The Fed has finally made up its mind… it wants inflation.

Ever since the great financial crisis of 2008, the big question has been:

What will be the ultimate outcome from all this money printing/ Fed intervention… another deflationary collapse or an inflationary storm?

Some 12 years later… we finally have our answer… it will be an inflationary storm.

Last week the Fed announced:

1) It is changing its inflationary target from 2% to an average of 2% (meaning inflation could overshoot to the upside).

2) That it was comfortable with inflation as high as 3% as long as it does so at a manageable rate.

Remember, this is the Fed we are talking about, not some gold bug. So, the mere fact the Fed is even suggesting that it is OK with higher rates of inflation has systemic implications.

The Fed has long averred that inflation was nowhere to be found… that it if ever did show up that the Fed could easily contain it… and that truthfully none of us need to worry about inflation ever getting out of control.

So, the fact the Fed is suddenly OK with inflation running hot is akin to a structural engineer saying, “I’m fine with this massive dam leaking, possibly even a lot… provided the leaks occur in a way that is manageable.”

You get where I’m going with this.

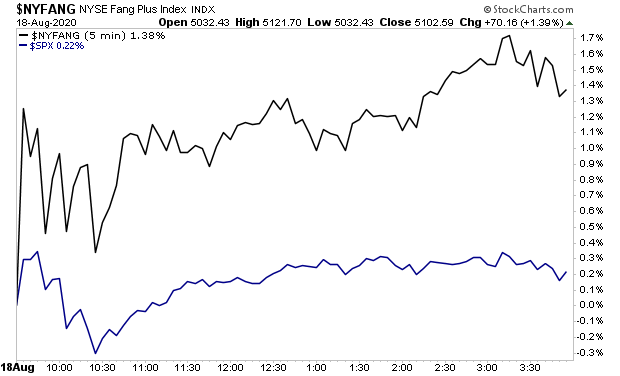

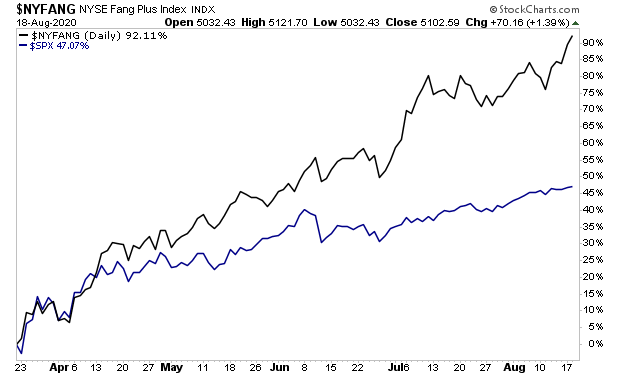

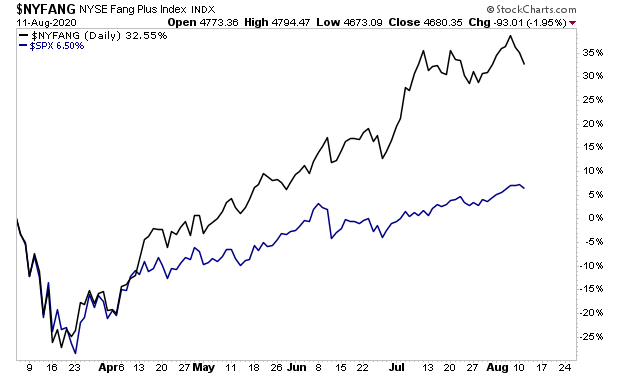

And so do the markets.

