The Fed is now expanding its balance sheet at a pace of $100 billion per month.

Yes, $100 billion, despite the fact its official QE program is only $60 billion.

On an annualized basis this means the Fed is now funneling over $1 trillion into the financial system every year.

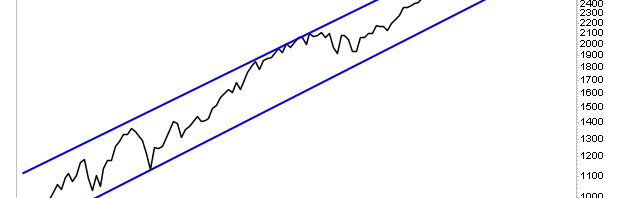

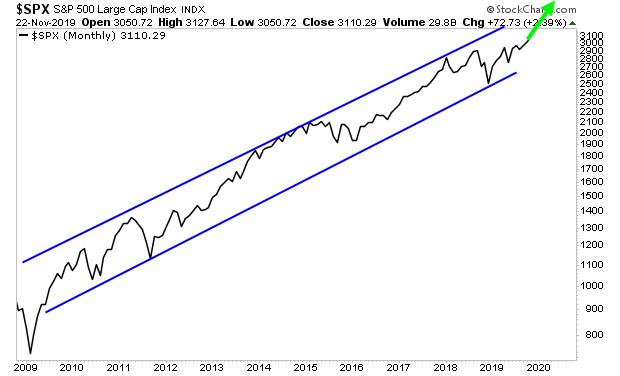

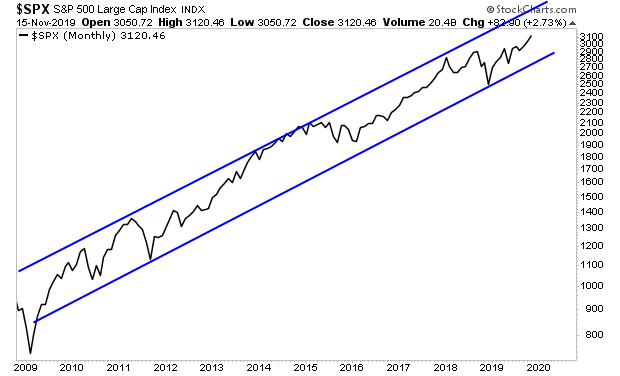

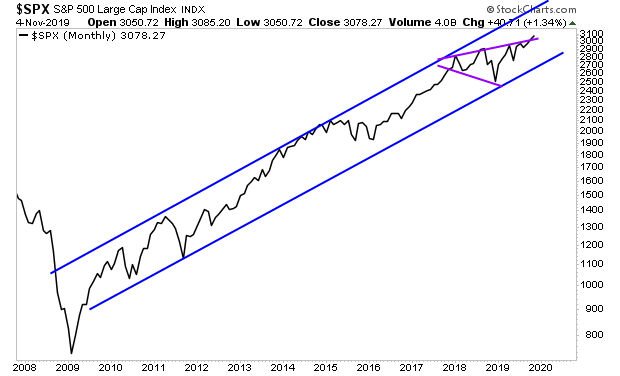

And it’s igniting the last great bull market of our lifetimes.

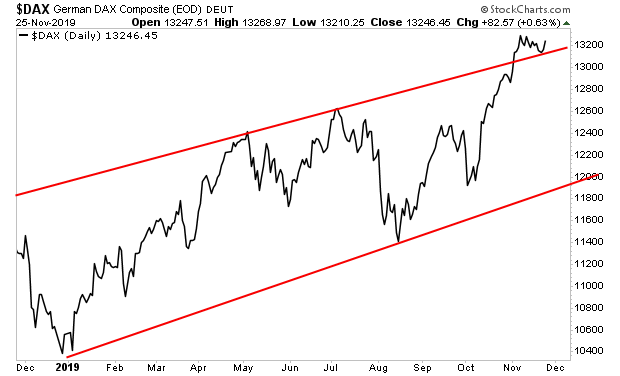

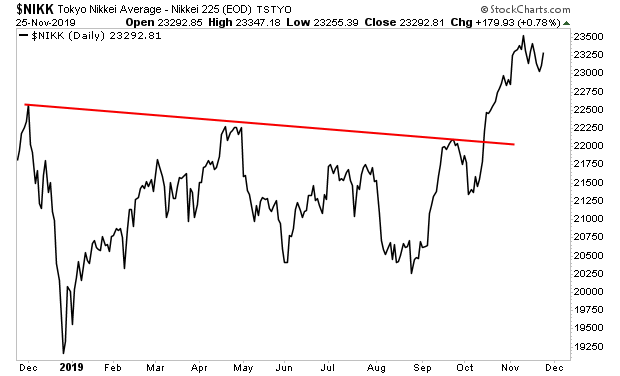

The German DAX just hit a new 52-week high.

