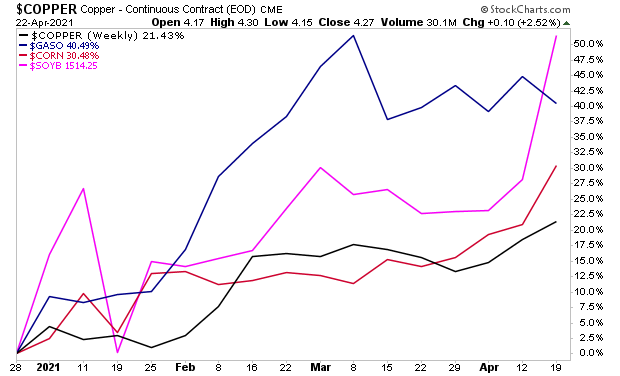

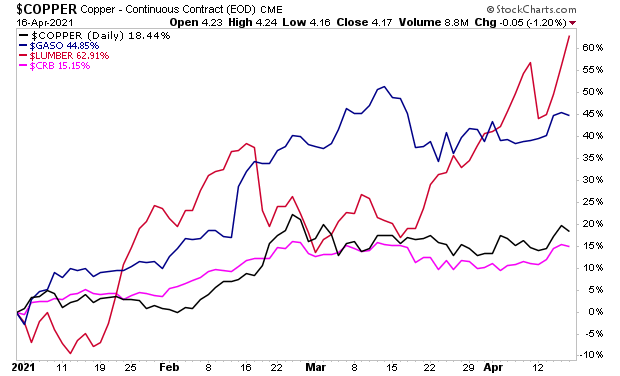

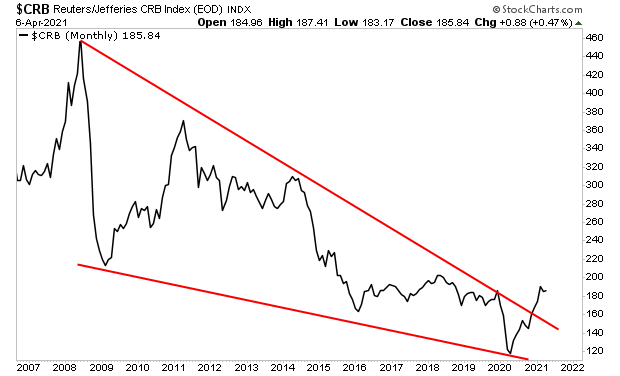

We’ve been outlining how the Fed and other central banks have unleashed an inflationary bubble in all assets… truly an Everything Bubble.

We’ve already assessed the impact this is having on commodities, bonds and other asset classes. Today I want to assess the impact this will have on stocks.

To do that, we need to look at emerging markets.

Inflation is a common occurrence for emerging markets, primarily because more often than not they devalue their currencies, whether by choice or because the markets lose faith in their ability to pay off their debts.

Because of this, emerging markets can provide a glimpse into how inflation affects stocks. So, let’s dig in.

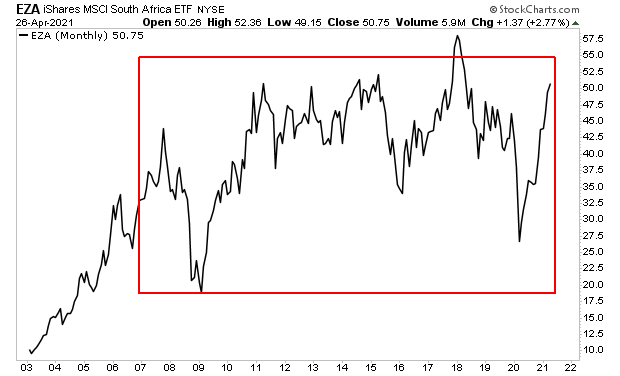

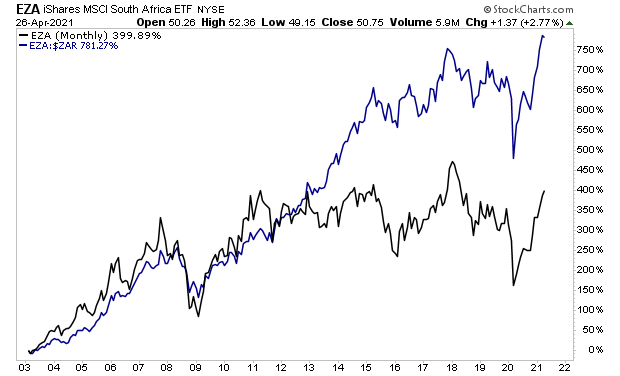

Here is a chart of South Africa’s stock market since 2003. As you can see, the stock market rallied significantly until 2010, but has effectively gone nowhere ever since then.

The reason this chart looks so lackluster is because it is priced in U.S. dollars. The $USD has been strengthening against the South African currency (the Rand) since 2010.

Watch what happens we price the South Africa stock market in its domestic currency (blue line). Suddenly, this stock market has been ROARING, rising some 750% since 2003. That means average annual gains of 41%!!!

Let’s use another example.

Below is a chart of the Mexican stock market priced in $USD. Once again, we see a stock market that has done nothing of note for years.

Now let’s price it in pesos (actually the exchange rate of pesos to $USD, but close enough).

