By Graham Summers, MBA

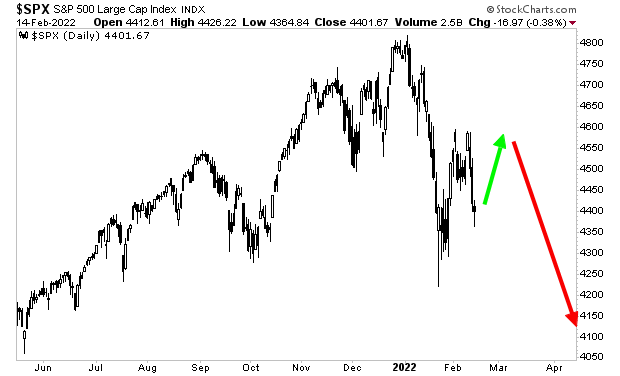

The Russia distraction appears to be over. The markets are enjoying a relief bounce. Enjoy it while it lasts.

The bigger issue for investors today is the fact that the markets are experiencing the first coordinated monetary tightening by central banks in years.

In the U.S., the financial system needs to digest the following:

· The Fed is ending QE in a few weeks.

· The Fed will begin raising rates, likely in March.

· Multiple Fed insiders are suggesting the Fed will be raising rates five or seven times this year.

Across the Atlantic, we have:

· The Bank of England (BoE) is already raising rates

· The European Central Bank (ECB) will be ending QE this year.

· The ECB is no longer committed to NOT raising rates.

The bond markets are fully aware of these developments. But stocks are in “la la land.”

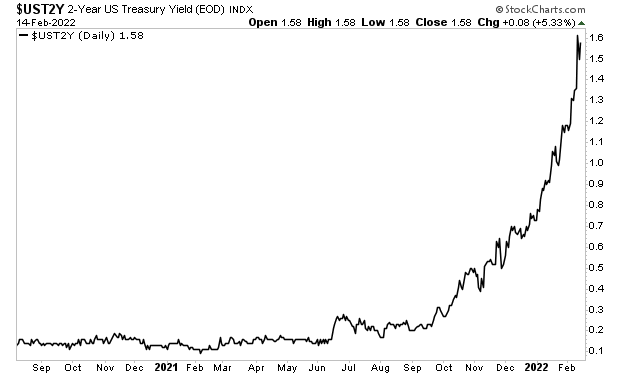

The yield on the 2-Year U.S. treasury has exploded higher, more than DOUBLING in the last six weeks alone.

In Germany, the 2-Year Government Bond has also exploded higher. Two weeks ago it moved more in a single week than it has in SIX YEARS.

This is the global financial system telling us, point blank, that we are in a “risk off” environment.

Stocks might chop around for a few more days, but we are going to NEW LOWS.

You can ignore this forecast, but in a week or so, you will wish you hadn’t.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,