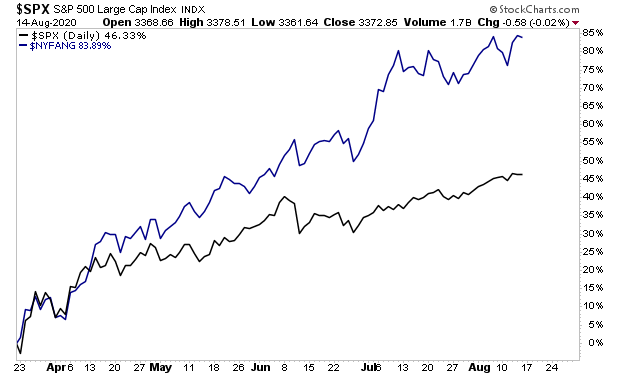

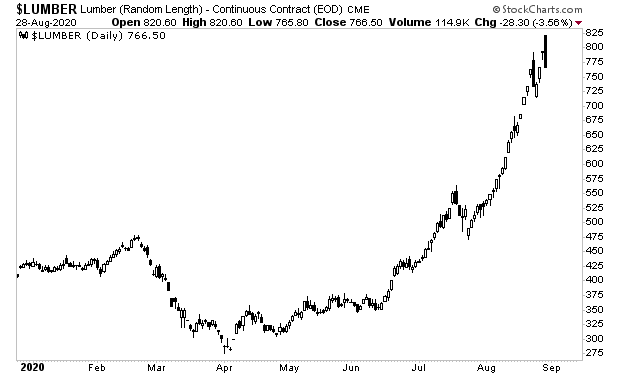

Take a look at Lumber.

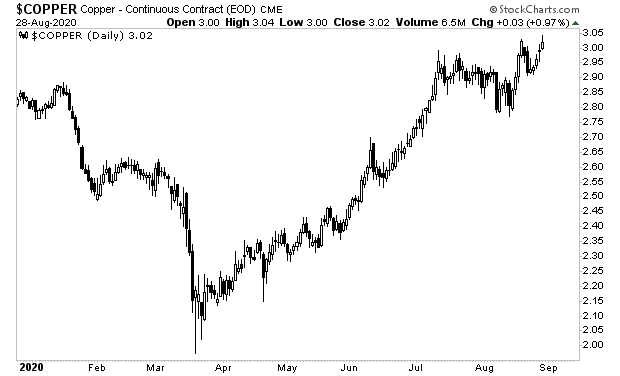

How about Copper?

