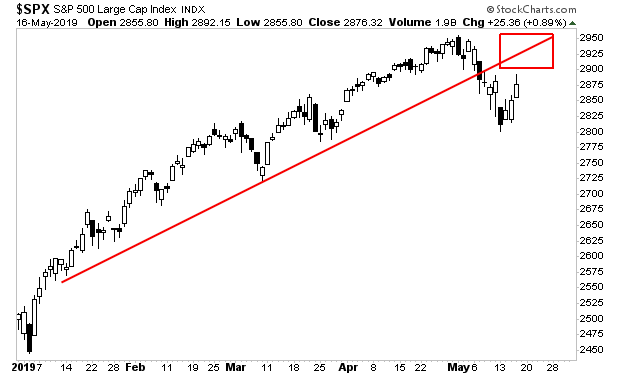

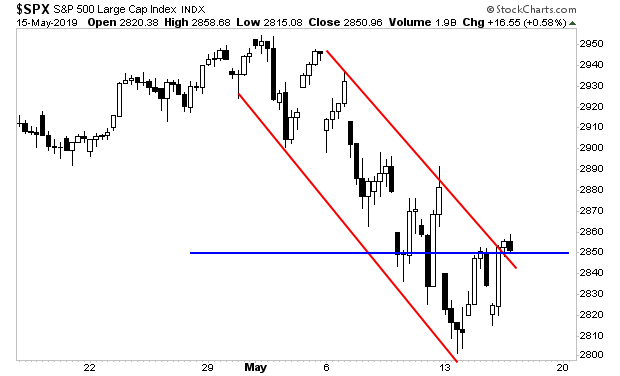

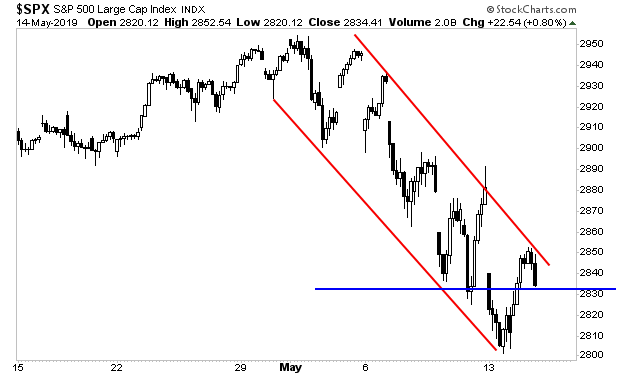

The “anger stage” started with a vengeance in May… when the market entered a multi-week drop. That stage is represented by the red square in the chart below.

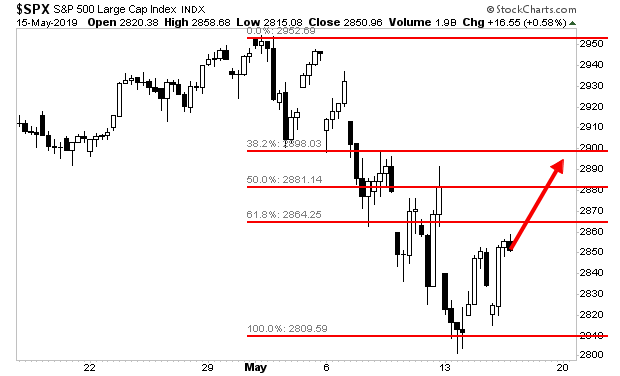

The markets have been in the “bargaining” stage over the last two weeks… as they waver back and forth with the hope that somehow the US and China might be able to come to an agreement. That stage is the green square in the chart below…

