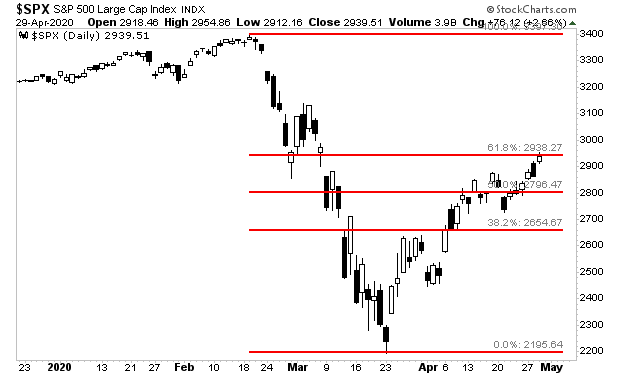

The stock market managed to break above its 61.8% retracement briefly yesterday.

From a technical analysis perspective, breaking above a 61.8% retracement usually means that the rally is no longer just a bounce but the start of something bigger.

However, for this to work out, we need stocks to break above the retracement and stay there. And as of this morning, this is not the case.

Today is key. The Fed has promised to keep rates at zero until the economy is back at full employment.

Trillions of dollars have been funneled into the financial system by the Fed and the Federal government’s stimulus package.

Unemployment numbers are horrific, but the pace of the claims is slowing.

Now is the time for the bulls to assert their strength and push the market above its 61.8% retracement with conviction.

This is particularly true given that it is the last day of the month and fund managers need to mark their holdings at the best possible numbers after a horrific March showing.

Will they do it?

If you’re sick of narratives and want to focus on how to actually make money from the markets, join our FREE e-letter Gains Pains & Capital.

https://gainspainscapital.com/

Graham Summers

Chief Market Strategist

Phoenix Capital Research