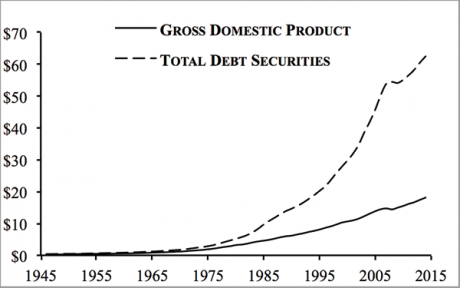

The Everything Bubble hit a new record in 1Q18… with total global Debt to GDP exceeding 318%.

All told, the world now has some $247 TRILLION in debt. As I explain in my bestselling book The Everything Bubble: The Endgame For Central Bank Policy, when the US abandoned the Gold Standard completely in 1971, it opened the door to a massive debt expansion.

Why?

Because from that point onwards, the US would be paying its debt solely in US dollars… dollars that the Fed could print at any time. What followed was truly parabolic debt growth, with total US debt growing exponentially relative to its GDP.

By the way, that chart is denominated in TRILLIONS of US Dollars.

—————————————————————-

10 of Our Last 11 Trades Were Double Digit Winners

Our options trading system is on a HOT streak: 10 of our last 11 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 35% this year alone… beating the S&P 500 by an astonishing 34%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

By the time the mid-90s rolled around, the US financial system was so saturated with debt the Federal Reserve opted to start intentionally creating asset bubbles to stop debt deflation.

The late ‘90s was the Tech Bubble.

When that burst, the Fed opted to created a bubble in Housing… a more senior asset class.

As a result, in the mid-00s we had the Housing Bubble.

When that bubble burst, the Fed opted to create a bubble in US Treasuries… the MOST senior asset class in the entire system, representing the risk-free rate of return against which all risk is valued.

Put another way, the Fed opted to create a bubble in the bedrock of the financial system. By doing this, literally EVERYTHING went into bubble-mode, hence my coining the term The Everything Bubble back in 2014.

Which brings us to today.

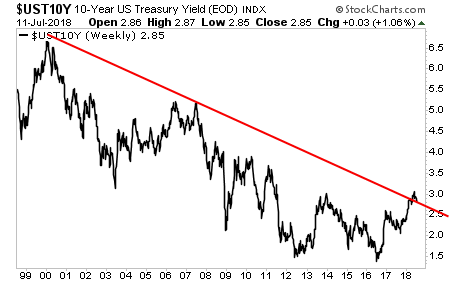

Yields on Treasuries have broken their long-term 20-year trendline.

This is a MAJOR problem. The entire debt bubble requires interest rates to remain LOW in order for it to be maintained. If bond yields continue to rise, bond prices will collapse.

If bond prices collapse, the Everything Bubble bursts.

The Fed now has a choice… continue to support stocks or defend bonds… and unfortunately for stock investors, it’s going to have to choose bonds.

Put another way, I believe there is a significant chance the Fed will let the stock market collapse in order to drive capital BACK into the bond market to force bond yields down.

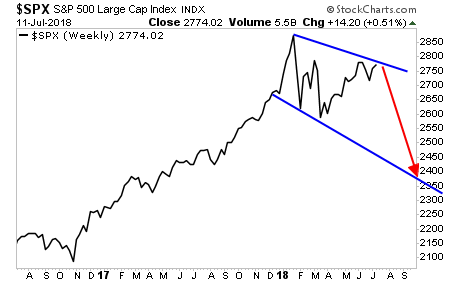

Yes, the Fed has screwed up with monetary policy. And it is doing so intentionally to try to sustain the Debt Bubble. Currently the downside target for the collapse is in the 2,300-2,450 range.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research