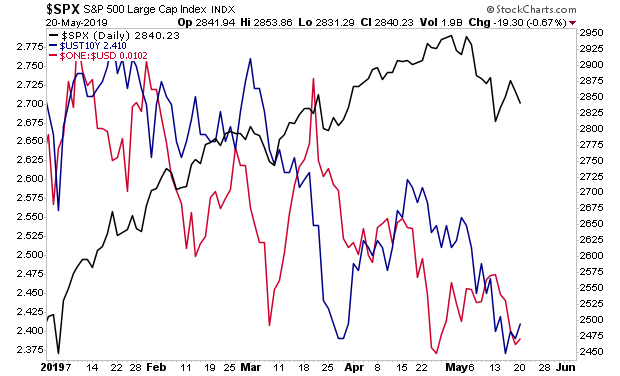

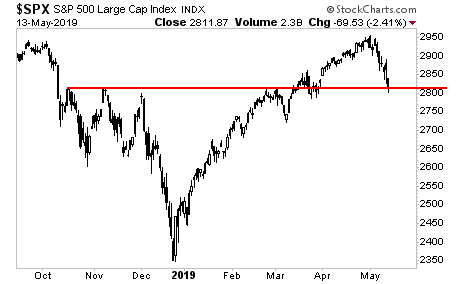

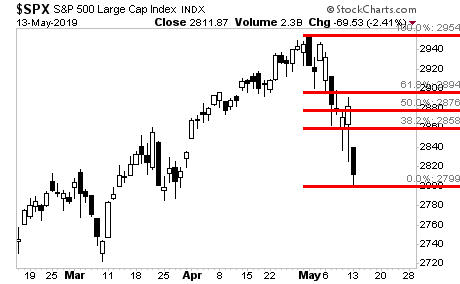

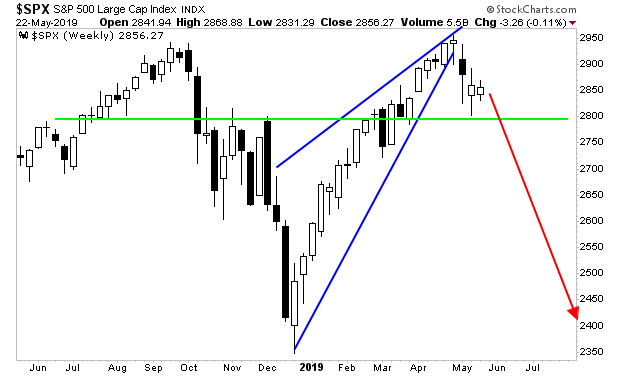

That is now ending… yesterday Treasury Secretary Steve Mnuchin confirmed that the US has NO plans to speaking with Chinese officials in the near future…

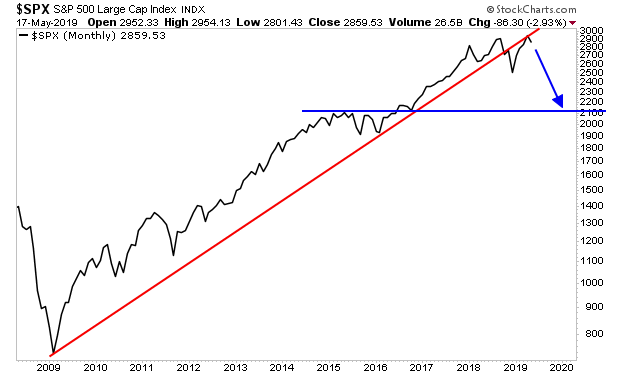

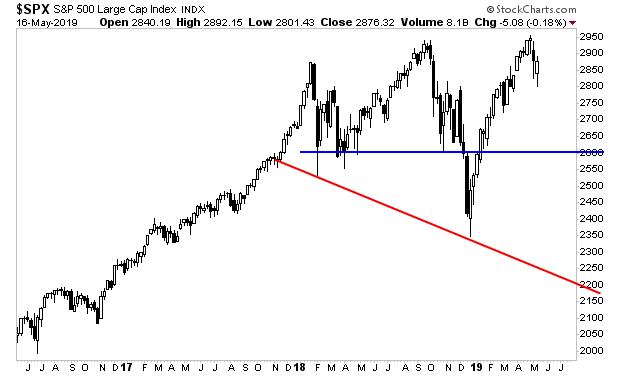

Which means… next up is the DEPRESSION stage… as the markets realize it’s GAME OVER.

That move is about to hit…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 3 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research