The Fed has already told us what is coming down the pike.

But no one is listening.

The Federal Reserve system employs roughly 20,000 people. I believe it is the single largest employer of economists in the U.S. And as a result of this, it actually produces a decent amount of high-quality research.

The problem is that NO ONE at the top of the Fed listens to it!

Case in point, in 2001, researchers at the Federal Reserve bank of St Louis discovered that the Fed’s preferred measures of inflation are the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) were in fact useless at predicting future inflation.

At the time they wrote:

We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…

Source: Federal Reserve bank of St Louis

Despite this discovery, the Fed continues to use CPI and PCE as its preferred measures of inflation. Put another way, despite the fact that the Fed’s OWN RESEARCHERS proves that CPI and PCE are garbage, the Fed keeps using them.

And if you think that’s bad, take a look at what the Fed discovered in NOVEMBER 2019 when it comes to printing money to service debt.

A solution some countries with high levels of unsustainable debt have tried is printing money. In this scenario, the government borrows money by issuing bonds and then orders the central bank to buy those bonds by creating (printing) money. History has taught us, however, that this type of policy leads to extremely high rates of inflation (hyperinflation) and often ends in economic ruin.

Source: Federal Reserve bank of St Louis

Yes, the Fed’s own research has found that printing money and using it to buy debt results in raging inflation and economic ruin.

Bear in mind, that the Fed has printed $3+ trillion over the last 12 months for this express reason… and intends to print $120 billion per month for the next TWO YEARS (another $2.8 trillion).

Those who believe that all this money printing and subsequent inflation it will unleash means stocks will forever go up need to brush up on their history.

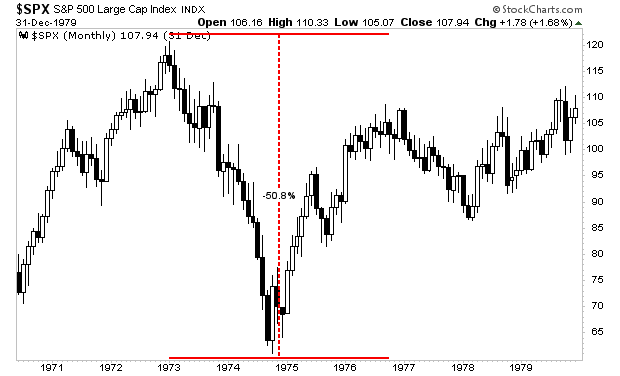

Stocks love inflation at first, but that love quickly turns to hate. During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I keep warning, inflation is going to ANNIHILATE investors’ portfolios.

Those who are properly prepared. however, will make literal fortunes.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research