The big message from Fed Chair Jerome Powell and Treasury Secretary Steve Mnuchin’s testimonies to congress yesterday was the following…

Even more money will soon be flowing into the economy.

Both Powell and Mnuchin were adamant that the recovery requires additional fiscal stimulus. Powell stated that the economy would likely slide back into recession without another stimulus program, while Mnuchin emphasized that the next stimulus program should target children and jobs.

So again… even more money will soon be flowing into the economy.

Remember, the U.S. government has already employed a $2.2 trillion stimulus program. A second stimulus program ranging from $1 trillion to $2 trillion is currently being held up by congress. But it is clear that both the Fed and the Treasury feel that this money needs to be released soon.

And this is going to unleash inflation.

As I’ve written previously, the big difference between policymakers’ response to the 2008 crisis and their response to the COVID-19 pandemic is that this time around, much of the money being printed has actually made its way into the economy.

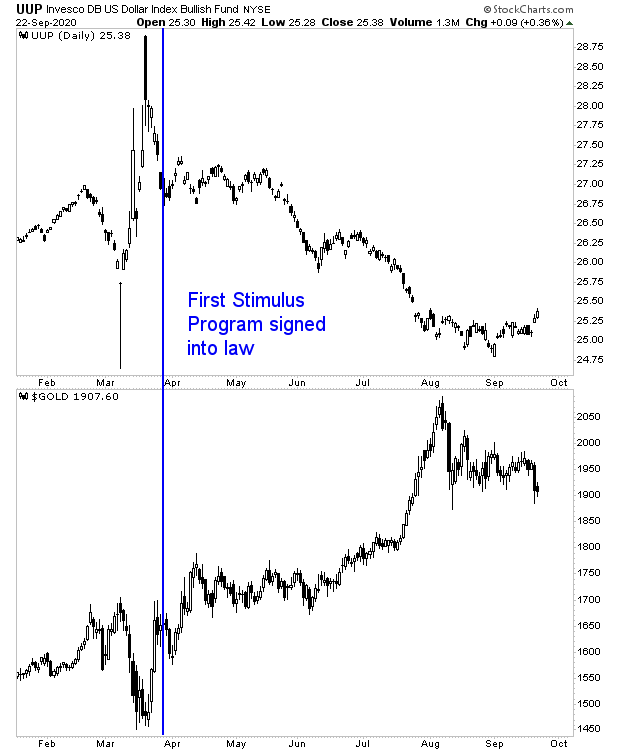

This is why the $USD has plunged while inflation hedges like gold have exploded higher.

Both of these trends are taking a breather right now (nothing goes straight up or straight down in the markets). But the comments from the Fed and the Treasury have made it clear that they want even MORE money to be funneled into the economy as soon as possible.

Which means… more money printing, which means a lower $USD, which means higher inflation.

Investors now have a decision… do they try to bet against the Fed AND the Treasury… or do they take steps to profit from what will be the biggest trend of the next 12 months?

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 39 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research