By Graham Summers, MBA

The single most important rule in investing is “don’t fight the Fed.”

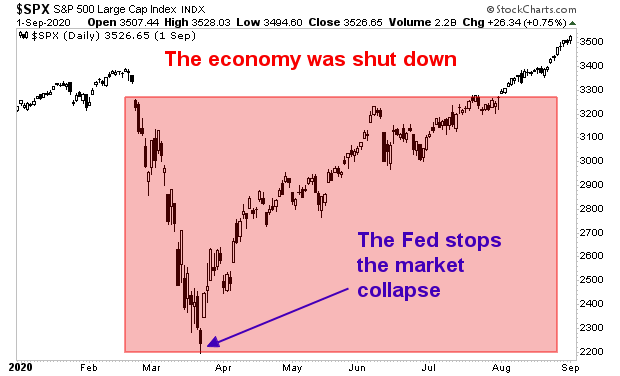

The Fed is the single most powerful entity in the financial system. And as we discovered in 2020, there is almost no limit to its power: the Fed was able to stop the most aggressive market crash in history… and push stocks to new all-time highs, at a time when the real economy was shut-down.

Again, the Fed managed to force stocks to new all-time highs during an economic shut-down. You can focus on value investing, momentum investing, day-trading… but whatever you do, DO NOT fight the Fed.

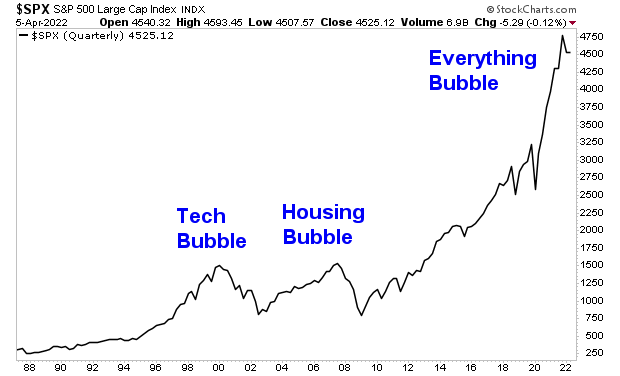

And right now the Fed is SCREAMING that it is going to aggressively tighten monetary policy.

Over the last six weeks, multiple Fed officials, including Fed Chair Jerome Powell (the most powerful Fed insider in the world) have stated that the Fed is WAY behind the curve on inflation and needs to start raising rates by 0.5% multiple times this year.

If you don’t believe me, perhaps you’ll believe Lael Brainard.

Ms. Brainard is the Fed Vice-Chair, the Fed’s second in command. She is arguably the most liberal, pro-money printing Fed official currently in office. Rarely, if ever, has she publicly stated anything that is not in favor Fed monetary easing.

Yesterday Ms. Brainard gave a speech in which she stated the following:

· High inflation places a “burden on working families.”

· It is of “paramount importance” that the Fed stop inflation.

· The Fed will start reducing its “balance sheet at a rapid pace” as early as May.

· The Fed is prepared to take even “stronger action” if needed.

Again, this is the most pro-money printing Fed official currently in office stating publicly that the single most important focus for the Fed today is ending inflation.

This means aggressive rate hikes and shrinking the Fed’s balance sheet as quickly as possible.

So while foolish investors continue to buy every dip in the stock market… and are willing to gamble on companies that couldn’t make money even when the Fed was easing… smart investors are preparing for what’s coming.

Don’t fight the Fed. Especially when it wants to stop inflation by popping a bubble.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html