Let’s put another nail in the coffin of the “recovery” talk.

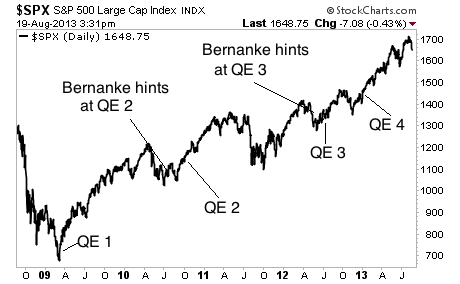

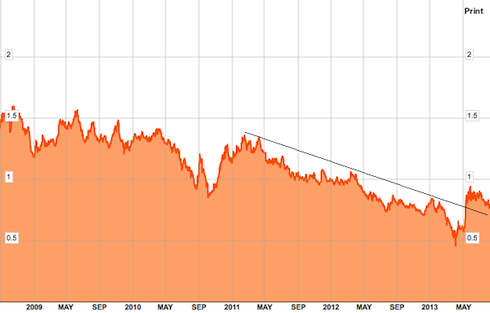

Bernanke and the Fed allege that the purpose of QE is to help housing recovery. But rising home prices do not actually equate to increased “wealth” for the average American.

Homes, unlike most purchases (well at least in the past), are financed via debt. In this regard the “homeowner” doesn’t actually “own” the home; the bank does. And anyone who looks at how much money banks make from mortgage lending can easily assess who comes out on top from that deal: hint it’s not the homeowner.

Say I buy a home for $200K with a down payment of $40K. I only own $40K worth of home. And if the home rises in value to $220K, I still owe the bank $180K. Sure, you could technically argue that I’ve made $20K off my initial $40K, but that would only count if I sold the house right then and there.

If I don’t sell the house, then technically I’m not wealthier, I’m just slightly less in debt (on paper). This fact becomes abundantly clear the minute I stop paying my mortgage and the bank comes knocking.

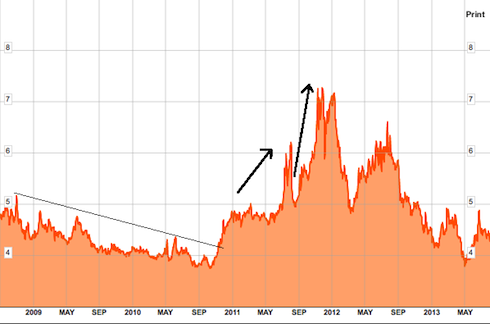

With that in mind, we need to ask, just who is wealthier as a result of the new housing bubble the Fed has created?

It’s not most Americans. According to the US census only 29% of us own our homes outright. Rather, it’s the banks and the large institutional investors who bought up thousands of homes in cash during the “recovery.”

This is not rocket science; it’s common sense. But the Fed keeps talking about a housing “recovery” like it’s helping Main Street. It’s doing no such thing. All of the Fed’s policies have been aimed at helping the large banks. They’re the ones who own the US’s homes.

If you’re concerned about your portfolio taking a hit when the bubble bursts, I strongly urge you to consider an annual subscription to my Private Wealth Advisory newsletter.

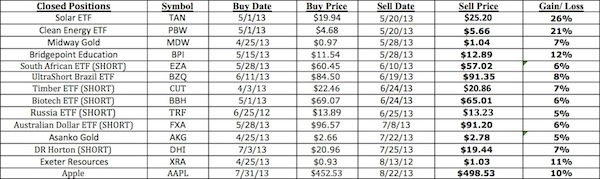

Private Wealth Advisory specializes in helping individual investors profit from any market environment. In 2008 the Private Wealth Advisory portfolio returned 7%. In 2011 it returned 9% (the market was flat). And from July 2011-July 2012, Private Wealth Advisory set a record for the investment newsletter industry, closing out 74 straight winning investments.

During this entire 12 month period, we didn’t close a single loser.

In fact, we’re currently on another winning streak having locked in FOURTEEN winning trades in the last two months, including gains of 10%, 11%, 21% and 25%. And our portfolio is on the move with winners number 15, 16, and 17 just waiting in the wings.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers