Yesterday I outlined how the Fed is extremely late to curb inflation.

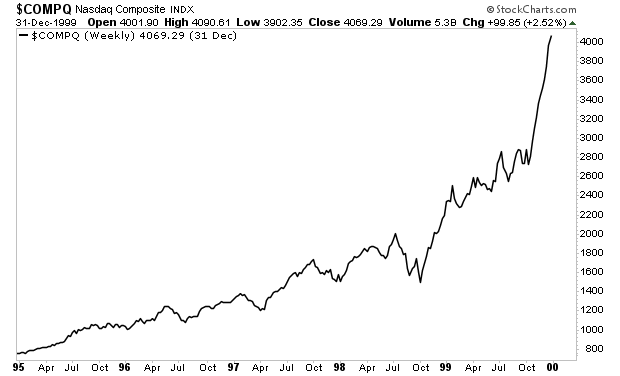

As a brief recap, it only took CPI clearing 5%, multiple signals that inflation is running hot, housing entering a bubble, stocks roaring to new all-time highs, and signs of frothiness including: someone sold a Non-Fungible Token (NFT) of a fart, crypto-currencies including ones that were designed as a joke exploding higher, etc.

Put simply, it only took an extreme level of frothiness as well as some of the worst inflation prints in decades for the Fed to decide it needed to do something.

We’ve already assessed how the markets initially reacted to the Fed’s move. But now it’s time to digest what the Fed actually did.

Did it actually hike rates?

No.

Did it actually taper QE?

No.

Did it do anything besides change inflation expectations?

No again.

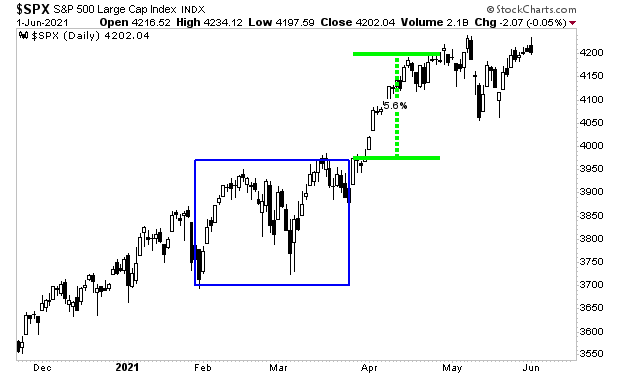

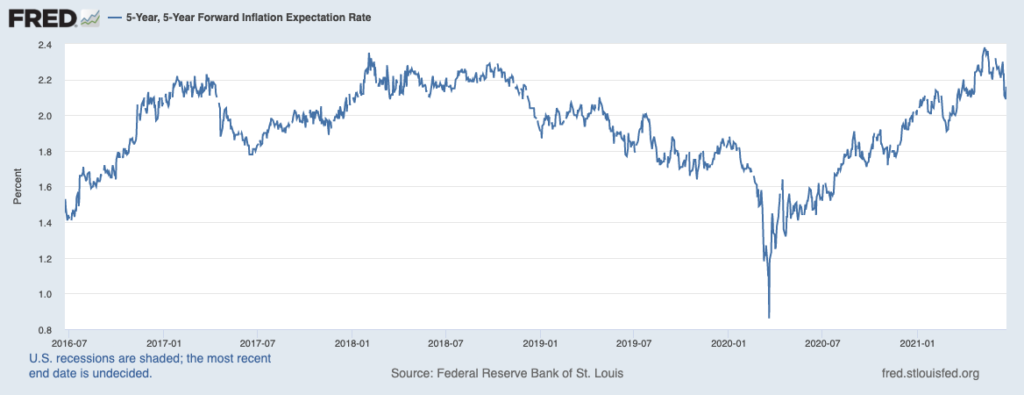

The Fed has clearly decided it is willing to stomach higher inflation in the near-term to sustain the bubble in stocks/ recovering economy. However, with inflation expectations rising (within 10 minutes they recovered over two years’ worth of declines)…

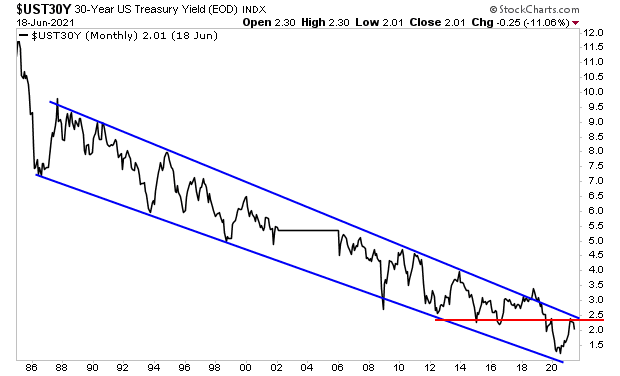

and Treasury yields getting dangerously close to breaking their long-term downtrend (see the chart below)…

… the Fed was forced to temper these expectations.

So, the Fed did what it does best… it made a verbal intervention.

But was the Fed really serious?

I can’t claim to be psychic in the sense that I can read Fed officials’ minds. What I can tell you is that I don’t think it’s coincidence that within 48 hours of stocks selling off:

1) The Biden White House convened a meeting with the President’s Working Group (the so-called Plunge Protection Team).

2) There will be SIXTEEN (16) Fed official appearances this week, the vast majority of which have been to issue dovish statements about how the market overreacted to the Fed and that the Fed is nowhere near thinking about tightening monetary policy.

