The US bond market is going the wrong way…

As I outlined in my bestselling book The Everything Bubble: The Endgame For Central Bank Policy, when the US completely severed the US dollar from the Gold Standard in 1971, US sovereign bonds, also called Treasuries, became the bedrock of the financial system.

From this point onward, these bonds represented the “risk-free” rate of return, the baseline against which ALL risk assets (including stocks) were valued. What followed was exponential debt growth as the US took advantage of this fact to go on a massive debt binge.

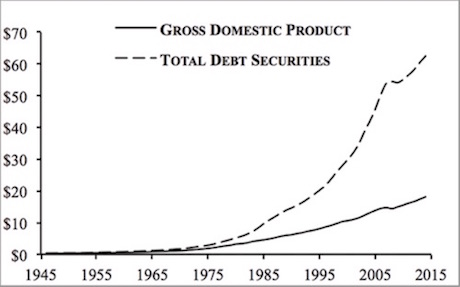

Debt vs. GDP in Trillions $USD.

ALL of this debt requires US bond yields to continue to fall. Put another way, in order for this massive debt bubble to be maintained the bond markets must make it continuously cheaper/ easier for the US to pay/ service its debts.

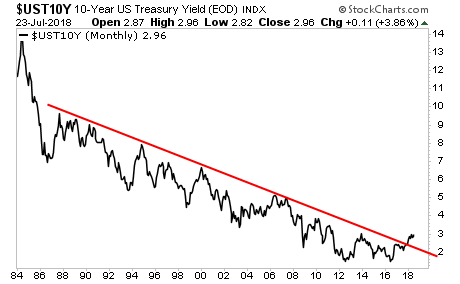

Which is why the recent breakout of bond yields is a MAJOR concern.

—————————————————————-

A Select Group of Traders Are CRUSHING the Market By 25%… With Just 1 Trade Per Week

Our options trading system is on a HOT streak: 12 of our last 14 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 29% this year alone… beating the S&P 500 by an astonishing 25%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

As you can see, the yield on the 10-Year US Treasury has broken above its long-term trendline… in the WRONG direction. This chart is telling us that it has become more expensive for the US to issue/service its debts.

Granted, this is not a systemic issue yet, but unless yields reverse soon, the Everything Bubble will begin to burst.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research