The stock market is pretty scary these days, isn’t it?

Anyone who is bullish on stocks… or thinks they are cheap and worth buying, keeps getting wrecked. It’s not entirely their fault; the non-stop interventions by “someone” keep making it appear as if there are real buyers in the markets.

Yesterday showed us that there aren’t.

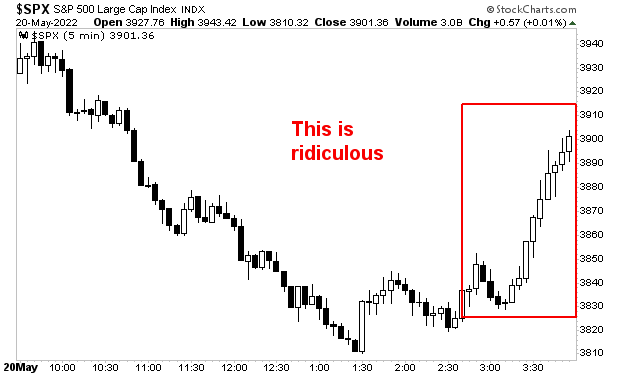

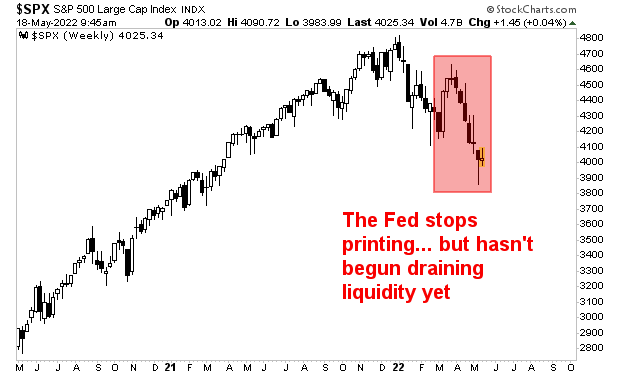

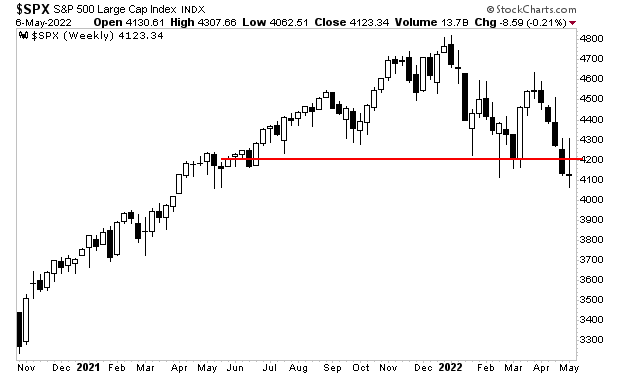

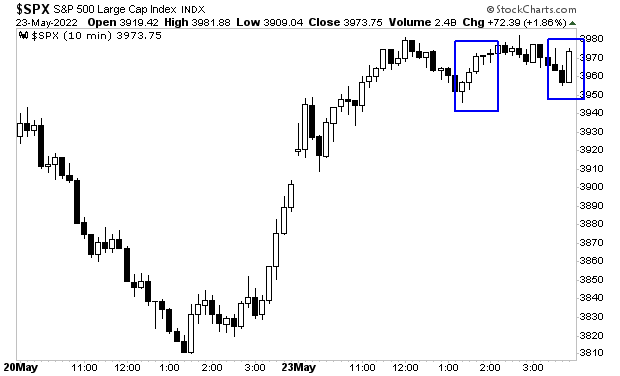

The S&P 500 came charging out of the gate yesterday… but gave up much of the gains around noon. If it weren’t for two OBVIOUS manipulations by “someone” which I’ve highlighted in the chart below, the market would have closed DOWN on the day.

This is the problem with blatant manipulation: it works in the short-term, but does nothing to fix the primary problem with the markets… namely that prices are not at levels at which REAL buyers want to buy.

