By Graham Summers, MBA

Make no mistake, a crisis is coming.

It might not be tomorrow, next week or even next month, but it will be truly life changing for most investors.

How do we know this?

Because the current bubble is so insane, so out of control, that when it bursts it will make 2008 look like a picnic.

Consider that:

- Options trading volume (a sign of speculation) is exponentially higher than it was during the Tech Bubble.

- Crypto currencies that were invented as jokes trade at tens of billions of dollars.

- Tesla (TSLA) a $1 trillion company, trades like a penny stock rising or falling 10+% in a single day.

- People are selling Non-Fungible Tokes (NFTs) of farts, and other garbage… and making significant money.

- “Meme stocks” or stocks that are traded for ironic/ humorous purposes rise triple digits in a single day.

- Former President Trump’s Special Purpose Acquisition Company (SPAC) rose to a value of $5 billion despite having no business or operations.

And what is the Fed’s answer to all of this?

The Fed is going to keep rates at ZERO until at least the middle of 2022. And between now and then, it’s going to print another $90 billion in QE ($60 billion in QE in January, then another $30 billion in February and finally no QE in March).

Put another way the Fed believes that because it is printing less money, somehow this is going to make investors become rational/ deflate the bubble without inducing a crash. There was a time, before 2008, in which the Fed didn’t do ANY QE at all, but those days are long gone.

So where does this us?

Official inflation metrics show it clocking it at 6.8%, while REAL inflation is somewhere in the ballpark of 9%. The Fed has rates at zero and won’t raise them until the middle of 2022.

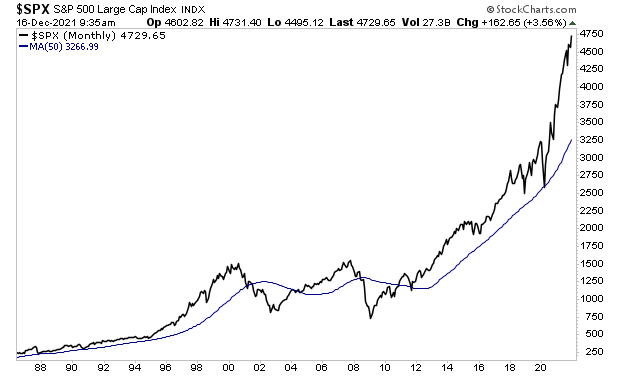

And this is happening:

Again, a crisis is coming. And it’s going to make 2008 look like a picnic.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards