As we noted in yesterday’s missive, the new Fed Chair Jerome Powell is rapidly changing the focus of the Fed in terms of monetary policy.

A large component of this stems from Powell’s experience prior to join the Fed. Indeed, Powell is the first Fed Chair with any kind of banking experience (albeit investment banking) since Alan Greenspan: former Fed Chairs Janet Yellen and Ben Bernanke were both career academics.

However, to say that Jerome Powell is strictly a private sector banker would be to overlook the most critical role of his career… namely, that… Jerome Powell was head of oversight for the Fed’s “too big to fail” banks.

In that capacity, Powell gave a speech titled Ending “Too Big to Fail” at the Institute of International Bankers 2013 Washington Conference in Washington, D.C.

During this speech, Powell emphasized that the Federal Reserve no longer has the authority to directly bail out a failing bank, stating, “Dodd-Frank eliminated the authority used by the Federal Reserve and other regulators to bail out individual institutions during the crisis, including Bear Stearns, Citicorp, Bank of America and AIG.”

So if the Powell Fed is not in the bail out business anymore… who is?

Shareholders and bondholders.

And guess who developed the plan through which this would happen?

Jerome Powell… the man Trump just picked for Fed Chair.

Powell was a central figure in the development of the “bail-in” strategy in the US, having been involved in “simulations” of a large bank failure as far back as 2011, as well as the development of the strategies put forth in Dodd Frank bill, namely:

1) That banks develop “living wills” or plans for “rapid and orderly resolution in the event of material financial distress or failure of the company, and include both public and confidential sections.”

2) Bail-Ins: programs through which the FDIC would seize a failing bank systemic importance and wipe out all of its shareholders’ capital as well as much of bondholders’ in order to prop the bank up.

Put simply, according to current proposals the next time a financial firm gets into trouble, the Fed won’t come running with a bail out. Instead, the FDIC will seize the bank and then use the capital from shareholders and bondholders to “prop it up” before breaking it apart into separate entities…

And the Trump administration, under the influence of Treasury Secretary Steve Mnuchin chose the man who helped develop these strategies (and who is a large proponent of deregulation of the financial system) as its Fed Chair.

But Treasury Secretary Steven Mnuchin, who advised the president on the Fed search, pushed hard for Powell, having held discussions with him this year in drawing up recommendations to deregulate the financial system.

Source: Politico

Even more importantly, in nominating Powell, the Trump administration bucked a long-time tradition of reappointing the current Fed Chair.

…In deciding to move on from Yellen, who presided over record stock market advances and gained trust on Wall Street, Trump broke from historic precedent in which new presidents typically renominate Fed chairs they inherited.

Source: Politico

Put simply: when it came time to pick the next Fed Chair, the Trump administration:

1) Broke with tradition (reappointing the current Fed Chair) and relieved Janet Yellen of her duties despite the media’s non-stop fawning over her.

2) Picked a man who has extensive private sector experience, NOT an academic economist.

3) Picked a man who was a central figure in developing policies through which the Fed would NO LONGER bail out failing firms.

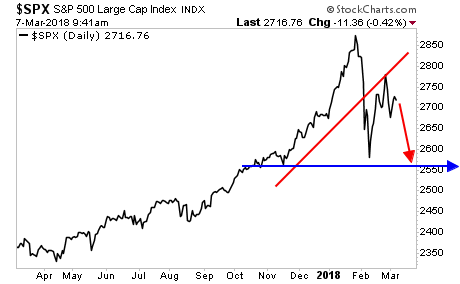

This makes one wonder… did Trump pick Powell because Trump knows the US will be having another financial crisis in the near future?

After all, Trump routinely called the stock market a “big fat bubble” in the run up to the 2016 election. As one of the most connected financial elites in the US, Trump would know better than most just how leveraged the system had become.

Why else would Trump pick the man who literally “wrote the book” on how to deal with systemic failure for the US banking system?

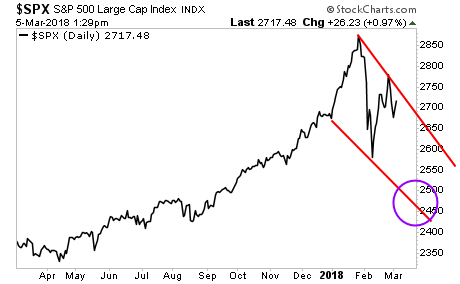

A crisis is coming. And smart investors will prepare for it well in advance.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research