At this point in my career, few things surprise me.

I’ve seen the housing boom, the Great Financial Crisis, the E.U. debt crisis, bail-ins, bail-outs, Fed chairs lying to congress, BREXIT, and President Trump.

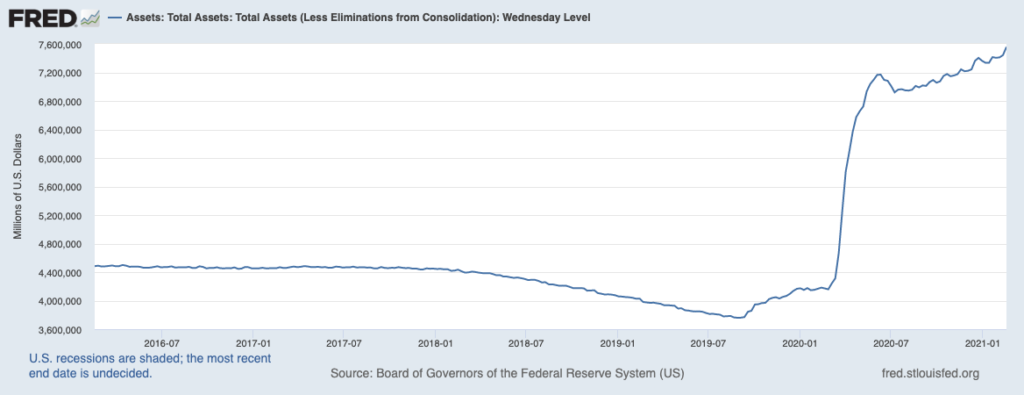

However, what Fed Chair Jerome Powell said this week made my jaw hit the floor.

In his testimony to Congress, Fed Chair Jerome Powell stated:

It may take three years for inflation to hit the Fed’s goal of 2%.

Three years, as in inflation won’t hit 2% until 2024.

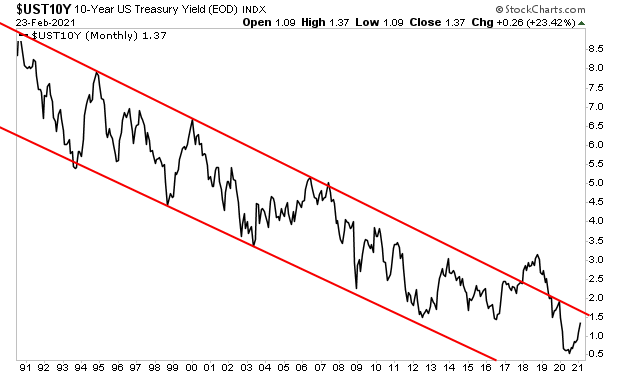

Bear in mind, inflation, today, right now, is well over that. Bond yields which trade based on inflation have more than doubled since August.

