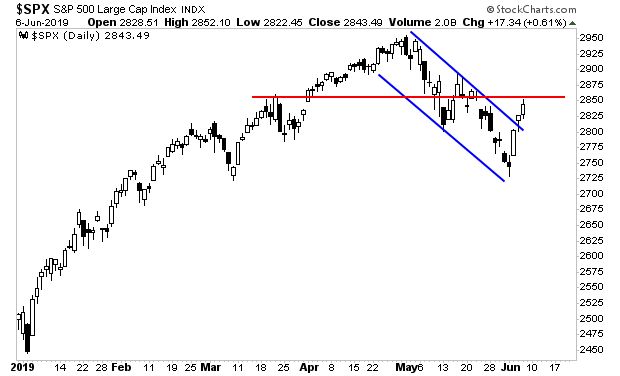

Stocks caught a bid yesterday, breaking their downtrend (blue lines in the chart below) and closing the gap from mid-May… the S&P 500 is now challenging critical resistance at 2,860 or so (red line in the chart below).

A break higher here would open the door a retest of the all-time highs.

Given the Trump administration’s propensity for suggesting bullish developments at critical moments… I’d wager we’re going to see some kind of “negotiations are going great with Mexico” announcement on Sunday… to insure stocks break that line and move higher.

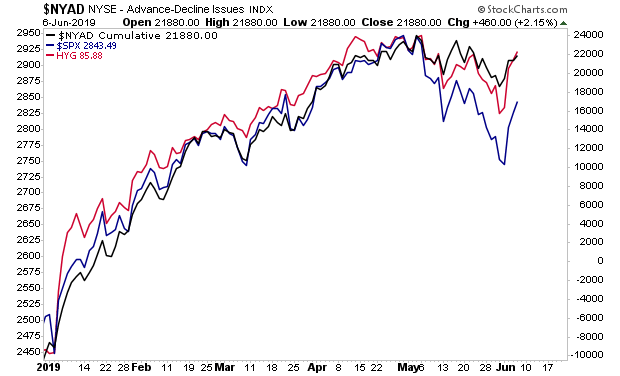

Both Junk bonds (red line in the chart below) and market breadth (black line in the chart below) suggest the S&P 500 will be making a run to at least the lows 2900s.

It’s ridiculous, I know… but that is the deal for now.

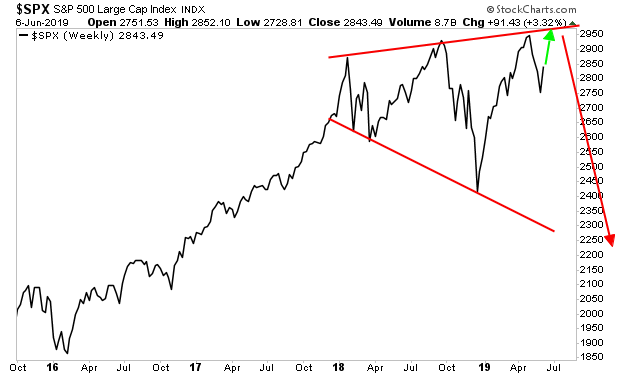

However, after that the market reaches those levels, it’s primed for a collapse.

Why?

Because the big drivers for the stock market are hopes of a trade deal between China and the US at the G-20 meeting in Osaka Japan… and hopes that the Federal Reserve will cut interest rate this month.

Both of these items will likely disappoint… in a BIG way…

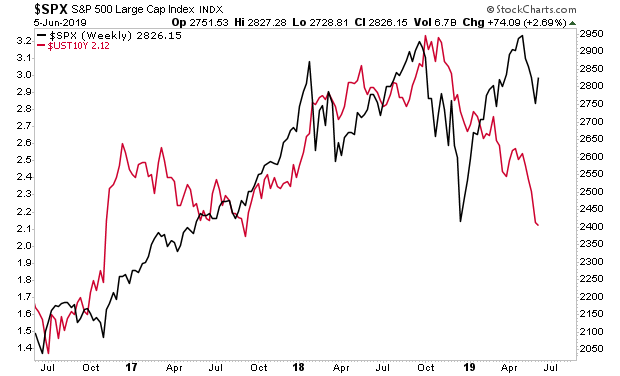

Regarding a US/ China Trade deal… if this was coming at the end of the month the Treasury market would have signaled that we are entering a period of economic stability.

That has not been the case. Treasury yields have continued to drop, telling us that the economy is weakening rapidly… and that NO trade deal is coming.

In contrast… the Fed cannot cut rates with the S&P 500 within 5% of its all-time highs.

Yes, the Fed is now in the stock market promotion business… but cutting rates with stocks above 2,900?

That seems a stretch.

Which means…

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research