Two weeks ago, the new government in the U.K. introduced a series of major tax cuts aimed at stimulating the economy.

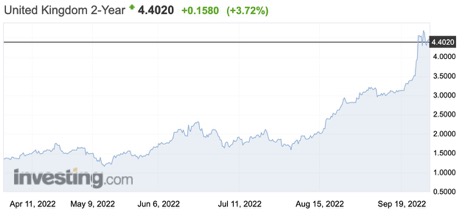

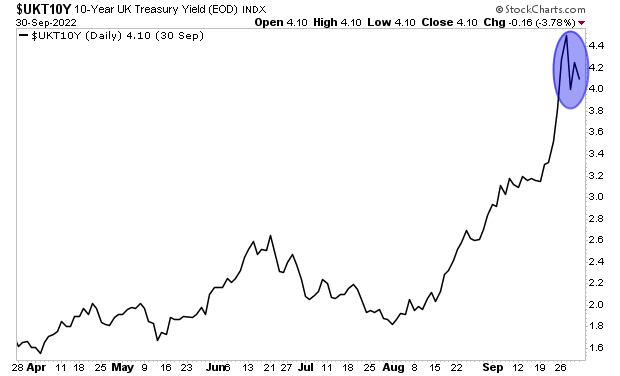

Tax cuts mean less tax revenues, which in turn means less money available to pay the interest on the country’s debt. Bond yields in the U.K. were already rising due to inflation and monetary tightening from the BoE. The announcement of tax cuts triggered a panic.

The yield on the 2-Year U.K. government bond exploded higher from 3.5% to 4.4% in a matter of days.

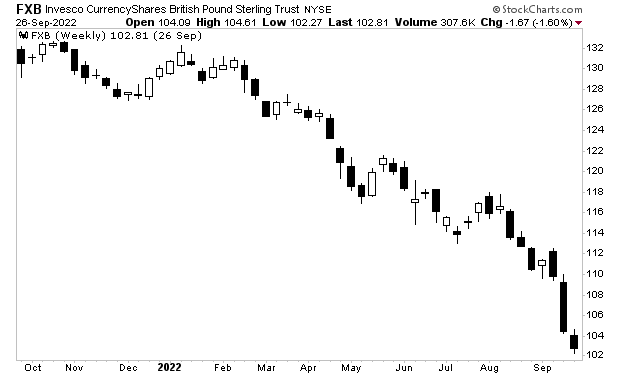

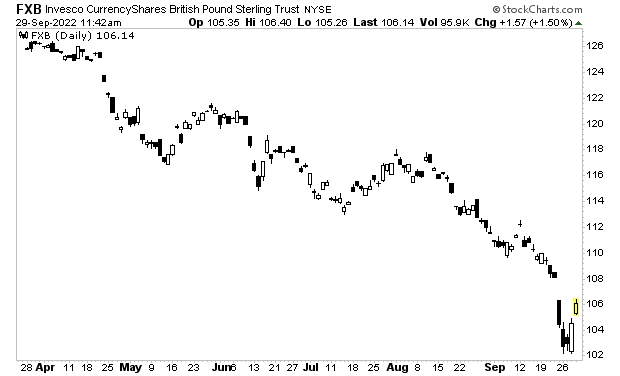

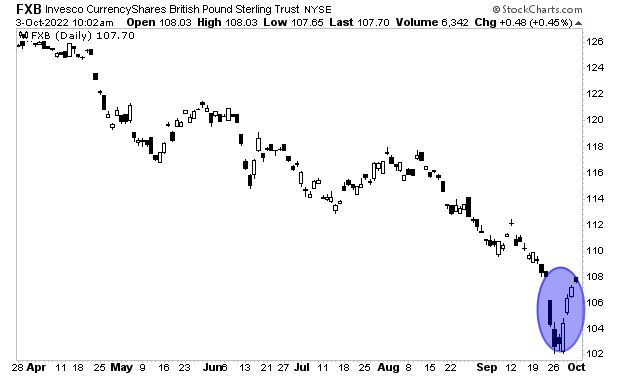

And the British Pound nosedived.

Remember, we’re not talking about volatility in a stock here… we’re talking about the GOVERNMENT BOND and CURRENCY of the FIFTH LARGEST ECONOMY IN THE WORLD!

Pension funds, which invest trillions of pounds’ worth of capital in the U.K. and which were heavily invested in U.K. government bonds, were on the verge of going belly up. So, the Bank of England panicked and announced it would introduce UNLIMITED QE again.

That is not a typo. The Bank of England is the first major central bank to be broken by the markets. And it won’t be the last.

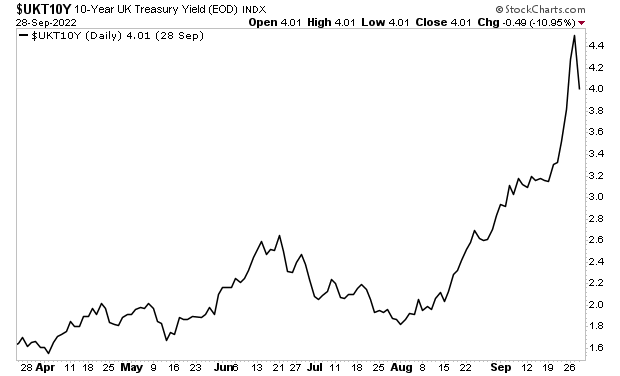

The BoE announced that it will begin “unlimited QE” to support U.K. bonds from September 28th until October 14th.

U.K. sovereign bond yields dropped on the news.

And the British pound rallied.

What happens here is critical. If yields on U.K, bonds begin to rally ,and the British Pound begins to collapse again… it means the BoE has LOST CREDIBILITY.

Yes, we’re talking about a MAJOR central bank for a developed nation losing credibility with the markets.

As I write this, it is too early to tell. But this is THE most important situation in the world right now. If things go south here, the U.K. will go bust.

The British Pound has managed to “close the gap” from the Monday decline, but it’s not out of the woods by any stretch. You would think that a major central bank saying it will do “whatever it takes” to defend its currency would have a bigger impact. But the pound remains in a downtrend.

Moreover, the yields on British Gilts have come down from their panic highs but remain at EXTREMELY elevated levels. The crisis here is not over by any stretch.

What happens here is critical. If the Pound begins to fall again, and yields on Gilts rise, then the great Crisis of our lifetimes, the crisis in which entire countries go bust, is here.

And it is inflation that triggered it!

On that note, we published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We made 100 copies available to the public.

Today is the last day this report is available to the general public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards,