A top is forming.

Whether it’s THE top of just A top such as the one from May remains to be seen.

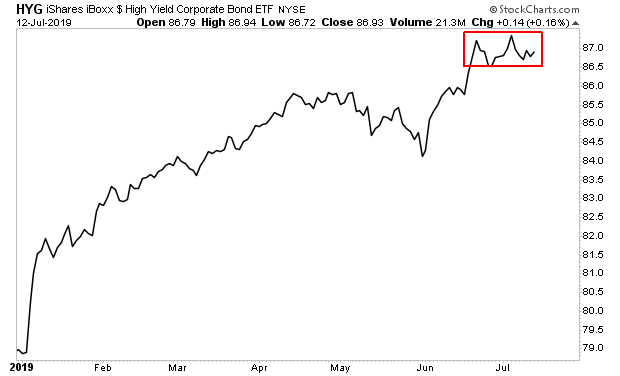

The big warning comes from junk bonds, which have lead stocks since the December lows.

As stock hit new highs, Junk Bonds have effectively traded sideways since mid-June.

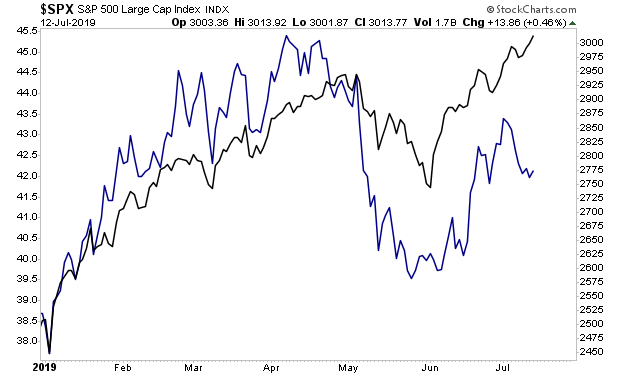

This matters a great deal because the Chinese stock market has already told us a trade deal isn’t coming.

This means the only thing driving stocks right now is hope of the Fed opening the liquidity spigots. The fact Junk Bonds are exploding higher tells us this hope is misguided.

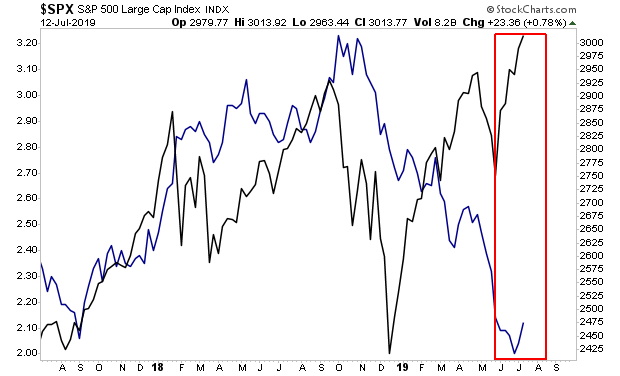

Take a look at Treasury yields vs stocks This divergence needs to close. Yields are rising, but for them to close the gap they would have to rise so high that the debt bubble burst.

This means the ONLY way for things to work out for the Fed is if stocks drop HARD and soon.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research