The following is an excerpt from my weekly investment advisory Private Wealth Advisory. To learn more about Private Wealth Advisory and how it can help you and your investments, Click Here!

This week I have good news and bad news.

The good news is that bonds are finally starting to stabilize.

The bad news is that they are doing this right as the economy collapses into a severe recession.

As I’ve outlined throughout this year, the ENTIRE stock market collapse thus far has been due to bond yields rising.

When Treasuries were yielding 0.25%-0.4% throughout most of 2020 and 2021, investors were willing to pay 20-22 times forward earnings for stocks. However, once Treasury yields rose over 4% stocks were repriced down to 16-18 times forward earnings. This makes sense. When the “risk free” rate of return is close to zero, you’ll pay a premium for growth. But once you can earn 4+% “risk free” suddenly stocks look a lot riskier!

Indeed, stocks were priced at 20-22 times forward earnings for most of 2020 and 2021. However, once Treasury yields began to rise in late 2021, stocks peaked in terms of multiples. They were eventually repriced down to 16-18 times earnings.

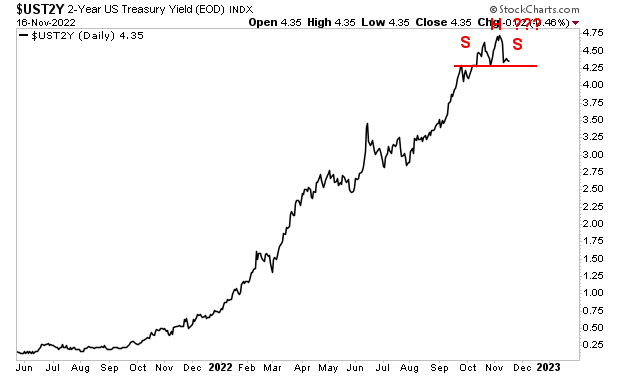

As I noted since this repricing began, the ONLY thing that would stop stocks from being repriced lower would be if bond yields stabilized. With that in mind, I want to point out that the yield on the 2-Year U.S. Treasury appears to have peaked. In fact, it now looks to be forming a kind of “Head and Shoulders” topping pattern. We only need the right shoulder to complete that pattern.

Regardless of whether that Head and Shoulders pattern is actually confirmed, the key item here is that Treasury yields finally appear to be stabilizing. Obviously, stocks would LOVE for Treasury yields to fall, as that would open the door to a higher forward multiple (assuming the economy is strong). But for now, the price action in the Treasury market suggests that stocks will remain priced at a forward multiple of 16-18 at least for now.

That is the good news.

The bad news is that earnings are now collapsing, as the economy collapses into a severe recession. This means the denominator in the P/E ratio (Price/ Earnings) is now shrinking. Earnings for the third quarter of 2022 are DOWN 8% Year over Year. As Charlie Bilello notes, this is the second consecutive quarter of negative earnings growth on a Year over Year basis.

Unfortunately, earnings will be dropping even more going forward. To understand why, we need to first understand the Treasury market. The Treasury is comprised of numerous bonds with different maturation periods ranging from 4 weeks to 30 years.

When you plot the yield on all of these bonds, you get the “yield curve.” And the difference in yield between various bonds on this curve is one of the most accurate predictors of recession.

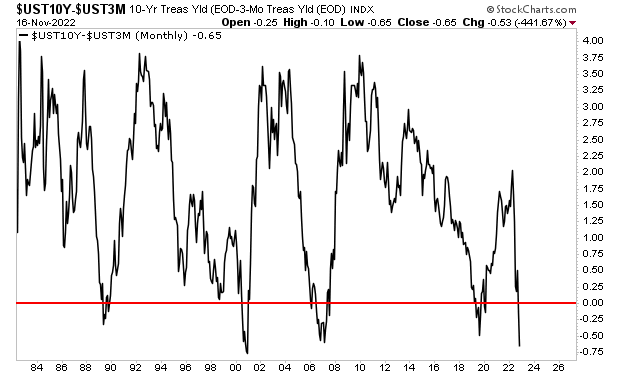

Specifically, the difference between the yield on the 10-Year U.S. Treasury and the yield on the 3-month U.S. Treasury. Anytime this difference becomes negative (meaning the 3-month yield is actually higher than the 10-year yield) this indicates a recession is about to hit.

I’ve illustrated this in the chart below. Anytime the black line falls below the red line, the 10-year 3-month yield curve is “inverted.” This was the case in 1989, 2001, 2007, and 2019: all of those preceded recessions.

It is happening again now. And as you can see, this metric is MORE negative today than it was before the COVID-19 crash as well as the Great Financial Crisis.

Put simply, the yield curve of the Treasury market is predicting a severe recession in the near future, likely the start of 2023.

This is going to force stocks to new lows.

During the typical recession, Earnings Per Share (EPS) usually fall 25%. As I write this, Wall Street’s current consensus for 2023 EPS is $230. And Wall Street expects this to GROW by 5%!!!

