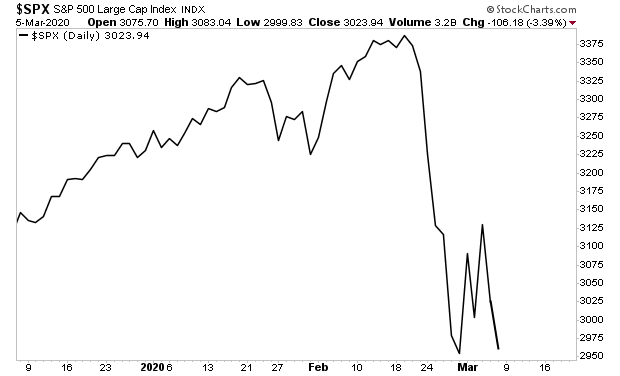

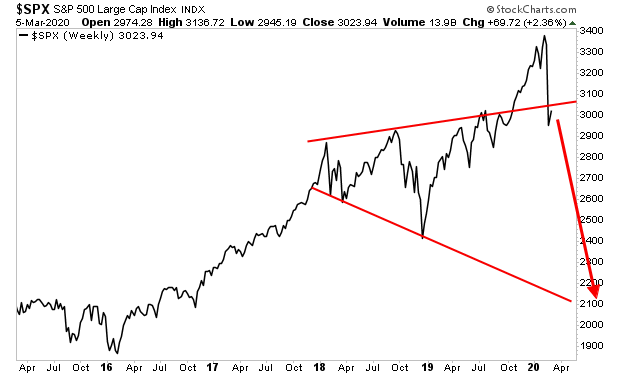

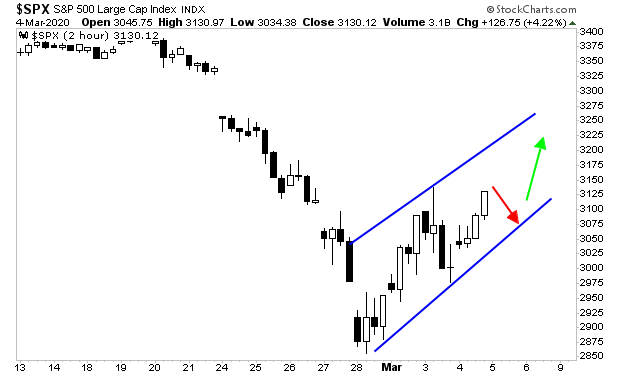

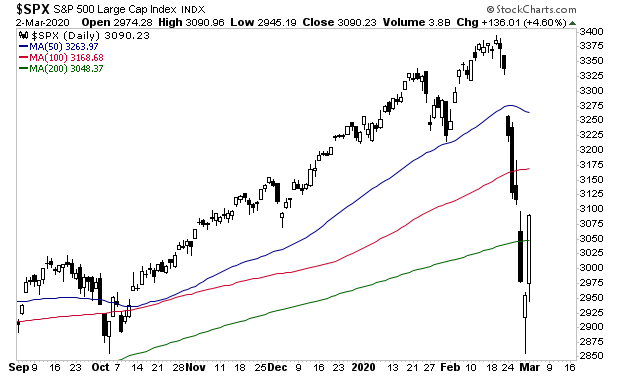

The Everything Bubble has burst. The next crisis, the BIG one to which 2008 was the warmup, is fast approaching.

During the 2008 crisis, the Fed did three things:

- Cut interest rates to zero making credit all but free for banks.

- Implemented large Quantitative Easing (QE) programs through which it printed $3.5+ trillion in new money to buy assets from large financial institutions, primarily mortgage backed securities and US government debt, also called Treasuries.

- Urged the Financial Accounting Standards Board (FASB) to abandon “market to market” valuations for the banks, thereby allowing the banks to value the debts on their balance sheet at “make believe” prices.

