The Fed blew up the Everything Bubble… and now it’s trying to “patch” it back together.

The dirty little secret from 2018 is that the Fed’s aggressive policy actually burst the bubble in bonds.

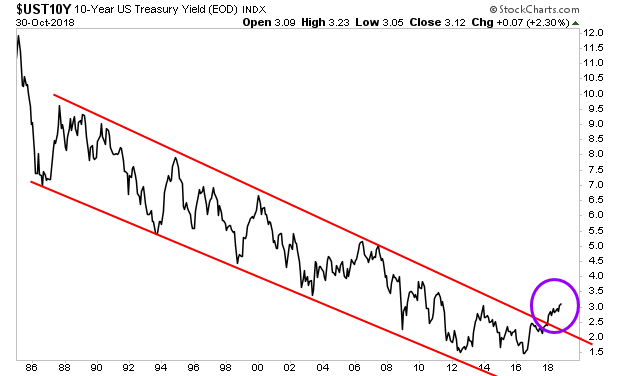

The financial media never said a word about this, but between the interest rate hikes and the $50 billion per month in Quantitative Tightening (QT), the Fed not only blew up the 30+ year bubble in Treasuries …

Purple Circle Shows the Treasury Bubble Bursting

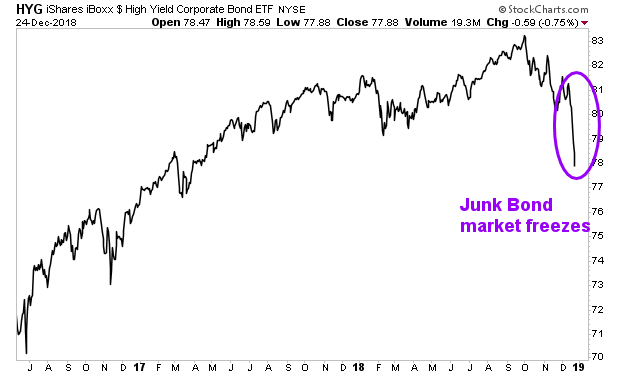

… but it also broke the High Yield credit markets… for 40 days not one company in this category was able to successfully sell a new bond on the open market.

Purple Circle Shows the Junk Bond Market Freezing

This is why the Treasury Secretary of the United States suddenly scheduled an emergency phone call to both the Fed and the Presidents’ Working Group (the Plunge Protection Team) over the 2018 December holidays…

It’s why the Fed did a sudden U-Turn in policy, dropping all talk of rate hikes and vowing to end QT this year…

And it’s why the Fed is now talking about CUTTING rates… and launching a new form of QE as soon as October of this year.

The Fed is desperately trying to “patch” over the burst Everything Bubble.

Will it succeed?

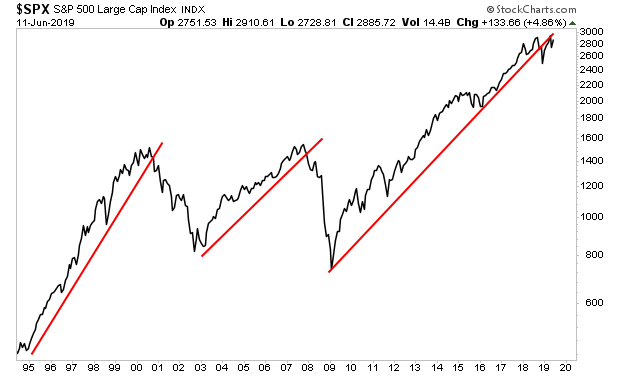

So far stocks have failed to reclaim their bull market trendline.

The last two times this happened were October of 2000 and December of 2007… just before the markets entered the Tech Crash… and the Great Financial Crisis of 2008.

Will the Fed succeed in stopping the system from experiencing another crisis?

I don’t know… but I DO KNOW that they will be introducing EXTREME monetary policies to try and stop another financial crisis from happening.

Those investors who take the right steps to prepare for those policies, will make literal fortunes.

Imagine if you’d shorted Tech Stocks in 2000…

Or if you’d shorted housing stocks in 2007…

Or if you’d bought Gold in 2003… when it was just $250 an ounce…

Those are the types of returns I’m talking about.

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research