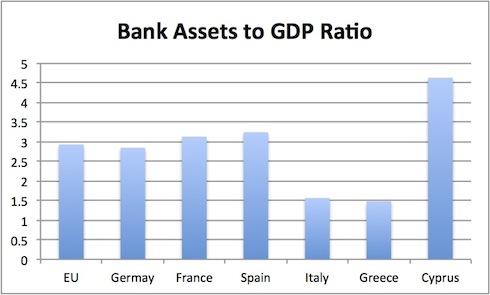

The EU continues to flounder around as Cyprus, a country whose GDP accounts for just 0.2% of the Europe’s economy, has proven the truth behind all of the “solutions” thrown around by the ECB and EU politicians: that they really don’t have a clue how to fix the problem plaguing Europe.

Why is this?

Because at the end of the day, there is really only one solution to this whole mess: DEFAULT… both by the banks and by EU nations as a whole.

What happened to Wall Street in 2008? Banks that were over leveraged (meaning they borrowed far more money than they actually had on hand) went bust because the assets they bought with the borrowed money fell in value to the point that it erased the actual money they had on hand.

Think of it this way, if you borrow $30 for every $1 you actually own, and you invest that $30 in various assets, you only need those assets to fall 3% (0.03 * 30 = 0.9) before you’ve wiped out almost all of your actual money (the $1 you owned and which you borrowed the $30 against).

This is what took down Lehman. And it’s what is taking down Europe today. The entire European banking system is leveraged at 26 to 1. Lehman was 30 to 1, Europe as a whole is only slightly below that,

And where did they invest the $26 in borrowed money?

EU sovereign bonds… (as well as garbage mortgages in the various EU housing bubbles).

When you are leveraged at $26 to 1, you only need the assets you’ve invested in to fall 4% before you are totally bankrupt. This 4% drop in asset prices has already happened across Europe, the only reason that we haven’t seen a systemic collapse there is because Mario Draghi, the head of the ECB, said he’d buy unlimited amounts of EU bonds.

Note, Draghi said he would buy these bonds, he hasn’t actually bought anything since he said this.

So why did Draghi’s statement matter?

Because the primary assets owned by EU banks are EU sovereign bonds. And if EU bonds keep falling, it results in the dreaded 4% drop in asset prices that would wipe out all the EU banks’ capital.

So Draghi stepped in last summer, promised to buy EU bonds, EU bonds went up, and EU banks could breathe a sigh of relief… for a while.

But anyone with a modicum of common sense can look at this situation and say, “but wait, nothing was actually fixed, all that happened was Draghi promised something and the markets reacted.”

PRECISELY. And that is what Cyprus just proved: that the ENTIRE EU “fix” was a huge lie. Nothing changed. Nothing was fixed. The banks are still leveraged at 26 to 1 and sitting on loads of garbage debts. And the EU countries are all still totally bankrupt.

So what happens when EU bonds start rolling over again… and what happens when EU banks start seeing their asset prices falling… falling… falling to -4% or even more?

SYSTEMIC FAILURE IN EUROPE.

If you are not prepared for this…YOU NEED TO ACT NOW.

We have released a number of Special Reports outlining precisely how to prepare for all of this.

The single most important one is called “The C Word: the Dark Secret the Fed Wants Hidden” and it explains in stark detail how Europe can bring about systemic collapse… WHY the Fed is terrified about Europe and is secretly pumping HUNDREDS OF BILLIONS of Dollars into the European banking system (QE 3 and QE 4 were European bank bailouts).

We also have three reports titled Protect Your Family, Protect Your Savings, and Protect Your Portfolio and they outline:

1) how to prepare for bank holidays (just like the one in Cyprus today)

2) which banks to avoid

3) how much bullion to own

4) how much cash is needed to get through systemic crises

5) how much food to stockpile, what kind to get, and where to get it

And more…

Collectively, these reports are worth nearly $900. But you can get all of them for FREE with a subscription to my Private Wealth Advisory newsletter.

To pick up your own copies of these reports., all you need to do is take out a subscription to my Private Wealth Advisory newsletter.

You’ll immediate be given access to the Private Wealth Advisory archives, including my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports.

You’ll also join my private client list in receive my bi-weekly market commentaries as well as my real time investment alerts, telling you exactly when to buy and sell an investment and what prices to pay.

So you get my hard hitting market insights, actionable investment recommendations, and real time trade alerts, for one full year, for just $299.99.

To take out an annual subscription to Private Wealth Advisory now and start taking steps to insure your loved ones and personal finances move through the coming storm safely…

Click Here Now!!!

Best Regards,

Graham Summers