By Graham Summers, MBA

We’ve now reached the point at which inflation will become a major problem.

Inflation is not inherently bad for stocks. The reason for this is that companies report growth in nominal terms, not in “real” or inflation-based terms.

Think of it this way: XYZ company sells widgets for $1.00. Then inflation hits and the company raises widget prices to $1.10. Even if the company sells the EXACT same number of widgets, revenues “grow” by 10%. After all, they don’t have to report that the 10% in growth was 100% due to inflation!

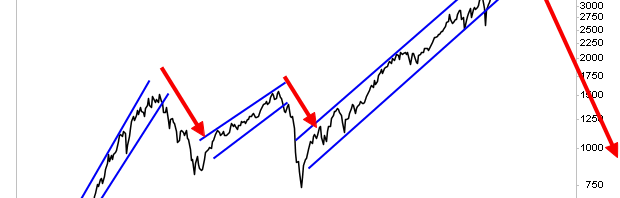

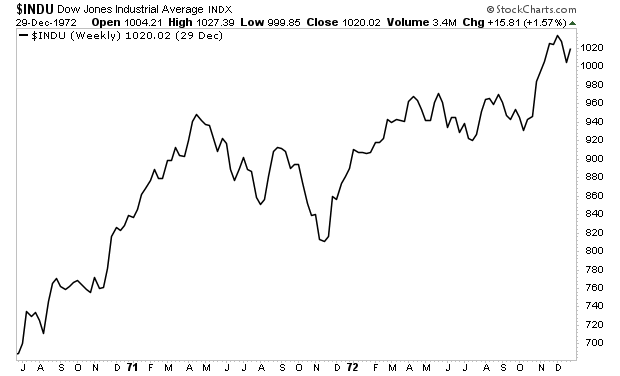

This is why stocks often spike higher when inflation initially hits. We saw this during the last major bout of inflation in the early 1970s. At that time, stocks roared higher, rising 50% while CPI, which measures inflation, gradually rose to 6.3%.

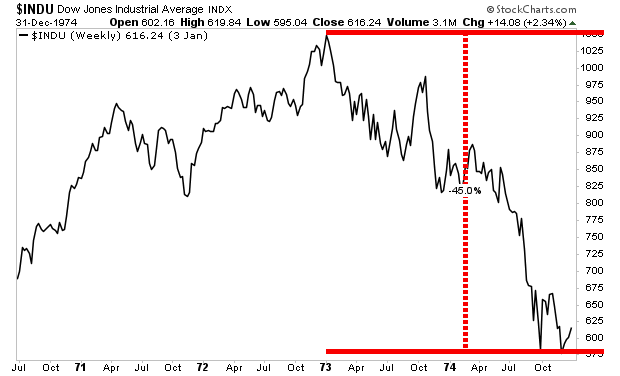

However, the relationship between stocks and inflation quickly goes from love to hate once costs rise fast enough that profit margins are squeezed. To return to the 1970s, this started in 1973 as CPI hit 11%. From that point onward, stocks crashed losing almost 50%.

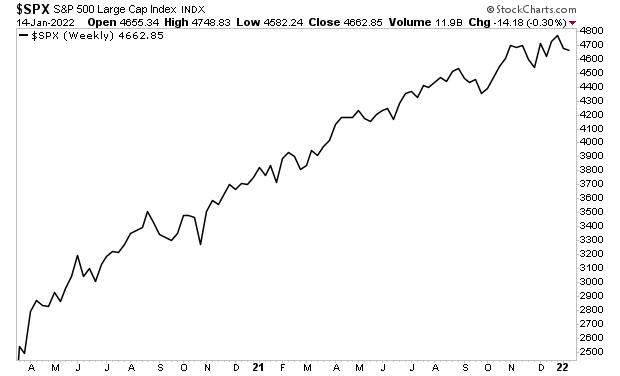

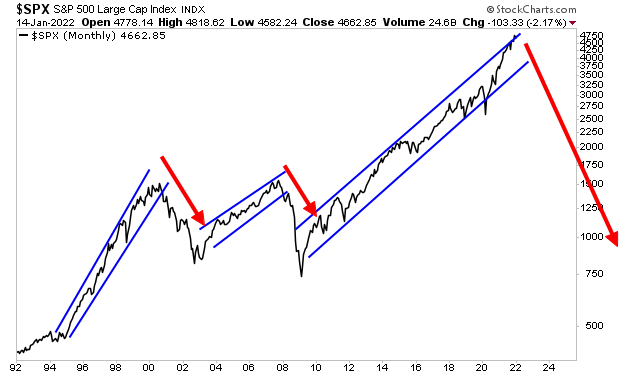

I bring all of this up because we are likely about to witness something similar today. Stocks have erupted higher on the back of inflation, courtesy of $11 trillion in Fed QE/ fiscal stimulus from the Federal Government between March 2020 and today.

This is the good part of inflation. And by the look of things, it’s about to go sour. Indeed, we are getting clear signs that costs are about to explode higher for corporations.

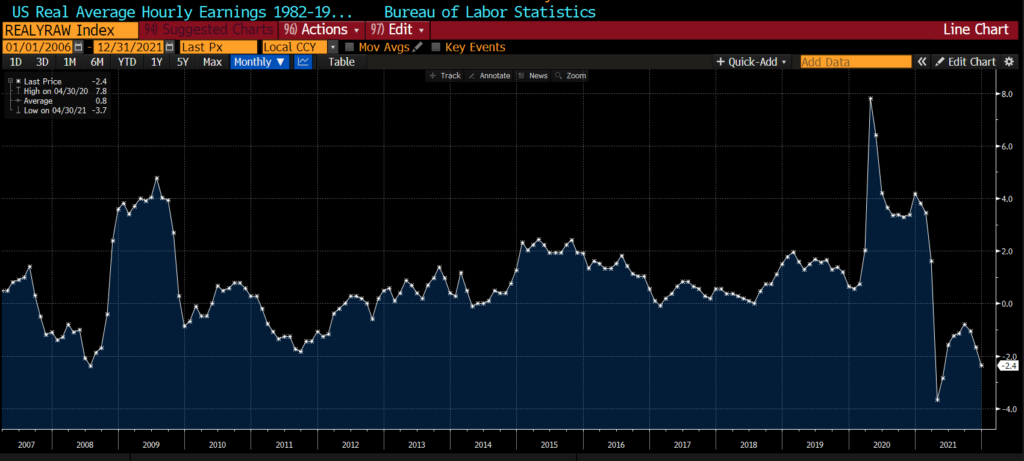

Profit margins are at all-time highs (there’s nowhere to go but down), while real wages (incomes adjusted for inflation) are DEEPLY negative.

Workers are now demanding higher wages. This means higher operating costs for corporations, which in turns means lower profit margins.

In simple terms, the clock is ticking for stocks. Sure, they might not crash this week, but another bloodbath is coming. The markets will soon be a sea of red. And the losses will be staggering.

The markets are warning us, but few have noticed.

The coming bust is going to be life-changing for many people. Most will lose much if not everything. But a small number of investors will generate LITERAL FORTUNES.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,