Last week was options expiration week as well as the end of the Third Quarter. So hedge funds were highly incentivized to gun stocks and precious metals higher (hedge funds are currently mostly long stocks and precious metals) to game their 3Q12 performance.

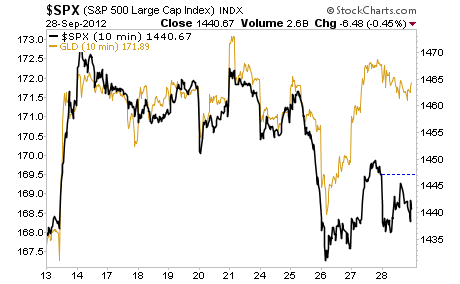

However, what’s notable is that despite this, stocks actually finished the week down. Indeed, as the below chart shows, hedgies continually pushed the market up only to find that there were few real buyers in the market, as a result, stocks tended to drift downward towards the end of each session.

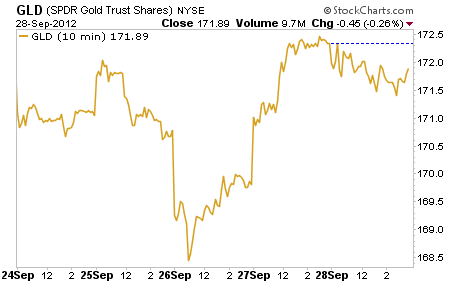

Gold on the other hand, finished the week up.

This is a critical development. A recent survey performed by Goldman Sachs indicates that the firm’s clients do not believe that QE 3 (or QE Infinite as it’s commonly called due to the program being continuous in nature) will do much to boost stocks, but that it will unleash higher inflation.

Last week’s action provides plenty of evidence that this is the growing consensus among institutional investors and hedge funds. This is particularly worrisome as it indicates that the Fed may have just spent its last bullet: if the only positive consequence of QE (stocks moving higher) is no longer in place while the negative consequences (higher inflation/ cost of living) are being exacerbated, then things will be getting very ugly indeed.

The key chart to watch for this will be the performance of Gold relative to the S&P 500. If and when the S&P 500 turns downward while Gold continues to rally, then the Fed will have lost all control and we’re heading into a truly disastrously inflationary collapse.

By the look of things, this is not far off. The below chart shows the performance of Gold vs. that of the S&P 500 since the Fed announced QE 3. If stock continue to crater while Gold rallies, then it’s GAME OVER for Fed intervention as the Fed literally cannot do anything more.

The significance of this cannot be overstated. The only reason the Fed has been able to get away with the various interventions it implements is because the stock market continues to rally each time the Fed supplies more juice.

So if the Fed announces an ongoing program with no end in site and stocks fall, then buckle up.

On that note, I’m currently preparing subscribers of my Private Wealth Advisory newsletter for the coming inflationary storm with a Special Inflation Portfolio consisting of unique, unknown inflation hedges that will outperform even Gold and Silver as inflation rips through the financial system.

I’m talking about extraordinary asset plays trading at massive discounts to their real value.

One of them is a junior Gold company with reserves valued at over $9 billion. Today it’s entire market cap is less than $300 million.

Another one is a Silver play currently valued by the market at less than 10% of its known reserves. And it’s already producing (so this is not some “pie in the sky” play on future discoveries)

I’ve got three other plays up my sleeve. I expect all of them will be up in the double digits in the weeks to come.

To find out what they are, all you need to do is take out a trial subscription to my Private Wealth Advisory newsletter. You’ll immediately be given access to my Special Inflation Portfolio as well as my three Special Reports titled Protect Your Family, Protect Your Savings, and Protect Your Portfolio.

Collectively, these reports outline critical information for the coming crisis including:

1) What banks are most exposed to systemic risk.

2) How, why, and where to buy Gold and Silver bullion.

3) How much food you need to stockpile, where to buy it and how to store it.

And more!

To take out trial subscription to Private Wealth Advisory…

Best Regards,

Graham Summers