The government bean counters are working overtime to hide inflation.

Yesterday’s Consumer Price Index (CPI) number would be hilarious if it wasn’t so damaging to Americans. According to the Bureau of Labor Statistics (BLS), inflation rose only 0.3% month over month for the month of August and 5.3% year over year.

Anyone who lives in America knows this is total bunk

The BLS claims inflation in rents is up a mere 2.9% year over year. The very same day this came out, the Wall Street Journal reported that in the real-world rents are up 10.3%. Also, home prices are up 18% over the same period.

Put simply, unless you live in a cave, your cost of living for shelter (which the BLS uses to calculate total inflation) is up a whole lot more than 2.9%.

Let’s keep going, shall we?

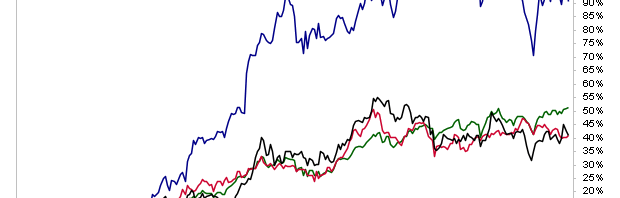

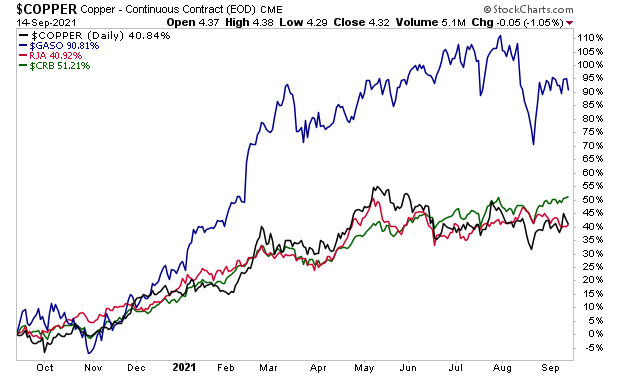

Over the last 12 months, the cost of every commodity is up 51%. Agricultural commodities are up 30%. So is copper. Gasoline prices have nearly doubled at 90%.

And yet, somehow the BLS claims inflation is just 5.3% year over year. I guess if you don’t drive a car, eat food, build anything, or use any commodities in any way, you’re probably fine.

The whole thing is ridiculous. And it begs the question… why is the BLS doing this?

I can’t claim to be psychic, so I have no idea what’s going on in these peoples’ minds. But I do know that a big reason to understate inflation is to mask the fact that real quality of life is in steep decline in the U.S.

This fact stares all of us in the face on a daily basis.

In the 1950s typically only one parent worked, and most Americans were able to afford their homes and live reasonably comfortable lives. In contrast, today typically both parents work, and most families have massive mortgages, student debt, credit card debt, auto loans, etc.

The whole system requires credit/ debt to function. Without it, most people cannot afford to live anything resembling a “middle class’ existence.

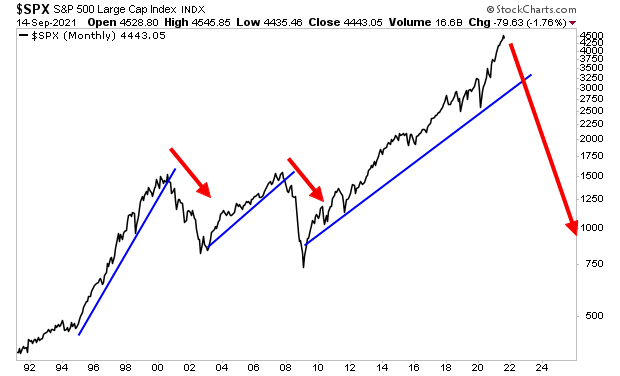

This whole mess will come crashing down one day. In market terms, this is going to happen, it’s just a matter of time.

The question of course is “when”?

To figure that out, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/predictcrash.html

Best Regards