Ditto for the Nikkei:

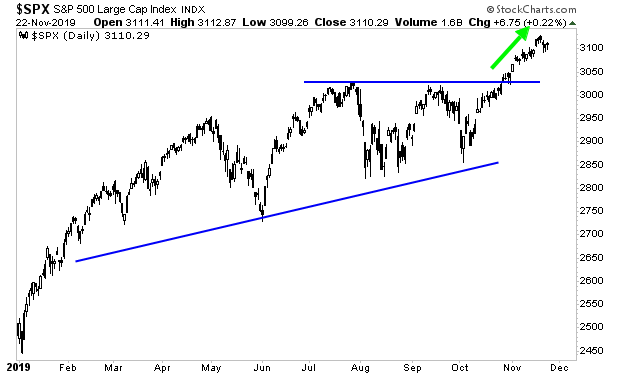

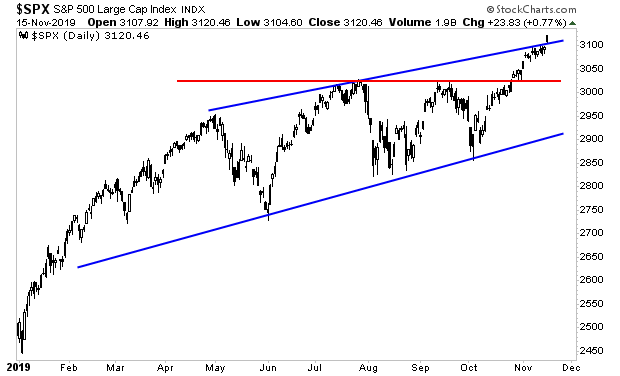

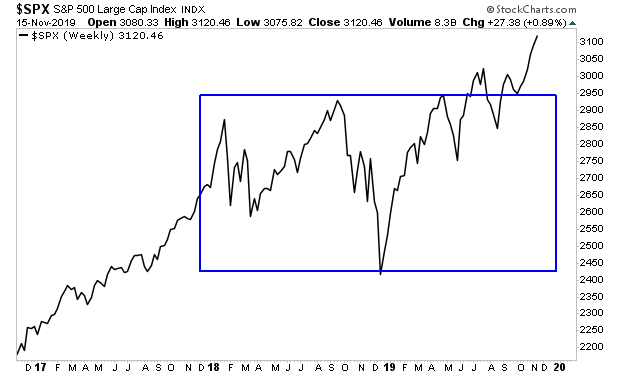

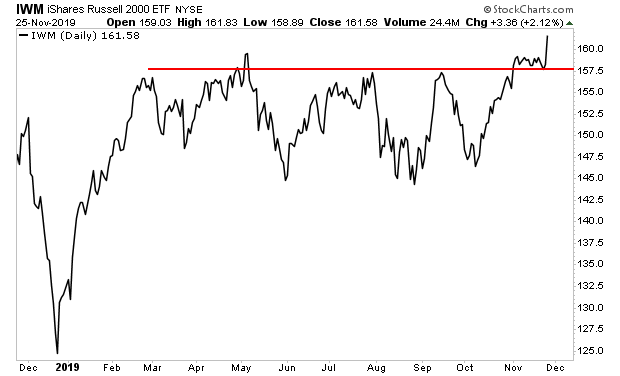

In the US most major indexes have hit new all-time highs. Even the laggards are now playing catch up.

———————————————————–

Financial Advisors HATE This!

I’ve discovered a trading strategy that takes less than 15 minutes per week… and has more than tripled investors’ money since inception.

A $30,000 investment is now worth nearly $130,000.

We are closing the doors on this product to new subscribers tonight at midnight.

As I write this, there are only three slots remaining.

———————————————————–

The Russell 2000 just hit a new 52-week high in the US.

Look, there’s no reason to overthink this. Central Banks are panicked and have started the printing presses again.

And it’s going to lead to the last great bull market of our lifetimes.

With that in mind, subscribers of my Private Wealth Advisory newsletter have recently opened five targeted trades to maximize their returns as the market melt-up continues.

As I write this, they’re already up in the double digits. And we’re just getting started,

I fully expect these plays to absolutely EXPLODE higher in the coming weeks.

We’re talking triple digit gains, EASILY.

To find out what they are, all you need to do is take out a 30-day trial subscription to Private Wealth Advisory for just $9.99.

During those 30 days you’ll receive:

1) A copy of my bestselling book, The Everything Bubble: The Endgame For Central Bank Policy.

2) Four issues of Private Wealth Advisory featuring my big picture analysis of the global economy and markets as well as…

3) At least THREE trade ideas (by the way, we’re running a 72%WIN rate on closed positions since 2015, meaning we’ve made money on more than SEVEN out of every 10 positions we’ve closed).

4) A copy of our Special Report The Great Global Wealth Graboutlining how to protect your wealth from the coming wealth taxes/wealth grabs.

All of this for just$9.99.

Today is the last day this offer will be available to the general public.

To lock in one of the slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research