Last week the markets rallied on hype and hope of a potential trade deal between the US and China… and the fact it was options expiration week.

Wit those items out of the way, the markets will now begin to adjust to economic realities again.

Those economic realities? That the global economy is slowing… and not a little.

Indeed, the latest spate of economic data indicates just had bad things are getting.

- Japan’s core machine orders for the month of September was expected to drop 9%. It fell 18% instead.

- That same month, South Korea, a bell-weather for global trade/ growth, saw exports collapse 8%.

- And then China’s manufacturing PMI fell to 50 in September… just on the border of showing outright economic contraction. But given how heavily massaged Chinese data is to show growth, it is safe to assume the REAL number was MUCH lower (think 40).

This is happening at a time when EVERY major Central Bank is pulling the plug on liquidity.

The US Federal Reserve is now actively draining $50 billion per month from the financial system. The ECB will be ending its QE program next month. And now even the Bank of Japan is stating that large-scale monetary programs (QE) are losing favor.

Japan’s economic activity and prices are no longer in a situation where decisively implementing a large-scale policy to overcome deflation was judged as the most appropriate policy conduct, as was the case before,” Kuroda said in a speech to business leaders in Nagoya, central Japan:

Source: Marketwatch.

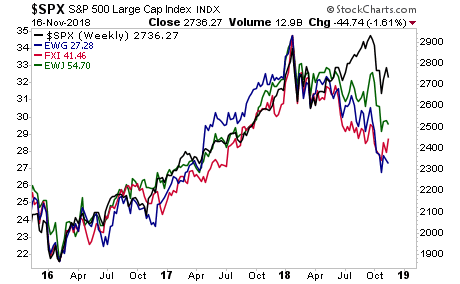

China, Germany, and Japan’s stock markets have already figured this out. It now time for US stocks to “play catch up.”

How bad will it get?

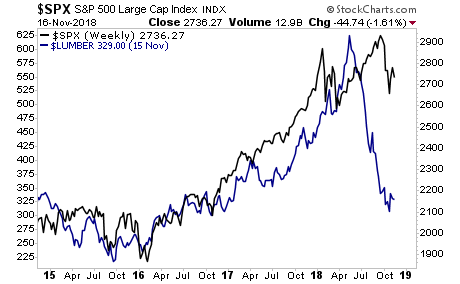

Lumber, perhaps the most “growth sensitive” asset on the planet, suggests the S&P 500 should be at 2,100.

Buckle up, the next crisis is about to hit.

If you are not already preparing for this, NOW is the time to do so.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research