Since that time, Fed Chair Jerome Powell has appeared before Congress during which he stated:

- Fed Will Wait for Actual Inflation as Trigger for Rate Rise

- Fed Won’t Raise Rate Preemptively

- 5% Inflation Is Not Acceptable (We’re old enough to recall the 2% threshold)

- Inflation Effects from Reopening Larger Than Expected

- High Inflation Temporary, Will Abate

- Factors Weighing on Labor Supply Should Abate

- May Take Some Patience to See What Is Really Happening

- Hard to Say When Supply Bottlenecks Will Disappear

- Enhanced Unemployment Benefits May Be Factor

- Expects to See Strong Job Creation in the Fall

- ‘Very, Very Unlikely’ U.S. Will Suffer 1970s Inflation Experience

So… Powell is basically telling us the Fed is NOT going to act preemptively concerning inflation… that the Fed still believes inflation will disappear by itself… and that the Fed is in “watch and wait” mode.

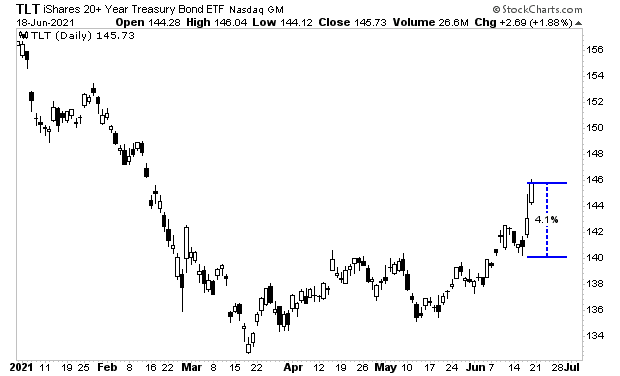

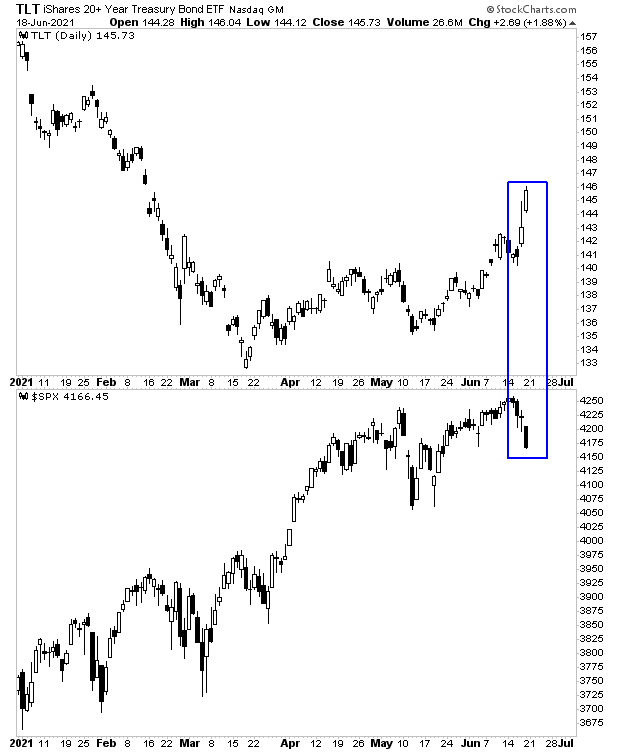

Put another way, the Fed spooked bond yields into dropping, and until they start rising again, the Fed is happy to let things bubble up in the markets.

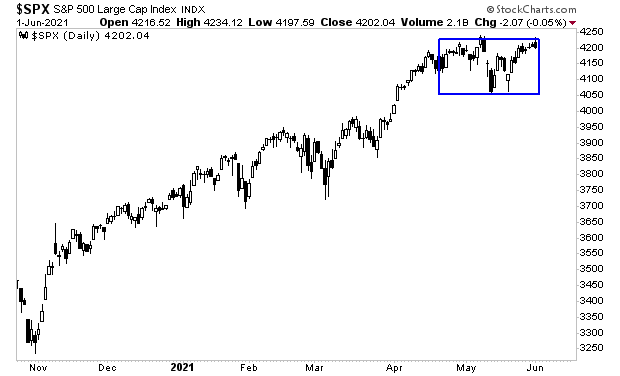

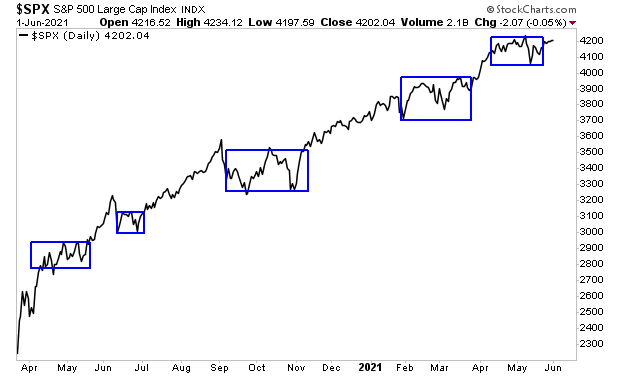

In this sense, what the Fed has done is move to curb future inflation expectations without actually doing anything. This in turn has pushed long-term bond yields back down again… which has opened the door to stocks roaring to even higher levels before crashing down in a spectacular crisis.

I’ll explain why in tomorrow’s article… until then.

In the meantime, we have published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research