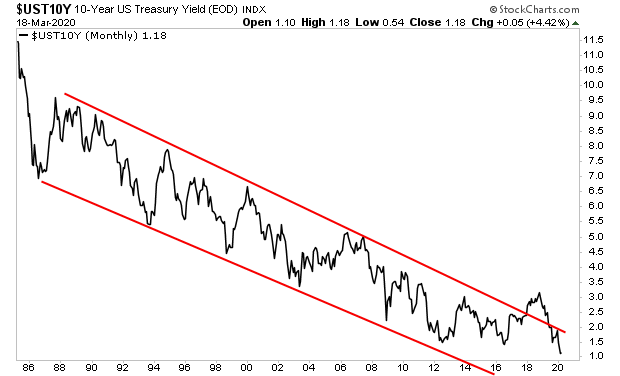

Combined, these three policies, particularly #s 1 and 2, create a bubble in US Treasuries, forcing yields to extraordinary lows.

Treasuries are the bedrock of the global financial system. Their yields represent the “risk free” rate of return: the rate against which all risk assets (stocks, commodities, real estate, etc.) are priced.

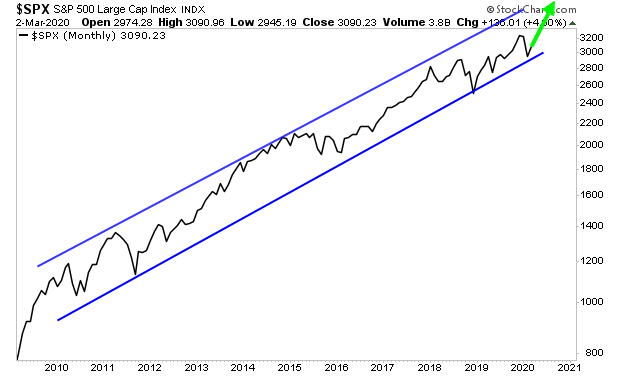

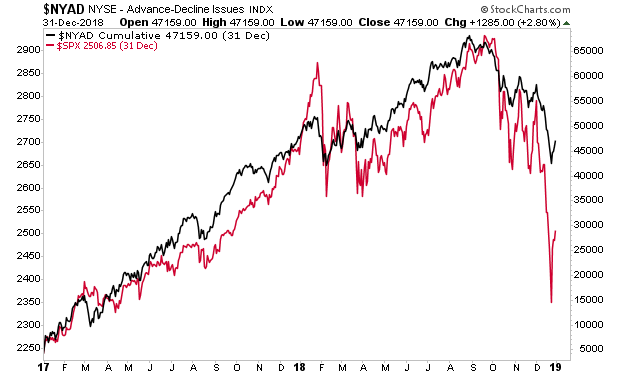

So, when the Fed created a bubble in Treasuries, it created a bubble in EVERYTHING: the entire financial system became mispriced based on a false risk profile.

Every asset class in the world trades based on the pricing of bonds. So the fact that bonds are in a bubble (arguably the biggest bubble in financial history), means that EVERY asset class is in a bubble.

I am focusing on the Fed here, but the same policies played out in every major financial system.

The European Central Bank (ECB) employed the same policies in Europe, the Bank of England (BoE) employed the same policies in the UK, and the Bank of Japan, (BoJ) which had already been doing both ZIRP and QE since 2000, took these polices to even greater extremes.

The end result is central bankers created the BIGGEST, most egregious bubble in financial history. A $250 TRILLION debt bomb… with another $500+ trillion in derivatives trading based on its yields.

To put this into perspective, the Tech Bubble was about $15 trillion in size. The Housing Bubble, which triggered the 2008 Crisis, was about $30 trillion in size.

The bond bubble is over $250 TRILLION in size. Some $50 trillion of this is in sovereign debt, with the rest coming from corporate debt, mortgages, auto loans, credit cards and the like.

