The market will likely hit new all-time highs this week.

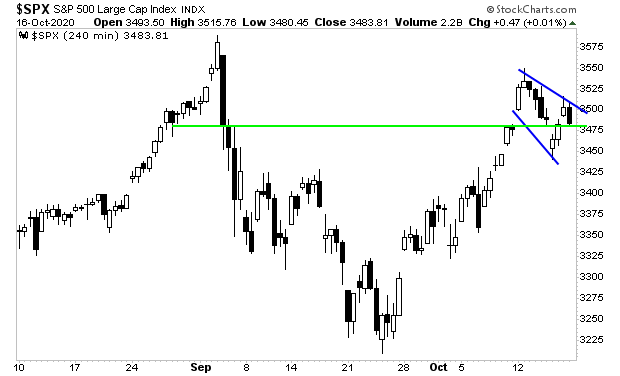

Stocks held support last week (green line in the chart below). We now have a bull flag forming on the 4-hour chart for the S&P 500 (blue lines in the chart below).

It’s incredible to be writing this: stocks roaring to new all-time highs multiple times after one of the sharpest most violent sell-offs in history hitting in March of this year.

Indeed, by the look of things, we’re going to see a massive stock bubble in the coming months.

And why not? The economy appears to be coming back strongly from the COVID-19 shutdowns. Last week we found out that retail sales rose 1.9% month over month (only 0.3% was expected).

And against this backdrop of growth, central banks and policymakers have unleashed a TSUNAMI of money printing.

Remember, to combat the economic fallout from the Great Financial Crisis of 2008 central banks printed $12 trillion between 2008 and 2016.

Well. they’ve printed more than HALF of this ($7 trillion) in the six months from April to September alone. Throw in stimulus programs from governments and the number balloons over $15 TRILLION.

Put another way, it previously took policymakers EIGHT years for to spend $12 trillion. They’ve already committed to spending MORE than this in less than EIGHT months.

Also, and this is key…between stimulus payments and central bank lending facilities directly to small businesses/ Main Street, much of this money is actually going straight into the economy.

In the U.S., we’ve already seen one stimulus program of $3 trillion. On top of this, the Fed has put over $1.6 TRILLION in actual real money into the U.S. economy in the form of credit facilities. Add that up are you’re talking about $5+ trillion in new money entering the economy this year.

And now Congress is talking about another stimulus program somewhere between $500 million and $1.8 trillion being funneled into the economy sometime in the next three months. That would put the total money printing for 2020 in the ballpark of $7 trillion.

Let’s put this into perspective. The U.S. economy is roughly $22 trillion in size. So, in the span of a single year, policymakers will have funneled an amount of money equal to nearly 33% of U.S. GDP directly into the economy.

This is how you get a MASSIVE bubble. As in the S&P 500 goes to 6,000 or higher in the next 12 months.

I realize that sounds insane. But remember, we’re talking about an amount of liquidity equal to 33% of the U.S. GDP being funneled into the economy in nine months.

As investors, our job is NOT to argue about what the market should do, it’s to make MONEY from what the market IS doing.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research