By Graham Summers, MBA

One of the central theses of my bestselling book The Everything Bubble is that once a central bank embarks on a path of extraordinary monetary easing, it can never escape.

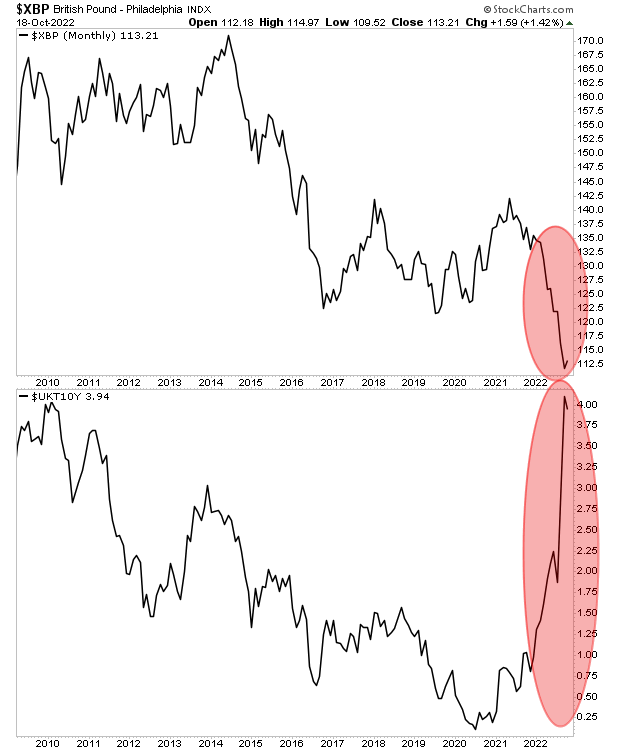

The Bank of England (BoE) is now finding this out the hard way. Back in September it had planned on shrinking its balance sheet via a process called Quantitative Tightening (QT).

Then the new government introduced more fiscal easing, the British Pound collapsed and the yields on British Government bonds exploded higher.

The BoE was forced to abandon all plans on QT and instead introduced emergency, unlimited Quantitative Easing (QE) to try and calm the markets.

The new plan was to provide QE for a few weeks until things calmed down. In fact, this “temporary” QE was supposed to end October 14. However, the BoE was forced to provide additional easing measures to make sure things remain calm.

So QE is ending… but easing is not. And the BoE claims it will once again try to start QT on November 1st.

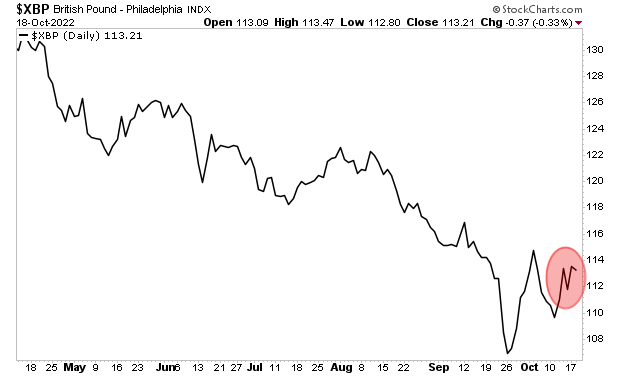

Good luck with that! The Pound is already rolling over again!

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2022, entire countries will do so.

The U.K. is the fifth largest economy in the world. And by the look of things, it will be the first to go bust. It won’t be the last. Japan, Europe and ultimate the U.S. will experience debt crises in the coming months.

Smart investors are preparing for what’s coming now… before it arrives!

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

We made an additional 100 copies available to the public based on what is happening in the markets.

As I write this there are 9 left.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html