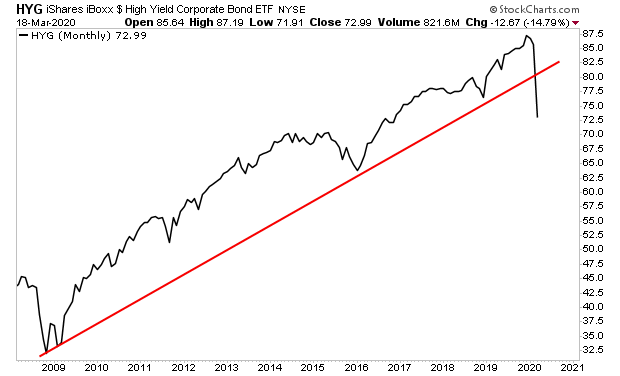

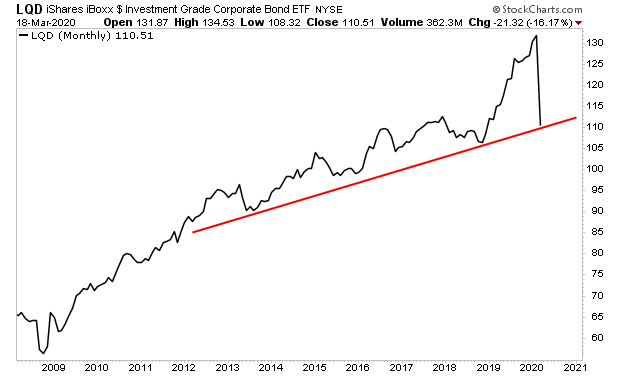

This mountain of debt is categorized based its riskiness. Not all debt is equal because of the fact that different borrowers have different levels of risk of default. For instance, an oil shale company that needs oil to trade at $60 per barrel is at much greater risk of default than a sovereign nation like the U.S..

For simplicities sake we’re going to ignore auto-loans, student debt, and credit card debt to focus on the truly systemically important debt.

Corporate, Municipal, and Sovereign/ National.

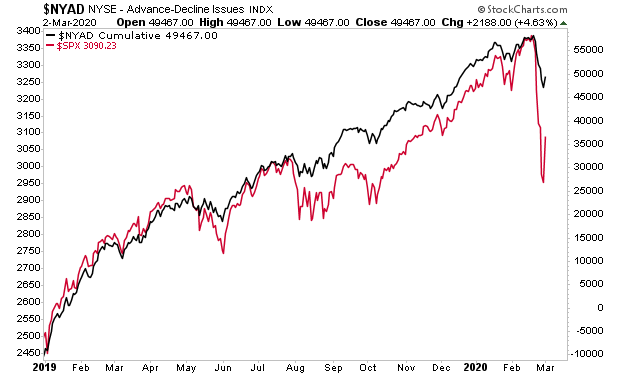

In the U.S., things rapidly moving up the bond food chain.

