Investors have to choose which of the two forces that are driving all stock market action they believe:

1) The approaching global economic collapse.

2) Desperate intervention to prop up the bursting bubble.

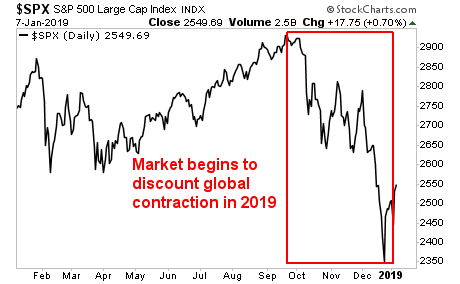

Regarding #1, in the last two weeks Apple, Samsung and Fed Ex have issued EXTREMELY negative guidance. If you think these three represent isolated corporate issues, think again. German Industrial Production collapsed the most since the 2008 crisis, while it’s just been revealed that REAL China GDP growth is somewhere below 3% and possibly even negative.

This is the global economic collapse the market began to discount in October. It is the reason why we had that major stock market drop. And it’s why the smart money has been selling stocks for months.

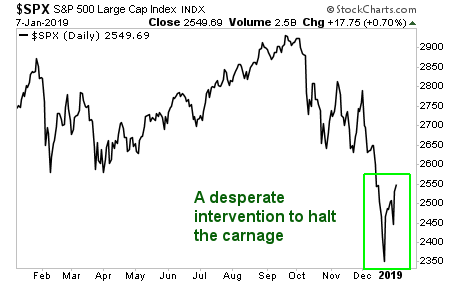

Against this backdrop of horrible fundamentals and massive selling pressure, we have a desperate series of interventions underway ranging from the President tweeting, US economic advisors saying there’s now chance of a recession, Fed Chair Powell suddenly suggesting that the Fed’s policies are indeed subject to change, and the Treasury Secretary calling the Plunge Protection Team to ramp stocks higher.

This is why stocks have erupted over the last three days. No real buyer invests BILLIONS of dollars indiscriminately all at once; REAL buyers enter large orders that take weeks to complete.

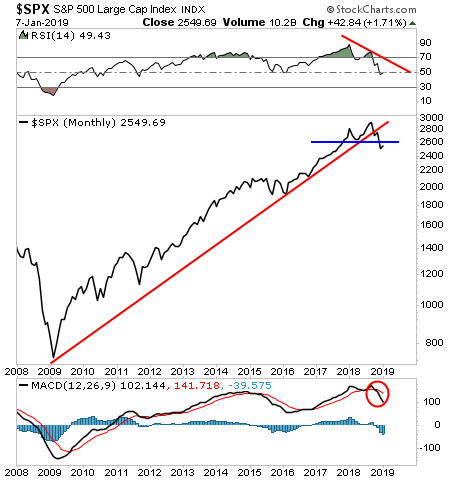

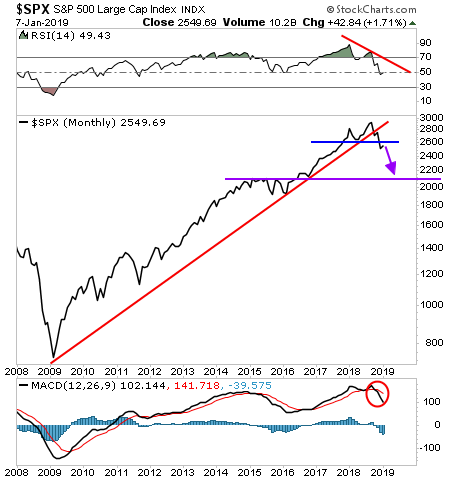

As investors we now have to choose which one of these we side with. Do we side with the fact that the credit cycle has turned and the bubble has burst… or do we believe that the Fed/ PPT can somehow hold the markets up despite this?

This chart seems pretty clear: we’ve broken the monthly bull market trendline for the first time EVER. Even if the S&P 500 rallies to 2,600, it won’t change anything from a chart perspective.

And what comes after that?

99% of investors will panic when this CRASH hits…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research