The Yellen Fed is rapidly digressing into a political entity.

The Fed is allegedly independent of politics, but Janet Yellen’s latest statements leave no doubt that she is more of a political operative than an economist.

Three months ago, on October 14 2016, Yellen stated the following:

Yellen Cites Benefits to Running Economy Hot for Some Time

Federal Reserve Chairwoman Janet Yellen offered an argument for running the U.S. economy hot for a period to ensure moribund growth doesn’t become an entrenched feature of the business landscape.

That would mean letting unemployment fall lower and spurring faster growth to boost consumer spending and business investment.

Source: Wall Street Journal

Compare this language to Yellen’s statement from last week.

Federal Reserve Chair Janet Yellen backed a strategy for gradually raising interest rates, arguing that the central bank wasn’t behind the curve in containing inflation pressures but nevertheless can’t afford to allow the economy to run too hot.

Still, she saw dangers in permitting the economy to overheat and inflation expectations to get out of control. “Allowing the economy to run markedly and persistently ‘hot’ would be risky and unwise,” she said.

Source: Bloomberg.

So three months ago, running the economy “hot” was a good idea. But today, it’s a massive risk that we cannot afford to take.

What changed in those three months?

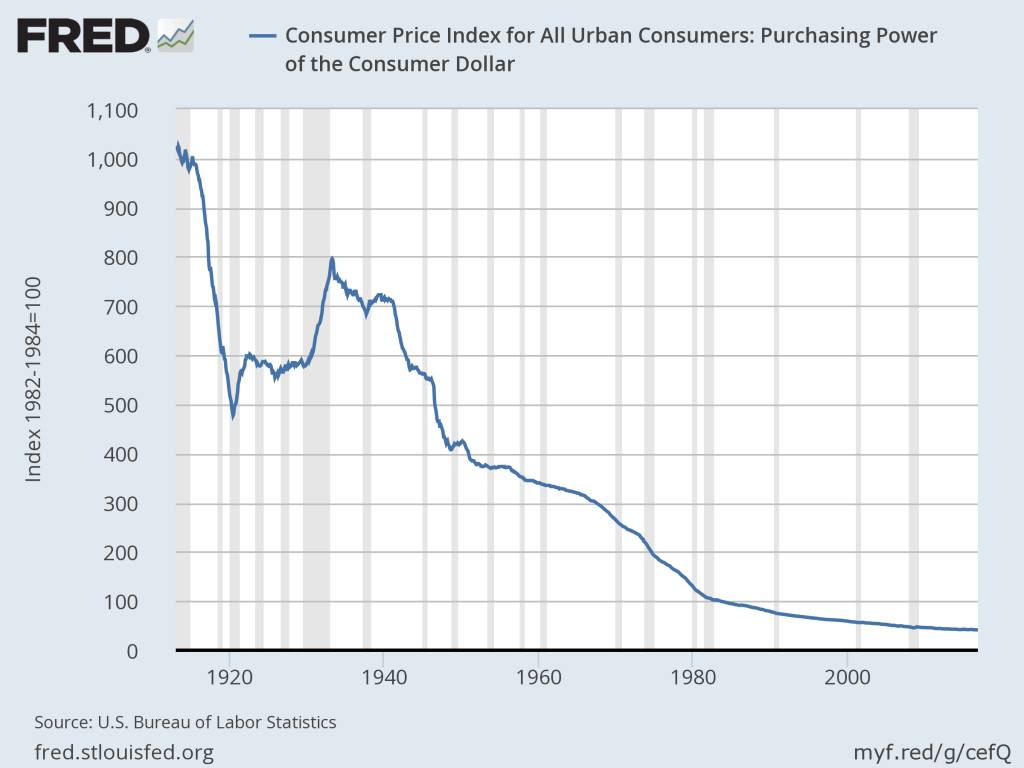

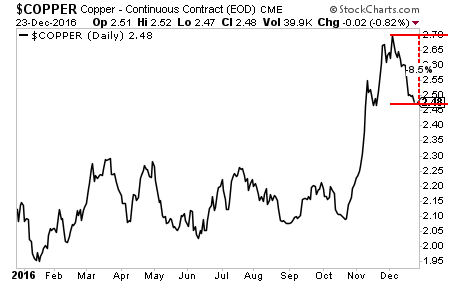

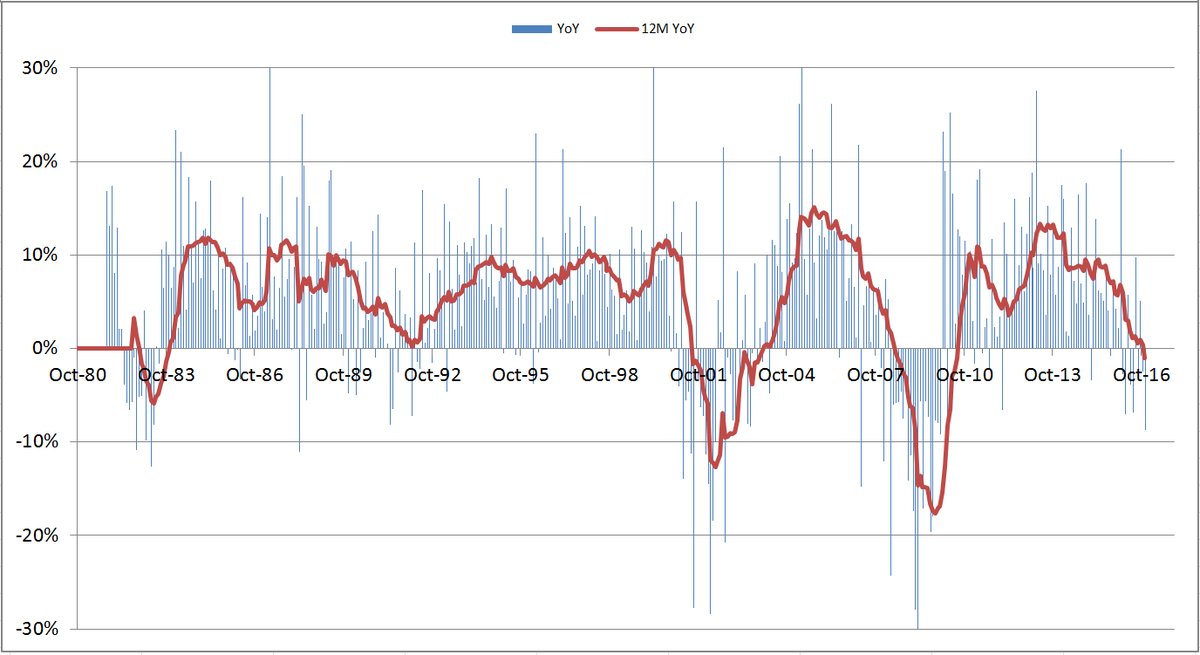

Core inflation rose 0.1%. And the US closed 2016 with a sub-2% growth rate for the year. Neither of those would qualify as remotely “hot.”

The main change? The GOP took the House, Senate, and White House.

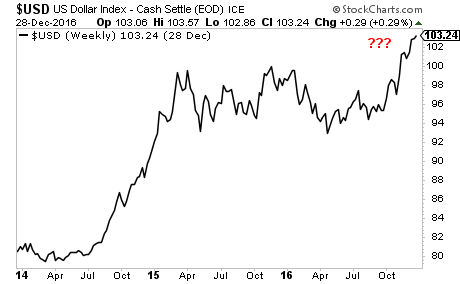

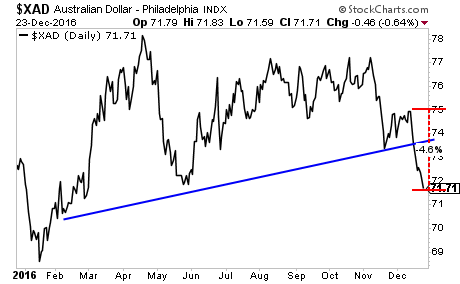

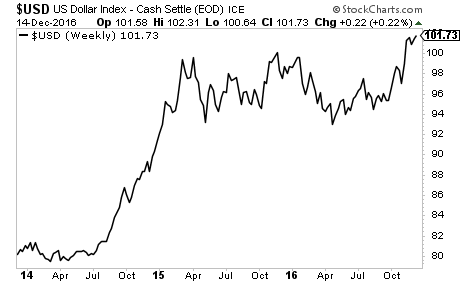

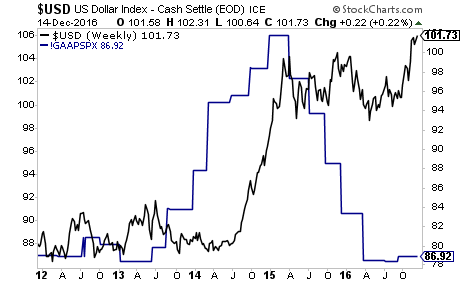

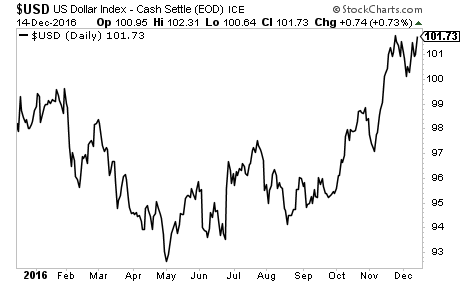

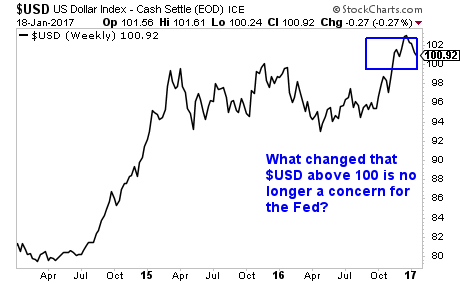

Bear in mind, Yellen’s statement came a mere 24 hours after then President-elect Donald Trump commented that the US Dollar was “too strong.”

So… we have a Fed chair performing a 180% on running a “hot” economy within three months and openly defying the new administration’s views on the US Dollar at a time when the data doesn’t support any of her claims.

Yellen may be seeing something everyone else is not, but it is difficult to see this as anything other than political hackery.

Originally posted on www.gainspainscapital.com

Graham Summers

Chief Market Strategist

Phoenix Capital Research

H/T Hedgin

H/T Hedgin