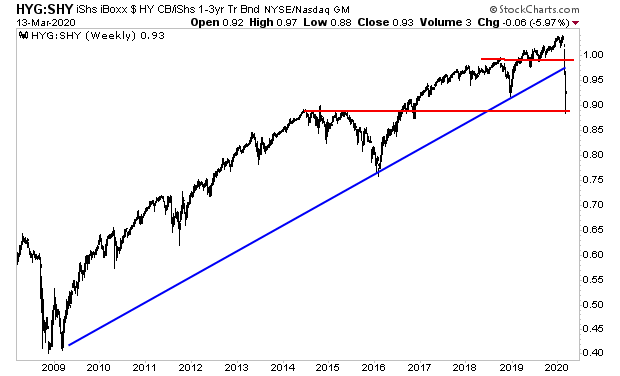

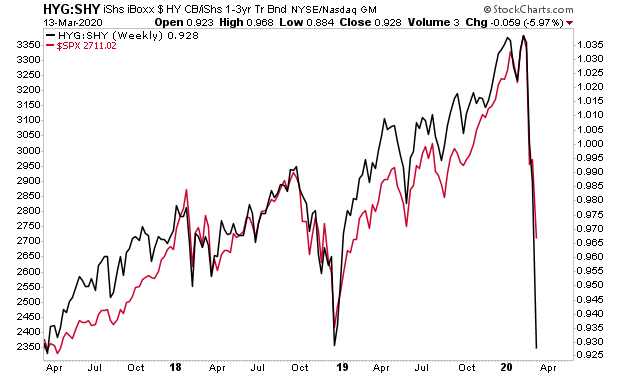

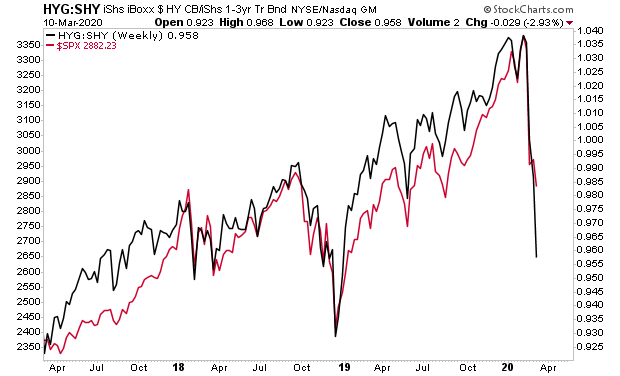

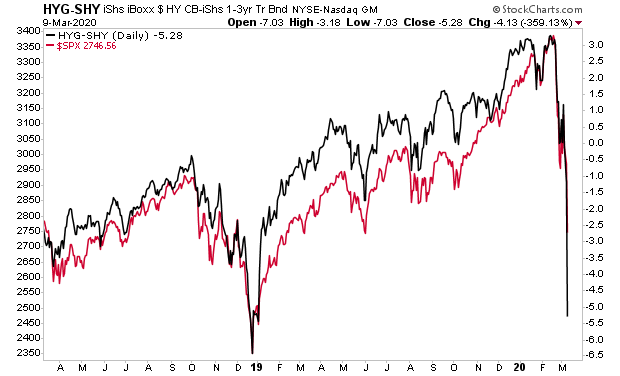

The Junk Bond corporate bond market bubble has burst.

The bubble in less risky corporate debt, called investment grade is about to do the same.

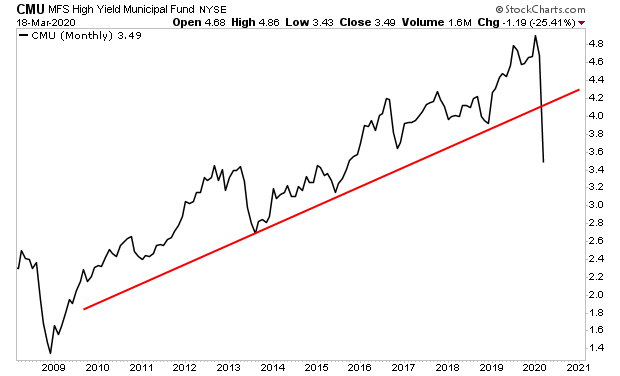

Further up the food chain, the bubble in high yield municipal bonds (bonds issued by cities, states and the like) has also burst.

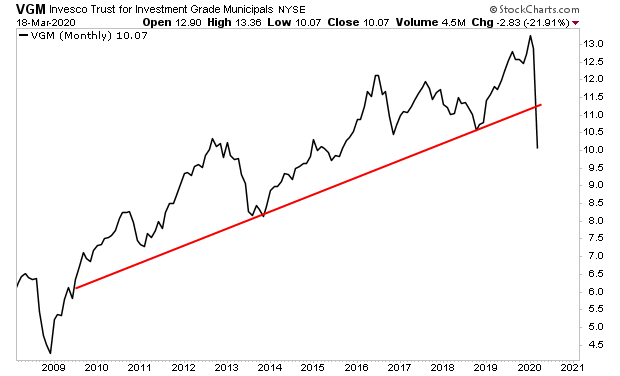

The BAD news is that the bubble in investment grade municipal bonds has ALSO burst.

