More and more insiders are warning of a potential systemic event.

The first sign of real trouble concerned a number of investment legends choosing to close shop and return investors’ capital.

The first real titan to bow out was Stanley Druckenmiller. Druckenmiller maintained average annual gains of nearly 30% for 30 years. He is arguably one of if not the greatest investor of the last three decades.

In 2010, he chose to close shop, foregoing billions in management fees.

Druckenmiller was not alone. In 2011, investment legend Carl Icahn closed his hedge fund to outside investors. Again, here was an investment legend who could lock in billions in investment management fees choosing to close up shop.

He has since stated he is “extremely worried” about stocks.

The list continues.

Seth Klarman used to manage the fourth largest hedge fund in the US. A legendary value investor (copies of his book Margin of Safety sells for over $1,500 on Amazon), Klarman returned billions in assets under management to outside investors citing “too few” opportunities in the market (again, a legend stating that the market was overvalued).

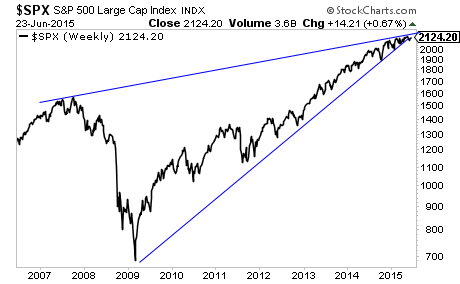

Even the perma-bulls are speaking with their actions.

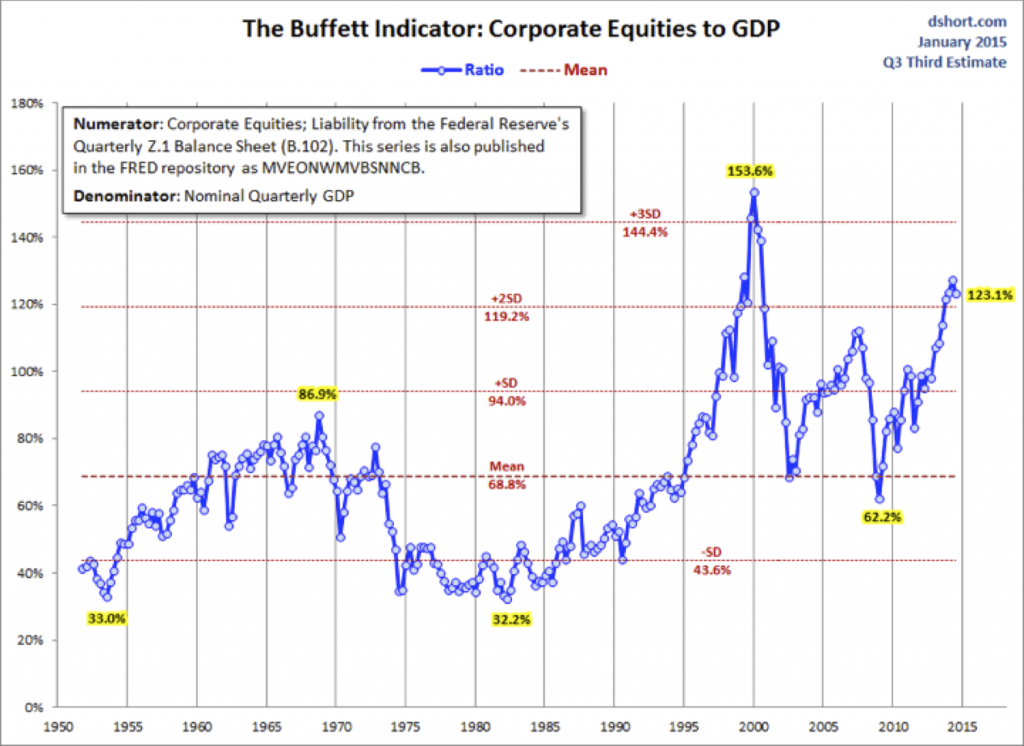

Warren Buffett, perhaps the single biggest cheerleader for stocks in the last 100 years, is sitting on a record amount of cash. The reason is obvious: the market is dangerously overpriced.

His partner, Charlie Munger recently commented that he has not bought a single stock in his personal portfolio in over two years. This would once again indicate an investment legend stepped out of the market a year or so ago.

Beyond the legends, institutional investors have been net sellers of stocks in 2014 and on into 2015. The same goes for hedge funds.

Do you think they’d be doing this if they thought stocks were offering a lot of opportunities and value today?

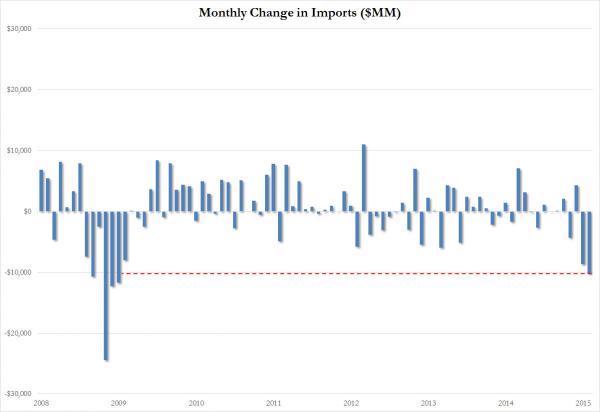

And finally, we get to today, where one of the largest asset managers in the world at Fidelity stated that we are heading for a “systemic event… similar to 2008” and that owning precious metals and physical cash is a good idea.

The punch line?

This was a bond fund manager. One of the class of investors who have poo poo’d Gold and physical cash in the past because those assets pay next to or no dividend.

And even HE is warning that it’s time to take safety and prepare.

Smart investors should take note of this now. It is a MAJOR red flag to be watched closely.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just opened seven trades to profit from the above trends in the last two weeks. As we write this, ALL of them are soaring.

This brings us to a NINETEEN trade winning streak… and 25 of our last 26 trades have been winners!

Indeed… we’ve only closed ONE loser in the TWELVE MONTHS

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research