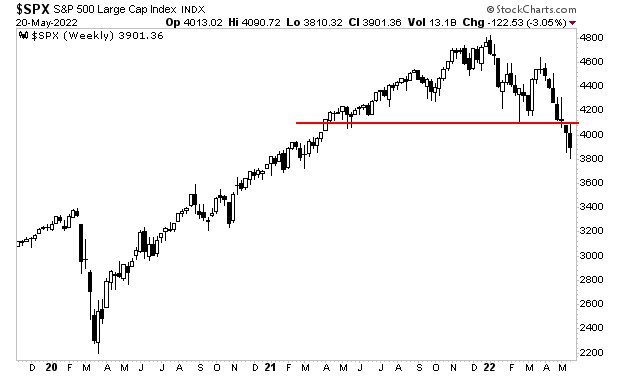

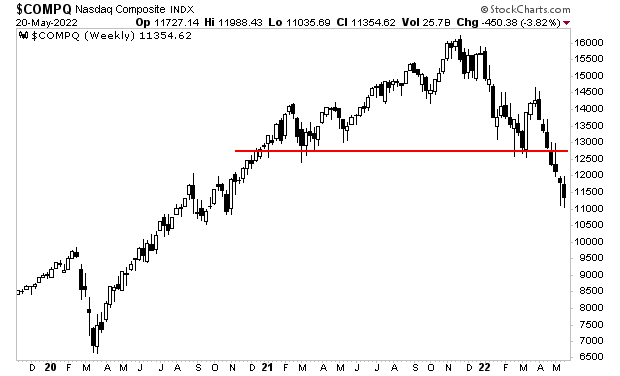

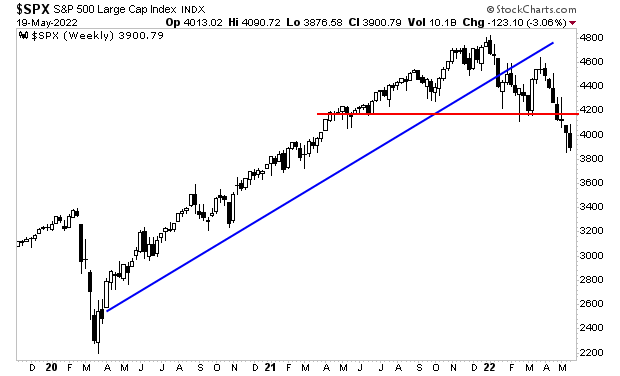

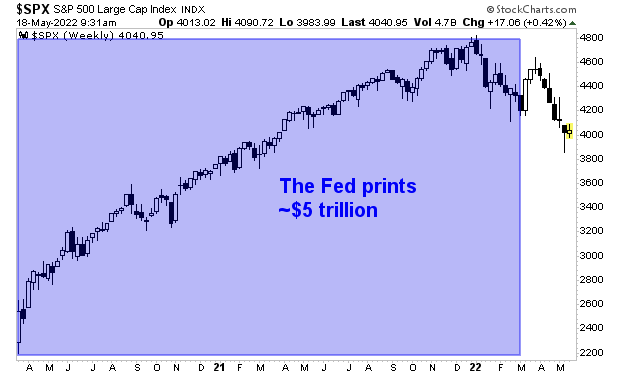

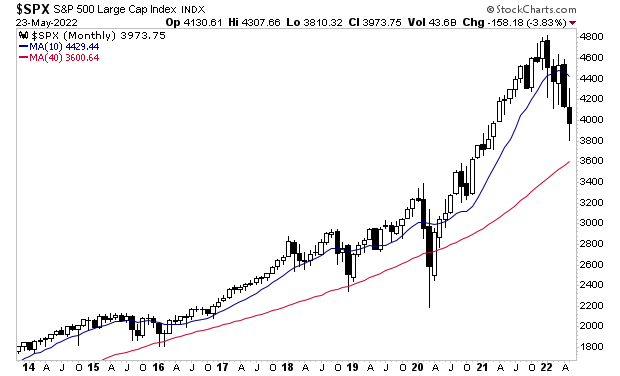

One way to get around this issue is to focus on long-term charts.

By focusing on what stocks are doing in weekly or monthly terms, you can tune out much of the “noise” caused by interventions that only last a few hours or even minutes.

