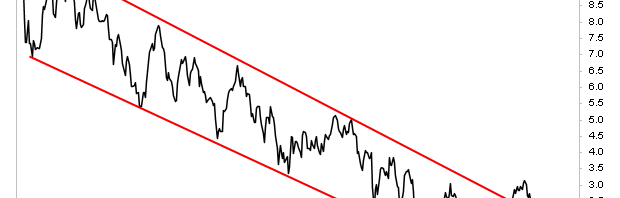

Inflation expectations continue to soar.

The US 5-year Breakeven Rate just hit 2.6%. Granted I’m not a genius Fed official, but what does this image look like to you?

Remember, the Fed believes inflation won’t hit even 2% for three more years.

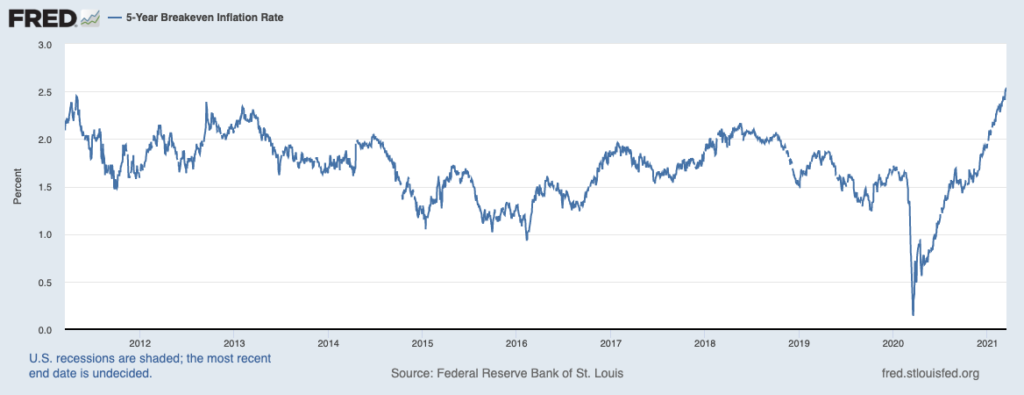

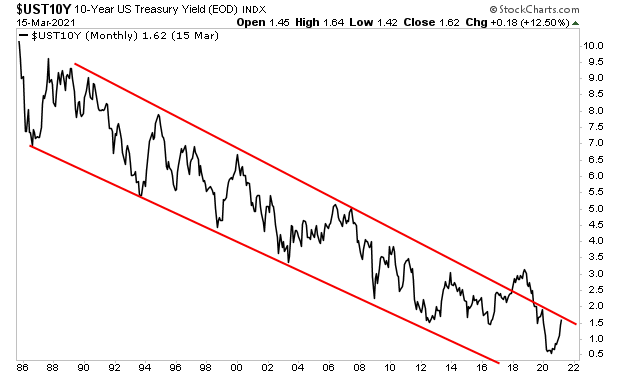

And then there’s the yield on the 10-Year US Treasury which is about to break its multi-decade downtrend for the second time since 1982.

By the way, the first break occurred when the Fed attempted to normalize monetary policy by raising rates and shrinking its balance sheet. THIS breakout is occurring while interest rates are at ZERO and the Fed is running a $125 billion per month QE program!

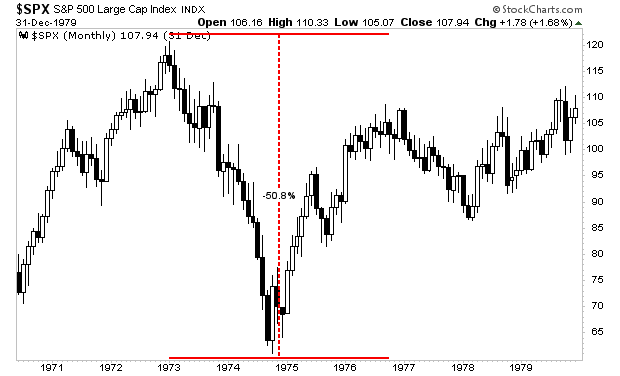

Those who believe that all this money printing and subsequent inflation it will unleash means stocks will forever go up need to brush up on their history.

Stocks love inflation at first, but that love quickly turns to hate. During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I keep warning, inflation is going to ANNIHILATE investors’ portfolios.

Those who are properly prepared. however, will make literal fortunes.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research