Thus far in his tenure as Fed Chair, Jerome Powell has emphasized that he is more concerned with the real economy than the financial markets.

Put another way, the Powell Fed, unlike the Bernanke or Yellen Feds before it, is willing to sacrifice stocks in the name of normalizing monetary policy provided the economy can withstand it.

As a result of this, the Powell Fed intends to continue with its rate hikes as well as the increase in QT (we go to $50 billion per month in July), despite the clear evidence that these policies is putting the financial markets under duress.

Indeed, already we’re seeing something of a meltdown in the Emerging Market space with Brazil, Turkey and other Emerging Stock Markets crashing.

—————————————————————-

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 41% this year alone.

In fact, we haven’t had a losing trade APRIL 2018.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

Here’s where it gets interesting.

Globally there is over $10 trillion in $USD shorts floating around the system. And with both rate hikes and QT strengthening the $USD, Powell is effectively playing “chicken” with this massive issue (at $10 trillion, this is roughly the size of the GDP of China).

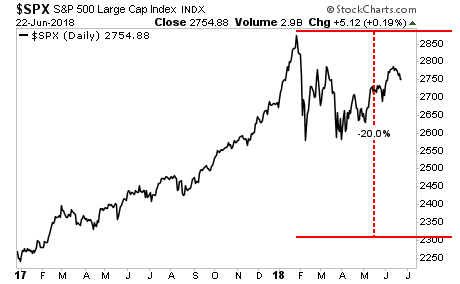

So while he claims he is willing to stomach market volatility, this might prove to be a bluff if the $USD short issue becomes systemic. Most Emerging Markets are already 20% off their recent peaks. If US stocks were to experience a similar drop, the S&P 500 would be at 2,300.

On that note, for the first time in 18 months, there is a significant risk that the markets might actually enter a free fall. Powell is playing a dangerous game. And if the Fed doesn’t walk back its policy there is a very real chance that the US markets could experience carnage similar to that which has already hit the Emerging Market Space.

If the Fed doesn’t figure this out soon, we could very well see a market bloodbath hit.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research