Disclaimer: none of the following is meant to be political analysis. I am not endorsing nor disparaging any candidate. I’m simply outlining my framework for how I see this election and what the markets are suggesting the outcome will be.

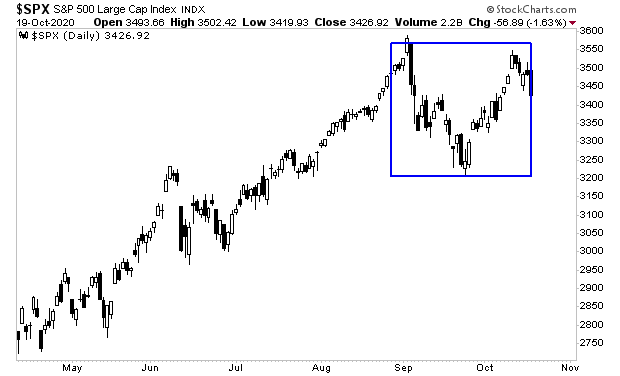

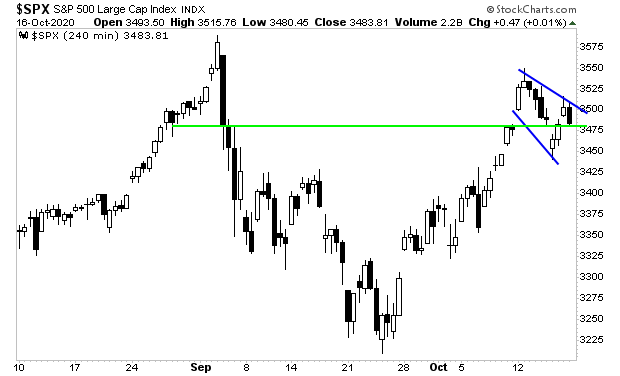

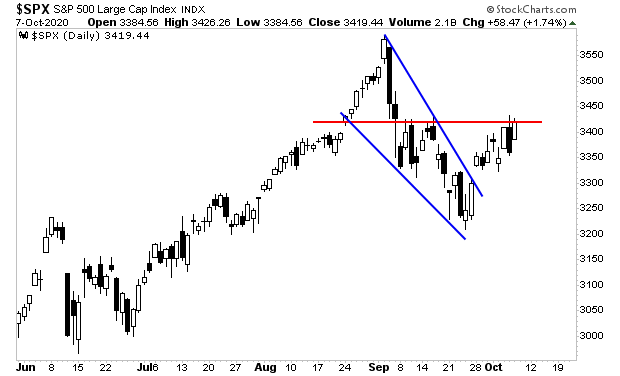

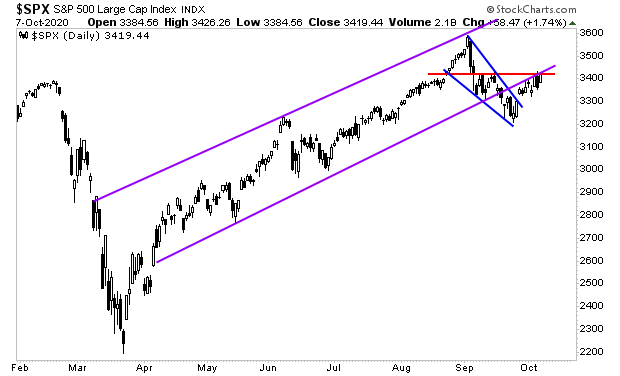

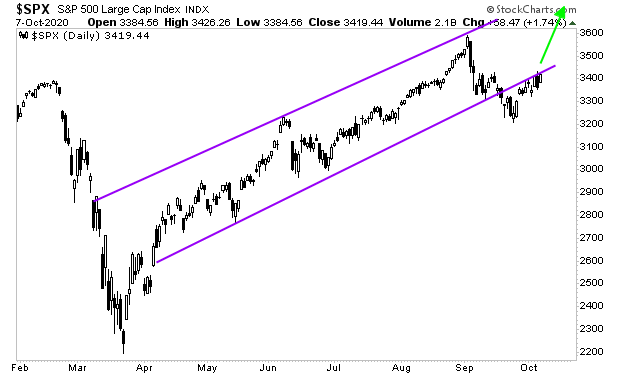

The markets are in a holding pattern until election day.

Retail investors are small fish in a big pond. The real price action occurs when financial institutions make a move. And NO financial institution is going to put capital to work this week with the election looming.

However, some items are clear.