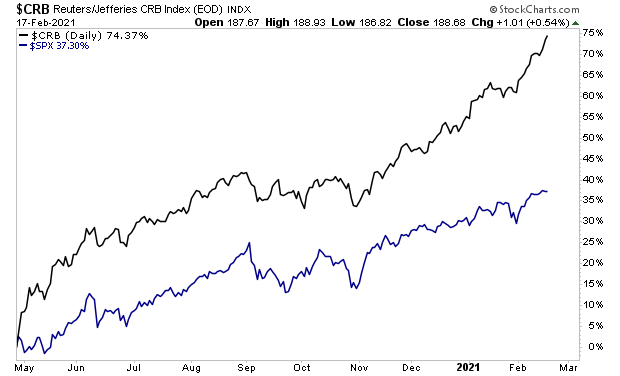

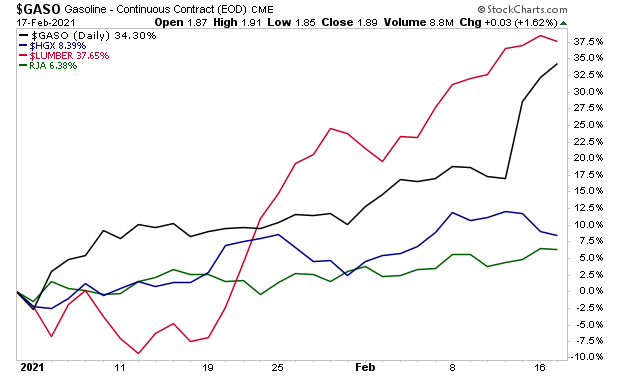

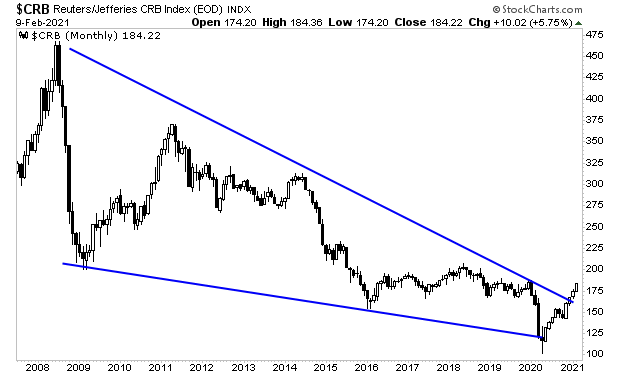

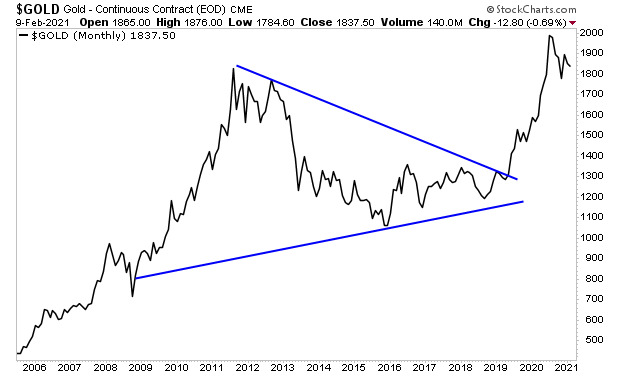

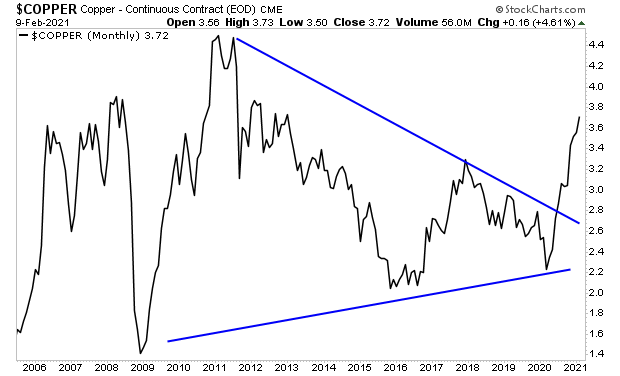

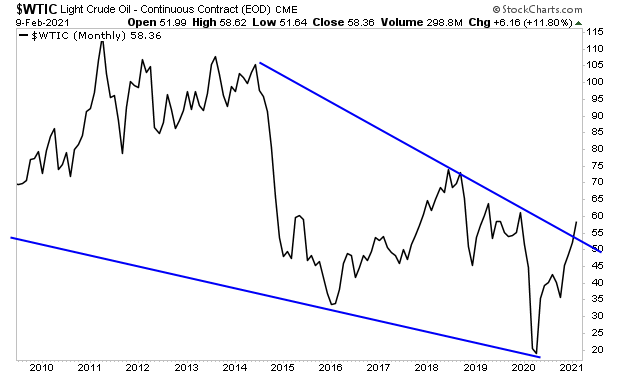

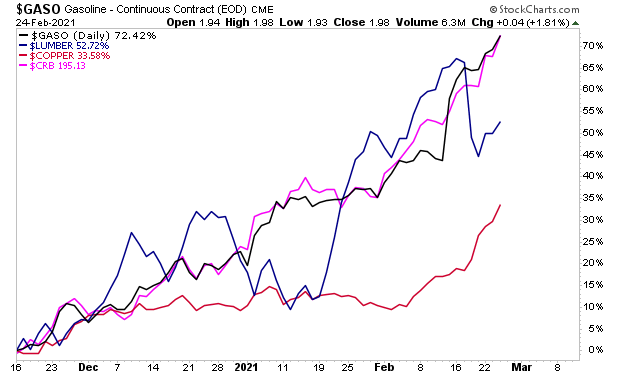

Gasoline prices are up over 70% since November. Lumber prices are up 52% over the same time period. Copper is up 33%. Heck, the ENTIRE commodities complex as measured by the Commodity Research Bureau’s index is up 26%!

There is no sign of this stopping. Indeed, as Bill King notes, on the very day in which Fed Chair Powell was making these insane claims, gasoline surged 2%, oil surged 2.5%, copper rallied 3% and bonds collapsed.

This is akin got the financial system SCREAMING “INFLATION IS HERE!” in Powell’s ear. And he claims we won’t even hit inflation of 2% until 2024.

This is total insanity. And it is going to end horribly.

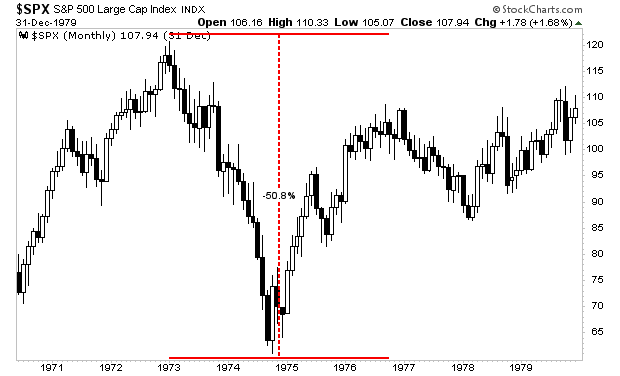

During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I keep warning, inflation is going to ANNIHILATE investors’ portfolios.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research