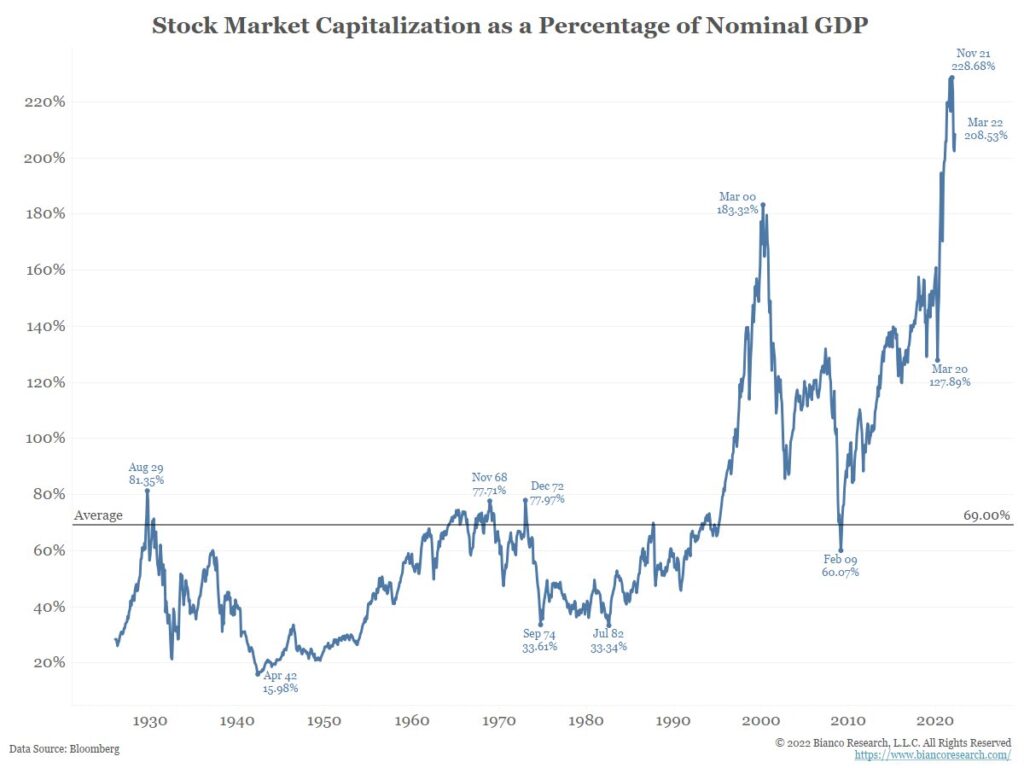

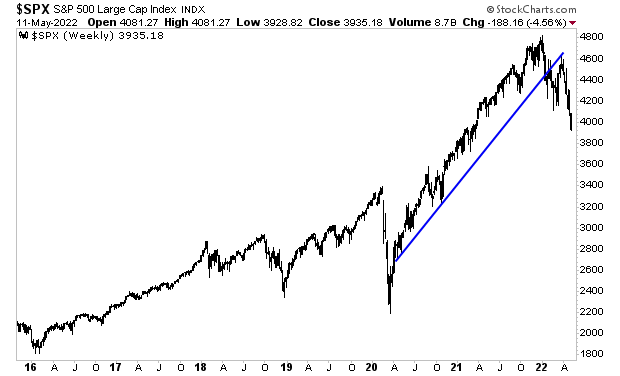

Here is a monthly chart of the S&P 500. As you can see, the market has taken out its 10-month moving average (blue line). As the last eight years have shown, any time stocks do this, they end up dropping to at least the 40-month moving average (red line).

What’s REALLY scary about this chart is the fact that the last FOUR times this happened, the Fed stopped the collapse by easing monetary conditions.

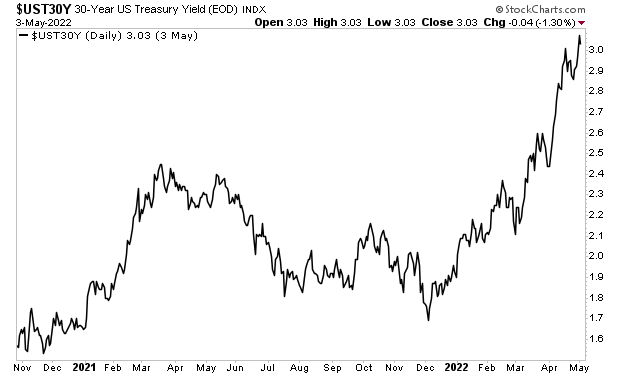

This time around the Fed CANNOT ease monetary policy.

Why?

Because monetary easing unleashed the very thing what triggered the collapse in the first place: inflation. More easing will only make the situation worse!

Put simply, the Fed is NOT coming to the rescue this time. Stocks could very well break below that red line and wipe out years of gains.

The time to prepare is NOW before it hits.

Private Wealth Advisory subscribers are doing just that.

I recently told subscribers about the #1 investment to own during a bear market. This one investment alone is giving them peace of mind, and allowing them to avoid the pain and destruction caused by the markets.

But that’s not all…

We also opened three proprietary Crash Trades to profit from the collapse.

As I write this ALL THREE are exploding higher.

Come join us in turning the coming crisis into a time of life changing gains!

To do so… all you need to do is take out a $9.99, 30-day trial to Private Wealth Advisory …

To do so…