As I keep stating, a top is forming.

Stocks are tired after weeks of promises and promotions by Fed officials and the Trump administration that something BIG is coming.

At this point there is little if any real buyers. It’s only by multiple interventions per day that the market hasn’t broken down.

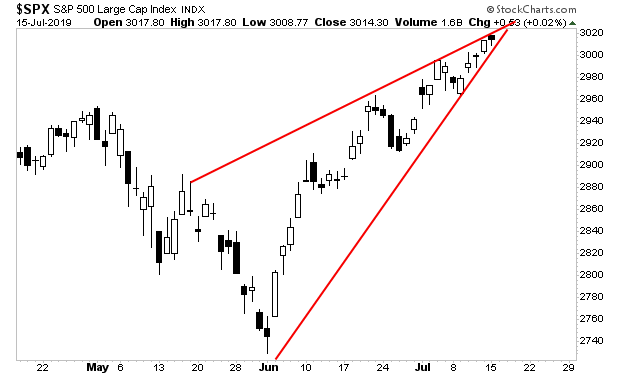

The S&P 500 is forming a textbook rising wedge formation. The Fed better deliver rate cuts in a BIG way or stocks are in serious trouble.

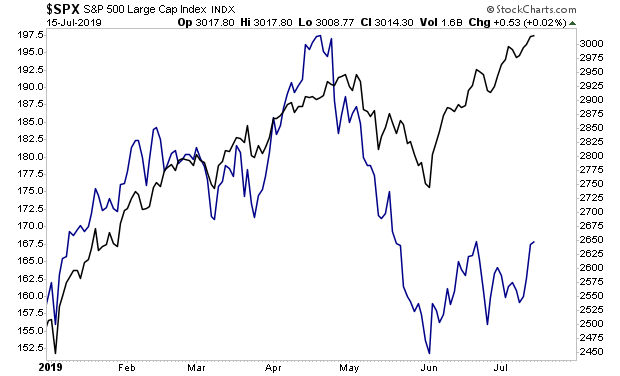

Fed Ex (FDX) is the private largest shipping company in the U.S. As such it is a great indicator for measuring real economic activity. And the broader market usually follows where FDX leads.

Based on FDX, stocks could easily fall to 2,620 if the Fed doesn’t deliver some BIG rate cuts in a few weeks.

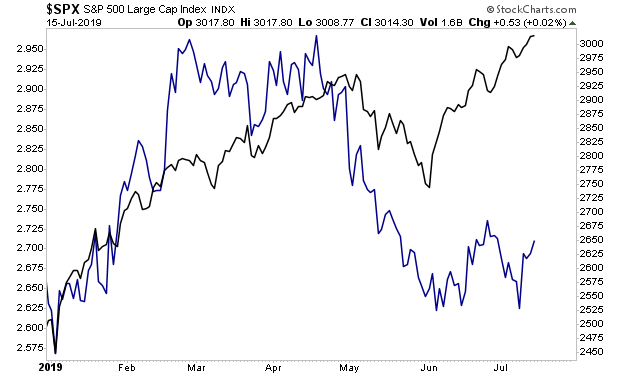

Incidentally that’s where Copper, another great economic indicator, suggests stocks will move as well.

Put simply, while the majority of investors are focusing on stocks hitting new highs, REAL economic indicators are telling us there’s trapdoor below the market today.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research