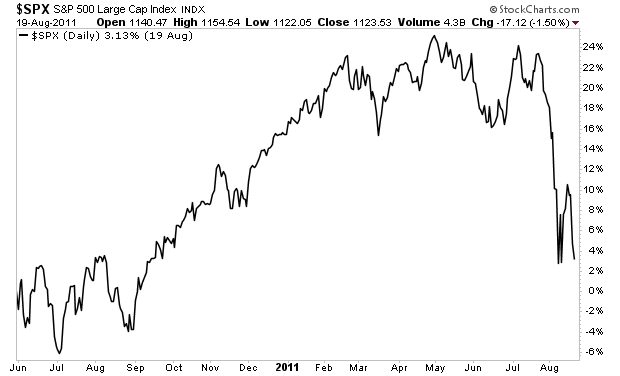

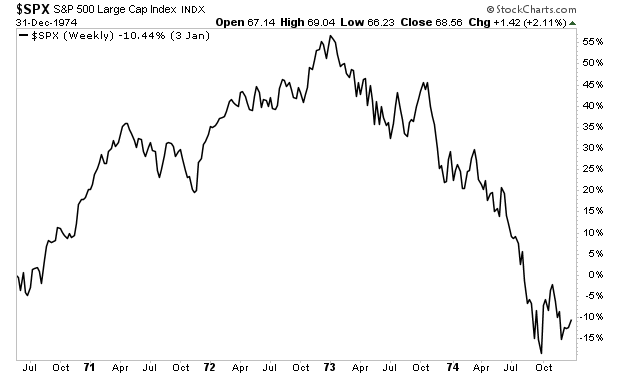

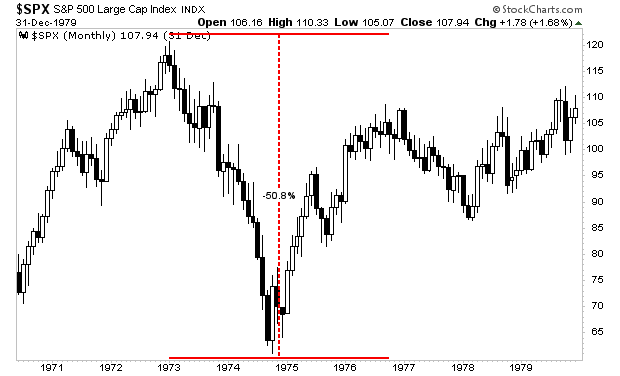

You get the general idea. So if hot inflation is in the U.S. financial system, it would make perfect sense for stocks (denominated in the $USD which is losing value due to inflation) to ERUPT higher.

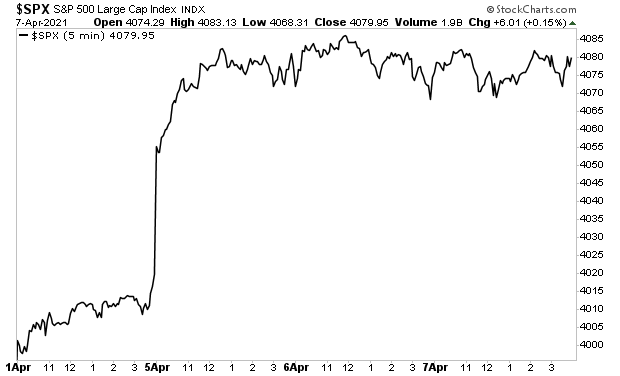

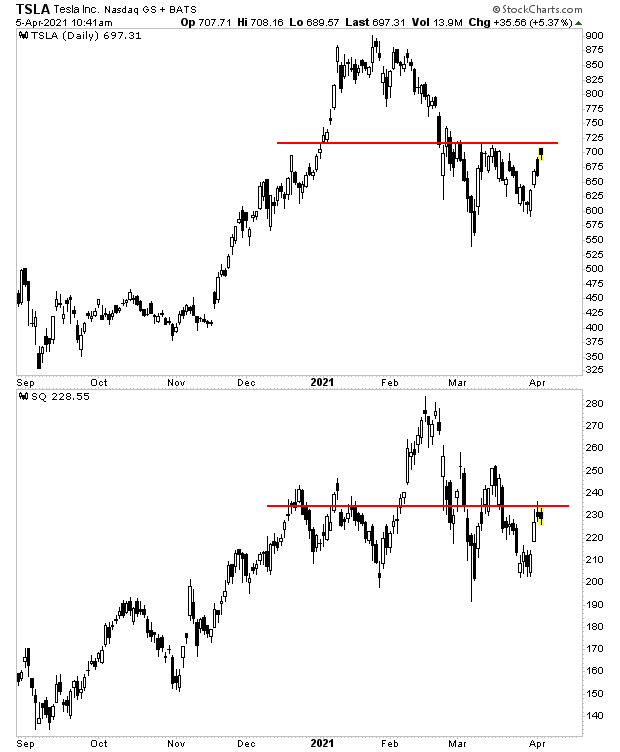

Something like… I don’t know… what’s happened since mid-2020?

Look, we all know what’s going on here. The stock market is erupting higher as inflation rips into the financial system based on Fed NUCLEAR money printing. And we all know what comes when this bubble bursts.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research