Russia’s invasion of Ukraine has laid bare all the misguided, naïve policies our “leaders” have foisted upon us in the last 18 months.

Among the more foolish policies enacted by U.S. policymakers is the idea that the U.S. should NOT be energy independent but should rely on outside sources for oil.

Within days of taking office, President Biden ended the development of the Keystone XL Pipeline while putting an indefinite pause on new oil and natural gas leases on public lands.

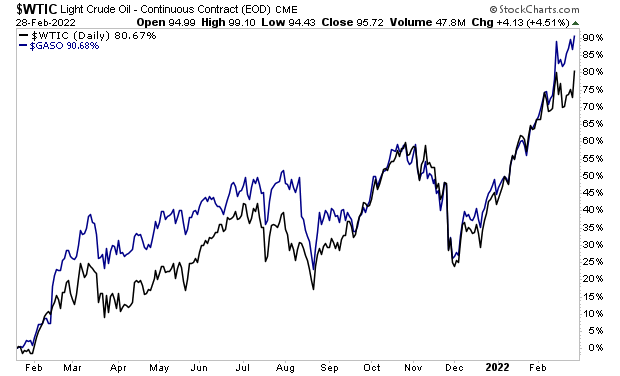

Months later he was asking OPEC to increase production of oil because oil and gasoline prices skyrocketed. Thus far, gas is up over 90% during the Biden Presidency, while oil is close behind at 80%.

Maybe we shouldn’t rely on countries that benefit from higher oil prices for our energy needs? Maybe those Executive Orders weren’t such a good idea? Maybe we should have people running our energy policy who actually know how many barrels of oil the U.S. consumers per day?

The icing on this cake of incompetence is the fact that the U.S. is directly financing Russia’s invasion of Ukraine. Russia supplies 7% of the U.S.’s energy needs. We are literally sending money to Putin every single day of the week… while calling him a monster. Maybe we should… stop buying oil from him!?!

As misguided as the Biden White House has been about energy policy, Europe’s leaders make it looks a bunch of geniuses. To that effect, Europe has been shutting down nuclear power plants and other sources of domestic energy production for years… all while signing deals with Vladimir Putin to supply its energy needs.

Currently Russia supplies ~40% of Europe’s gas and more than 25% of its oil.

How insane, or corrupt, or simply ignorant do you have to be to shut down domestic energy production and hand your energy needs over to Vladimir Putin? A kindergartener could tell you this was a dumb idea. But Europe’s elites signed off on it.

The end result?

Oil is above $100 a barrel for the first time since 2014. And there is little if any signs it’s not going much higher.

This is going to trigger a global recession… which in turn will trigger a market crash.

The world economy which was already fragile due to roaring inflation and supply chain issues will now be contending with an energy crisis. How do you think the economy will handle $100 oil when inflation was already at major problem when oil was at $80 a barrel?

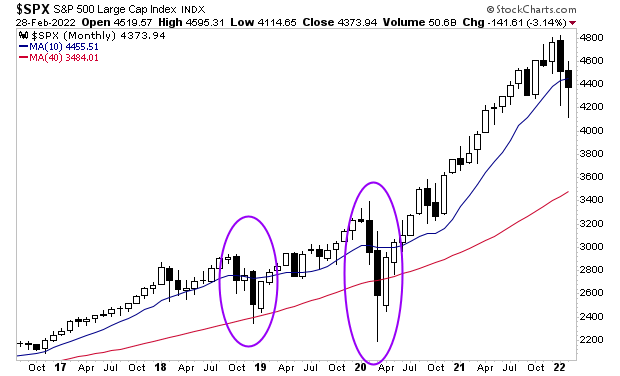

Stocks know what’s coming, as they have already broken below their 10-month moving average (MMA). The last two times this happened, the market ended up testing its 40-month moving average soon after (see the purple circles below).

That means the S&P 500 falling to 3,450 or so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,