The market continues to grind higher.

At this point, we’re about to enter the final month of the year. Most fund managers have had a TERRIBLE year. Only a handful of them accurately predicted the March meltdown and even fewer managed to buy at the lows once the market bottomed.

What does this mean?

That an entire industry of money managers has about four weeks to play “catch up” so they can post the best possible returns for 2020. Those who fail will lose clients and assets under management.

This has the makings of a market melt-up into year-end.

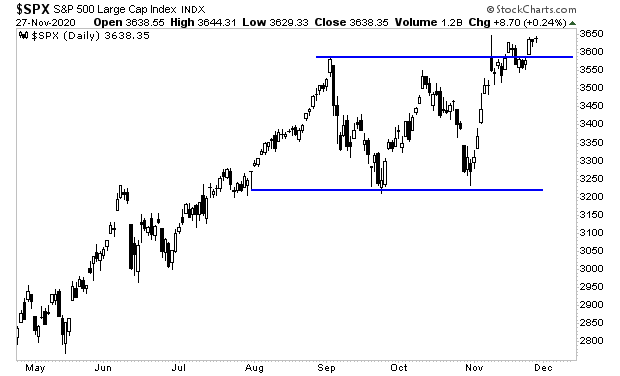

The S&P 500 has broken out of its three-month consolidation period. This breakout if it holds predicts a move to 4,000 before year-end.

This sounds crazy I know, but which is crazier… 4,000 on the S&P 500, or the notion that money managers will say, “you know what, I’ve performed terribly this year… I’m going to just take it easy in December and post my awful returns to my clients.”

You get my point.

Throw in the fact that both the Fed and the European Central Bank (ECB) are both printing tremendous amounts of money with both banks’ balance sheets hitting new all-time highs and you have the makings of a MELTUP into year-end.

And then of course… there’s the market’s reaction if the 2020 Presidential election ends up going for Trump.

KABOOM!

With that in mind, I stand by my original forecast that President Trump will end up winning this election. And our clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, we detail five unique investments that we expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research