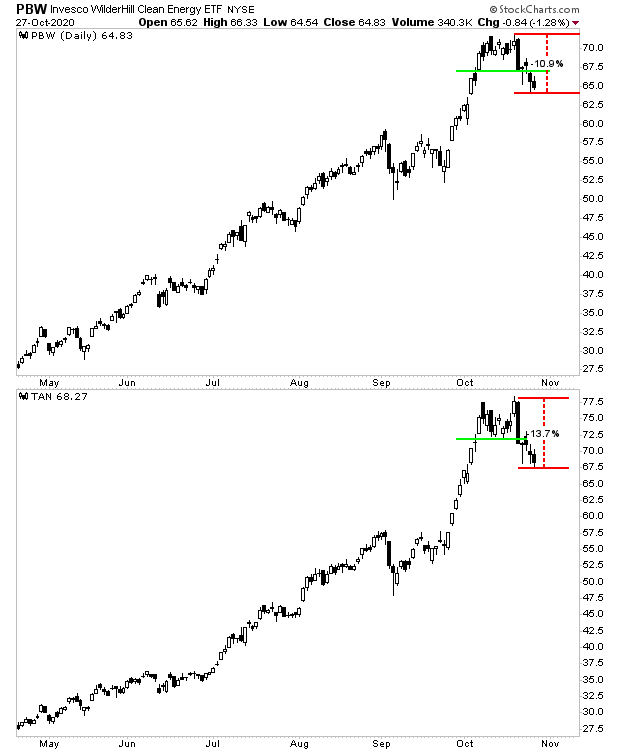

Key market sectors are increasingly pointing to a Trump win.

One of the key differences, between the Biden and Trump campaigns are their attitudes towards green energy. Trump is decidedly pro-fracking and fossil fuels while Biden leans towards green energy (he has formally endorsed the New Green Deal on his website).

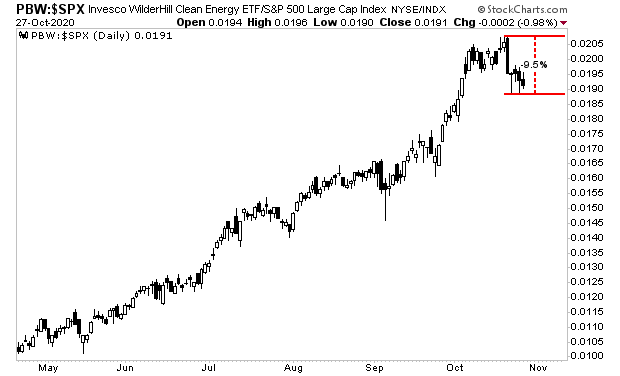

With that in mind, the green energy sector has rolled over and is falling rapidly. We’re already into a 10% correction on both $PBW and $TAN.

Of course, much of the market has been red lately, so I would also like to point out that underperformance has occurred relative to the broader stock market. The ratio between $PBW and the S&P 500 is down 9% meaning clean energy ETFs are down 9% relative to the rest of the market.

That’s a heck of an underperformance. Again, this suggests Biden’s odds of winning the election have fallen dramatically.

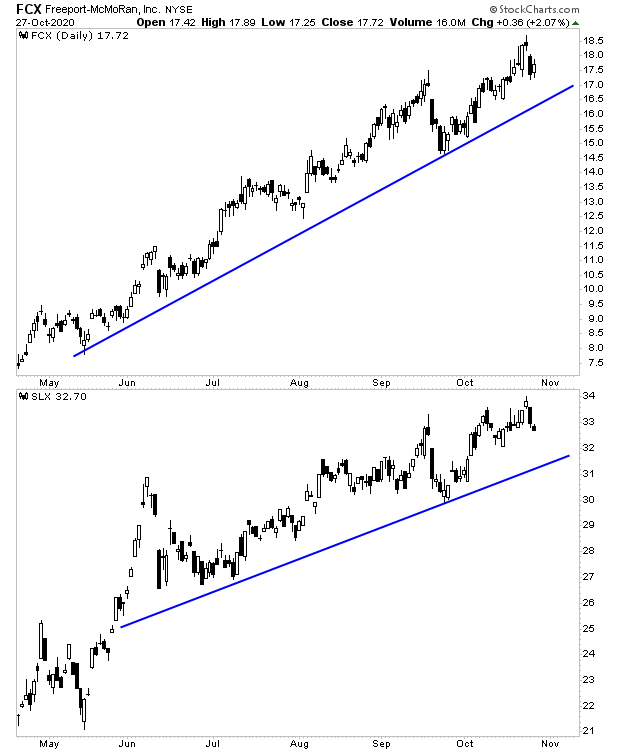

Meanwhile, we see industrial metals, which are heavily pro-Trump due to his obsession with U.S. manufacturing and industrial production, remain in clear, strong uptrends. Looking at these charts it’s difficult to even see a corrective move.

This strongly suggests the odds of a Trump win have increased dramatically.

Taken together, these two developments STRONGLY suggest Donald Trump will win re-election. In fact, you could argue that based on these issues, the election won’t even be close.

I’m not saying I’m happy about this. I’m simply saying what the markets are telling me right now. Again, I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research