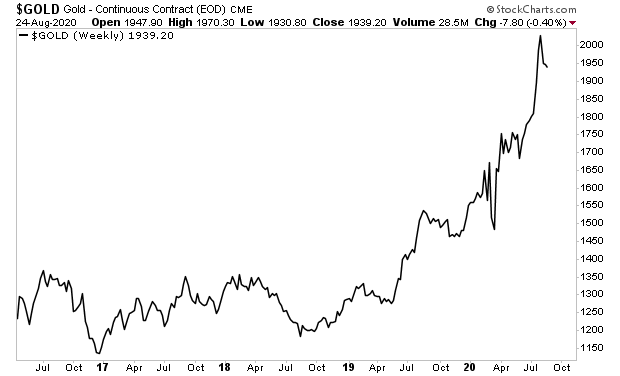

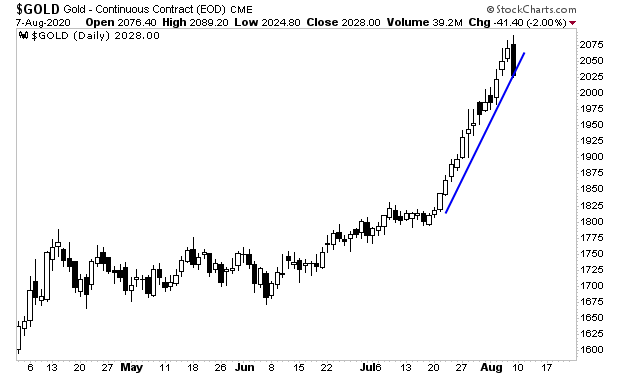

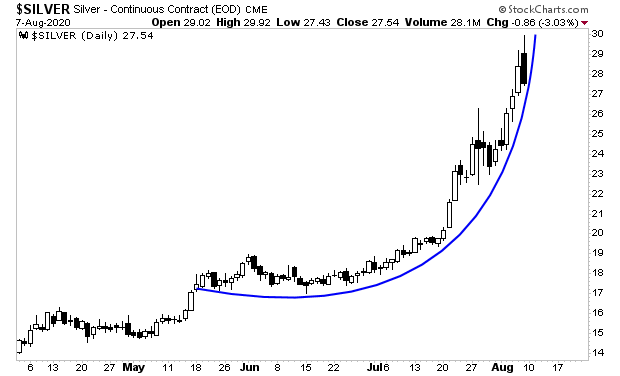

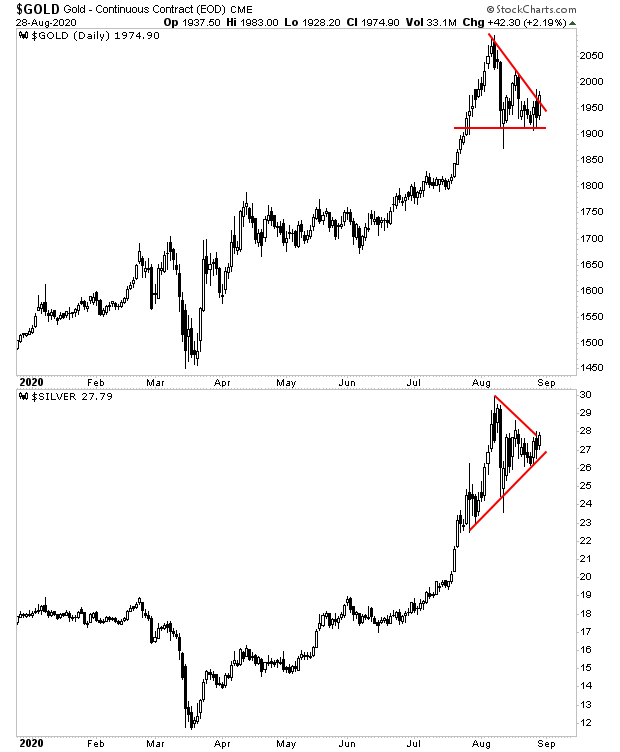

And then there’s gold and silver… which have already begun their next legs up.

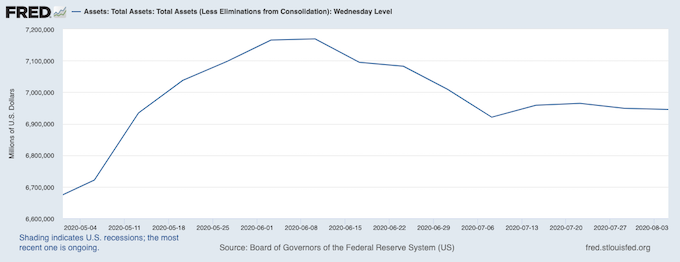

The Fed is not just talking about wanting inflation either.

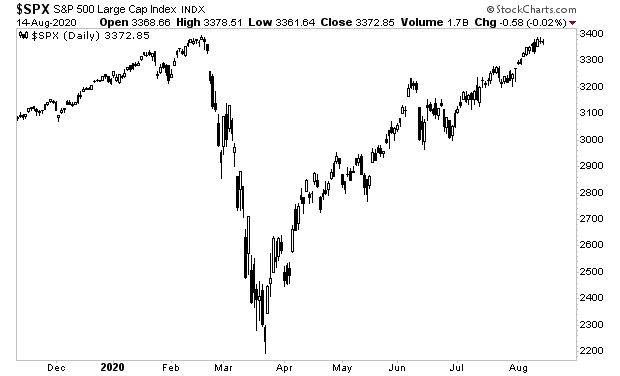

In response to the Great Financial Crisis of 2008, the Fed printed $3 trillion in new money from 2008 to 2016.

It’s already printed MORE that that in the last six months.

And its current QE programs mean AT LEAST an additional $1.8 trillion in new money being printed every year going forward.

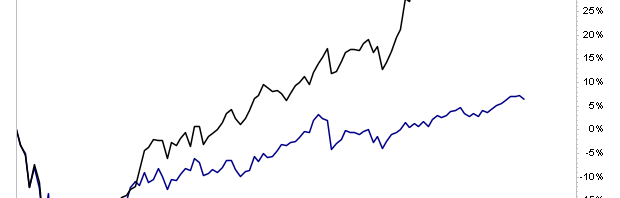

This is going to unleash an inflationary storm that will send inflation hedges like gold and silver (and their miners) THROUGH THE ROOF.

Indeed, gold has already exploded higher to over $2,000 per ounce. Imagine where it and other inflation hedges will go by the time the Fed has REALLY turned on the printing presses.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 17 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research