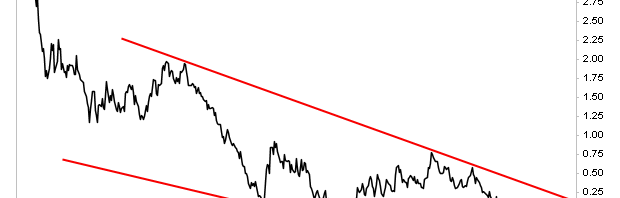

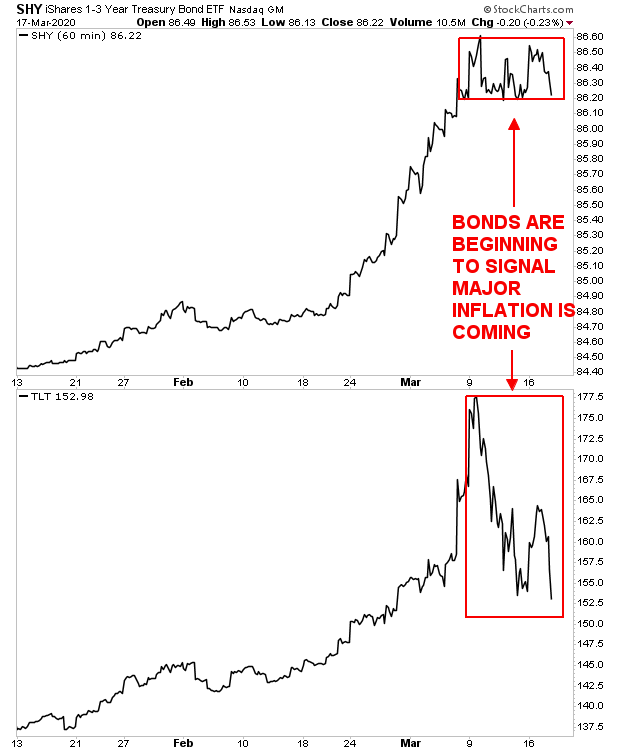

This leaves sovereign bonds, or Treasuries. Right now, the bubble in U.S. treasuries remains intact with bond yields within a clearly defined bear market (bond yields fall when bond prices rise, so the bubble is stable).

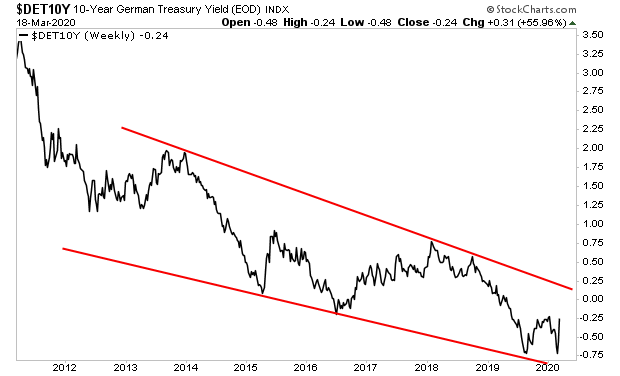

This is NOT the case in Europe.

Germany is the largest most dynamic economy in Europe. As such Germany is the ultimate backstop for the EU. And German sovereign bonds are beginning to breakdown.

Despite a deflationary collapsing, bond yields on the 10-Year German Government bonds is RISING, meaning those bonds are falling in value.

This SHOULD not be happening. German bond yields should be falling based on the deflation in the system right now.

Indeed, just this week Germany experienced a failed bond auction… meaning not enough buyers showed up to buy its bonds.

That kind of thing can happen from time to time… but for it to happen during a flight to safety like the one happening right now is a REAL signal that the EU’s bond market is in serious trouble.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research