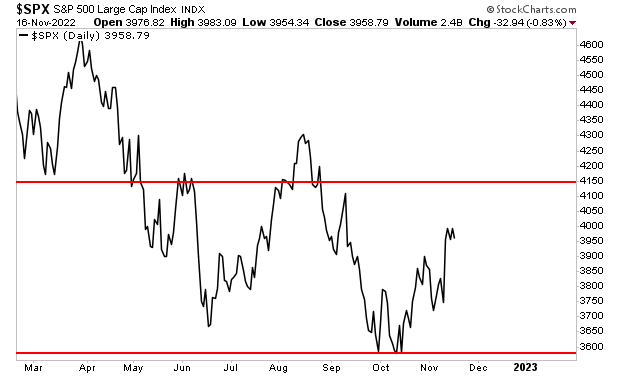

This means the anticipated fair value for the S&P 500 is somewhere between 3,680 and 4,140. Incidentally, that is the EXACT trading range the S&P 500 has been moving in for the last six months.

Put simply, the market is trading based on what Wall Street expects is coming down the pike. But as I just noted, Wall Street expects earnings growth of 5% next year. However, the reality is that bonds are telling us a recession is coming… and a recession would mean a DECLINE in earnings of at least 25% (remember, the yield curve is predicting a SEVERE recession).

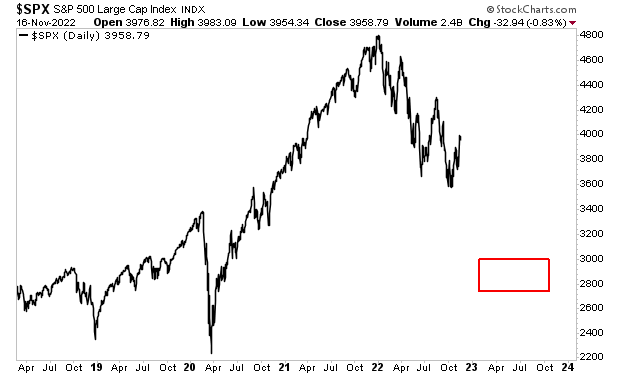

This would mean the actual 2023 EPS would be closer to $172.

Assuming Treasury yields no longer rise, this means the fair value for the S&P 500 at 16 to 18 times this much lower EPS would be 2,752-3,096. I’ve illustrated that range in the chart below. Suffice to say, the stock market has a LONG ways to go to the downside.

“But wait a minute, Graham” some of you are probably thinking… “the Fed is about to pivot sometime next year, and that would STOP the bear market!”

I wish that was the case…

Historically, anytime the Fed stops tightening and begins easing, the markets don’t actually bottom for another 14 months.

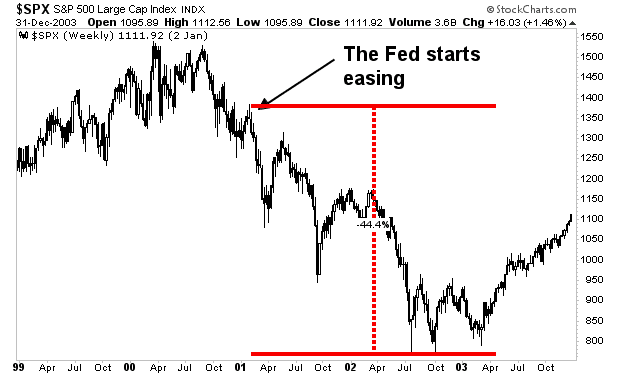

During the Tech Crash, the Fed started cutting rates in January of 2001. However, by that point, a recession had hit and stocks lost another 44% eventually bottoming in October 2003.

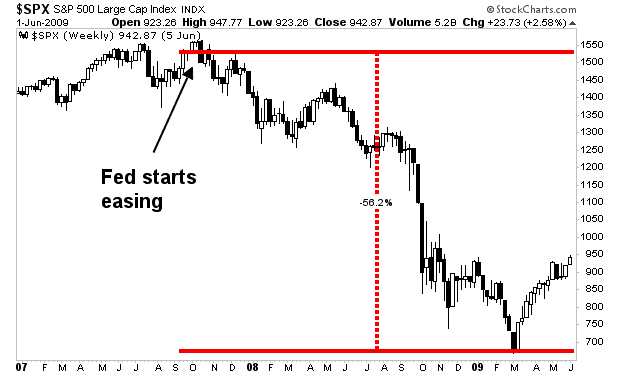

Similarly, during the Housing Crash, the Fed started easing in August of 2007. There again, a recession hit and stocks lost another 56% before eventually bottoming in March 2009.

Simply put, even if the Fed were to surprise everyone and start easing as soon as next month (December) the coming recession would STILL result in EPS collapsing and stocks cratering another 30% or so.

With stocks at 4,000 or so on the S&P 500, a 30% decline would bring them right to… 2,800, or around the lower end of the implied fair value for the market at a 16- times my expected EPS for 2023: $172.

Low Multiple Recessionary EPS Fair Value in 2023

16 X $172 = 2,752 or ~2.800

So again, this week we have both good news and bad news. The good news is that bonds are stabilizing. The bad news is that a recession is coming, and earnings are about to crater.

That will trigger a stock market collapse to new lows… possibly down to the mid-2000s on the S&P 500.

If you’ve yet to take steps to prepare for this, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html