The Euro situation is coming to a point… literally: we’ve entered a triangle pattern. In fact, we have a second triangle forming within this larger pattern.

We’ve got just a little more room to run before we reach the apex of this pattern. However, given how things are going over there, we could see the breakout come at any minute now. These patterns can break either up or down, but given the situation over there, it’s likely going to be down and it will be taking most of the financial world with it.

Remember, the European debt drama was always about Spain and Italy: Greece, Ireland, and Portugal were the minor players (Portugal did pose something of a threat in that Spanish banks were massively exposed to its debts). However, when Spain or Italy go down, they’re taking France and Germany (the two most solvent EU members) with them.

Remember, the European debt drama was always about Spain and Italy: Greece, Ireland, and Portugal were the minor players (Portugal did pose something of a threat in that Spanish banks were massively exposed to its debts). However, when Spain or Italy go down, they’re taking France and Germany (the two most solvent EU members) with them.

And that’s when the Eurozone will crumble.

With that in mind, the two key items to note are Italy’s emergency austerity program (how this tactic work for Greece and Ireland?) and France’s AAA credit rating coming under review.

This latter situation has almost come out of left field. But the fact that France is now coming under fire tells us that the European mess has now spread to the key “prime” players or France and Germany.

If you’ll recall, a similar process happened to the US banks in 2008 when the alleged “well capitalized” banks of Merrill Lynch and Morgan Stanley started collapsing. Greece and Portugal are like Bear Stearns. Italy and Spain will be Lehman Brothers. And France and Germany are Bank of America or Citigroup: Too Big To Fail. If the financial solvency of one of these countries (France or Germany) becomes suspect, then it’s game. set. match. for the Eurozone in its current form and the ensuing Crisis will make 2008 look like a picnic.

Keep your eyes on the French market. While the S&P 500 has exceeded its May 10 high (courtesy of the PPT), France is only just coming up to test this level. A breakdown here means that the next wave of collapse has begun:

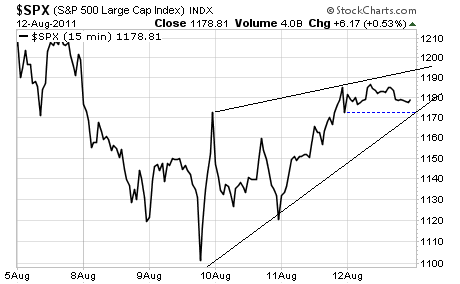

Speaking of the S&P 500, that index is forming something of a bearish rising wedge pattern. Given how weak things got towards the end of last week, we could see a breakdown as early as today). However, the pattern does allow for a final thrust to 1,200 or so.

Big picture: I warned to get defensive several weeks ago. Stay defensive now. This snapback rally is not the start of a new bull market rally. If anything, the volatility of the last week has made it evident that we’re back in a 2008 environment: you simply don’t see 3-4% price swings on a daily basis in a healthy market.

Big picture: I warned to get defensive several weeks ago. Stay defensive now. This snapback rally is not the start of a new bull market rally. If anything, the volatility of the last week has made it evident that we’re back in a 2008 environment: you simply don’t see 3-4% price swings on a daily basis in a healthy market.

On that note, if you’re looking for actionable investment ideas and in-depth market analysis that will not only get you through this mess, but actually help you make some money, you NEED to get in on my Private Wealth Advisory newsletter.

Over the last two weeks, while 99% of investors got crushed, Private Wealth Advisory subscribers locked in seven winners including gains of 6%, 7%, and 9% in as little as one day (no we were not using options, just stocks and ETFs).

My readers made money in 2008 and the Euro Crisis of 2010. They’re making money now.

They’re also taking steps to prepare their families and loved ones for what’s coming with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports, which are also included with every Private Wealth Advisory subscription.

To join them…take action to get your financial house in order… and start making this Crisis grow your portfolio instead of crushing it…

Good Investing!

Graham Summers