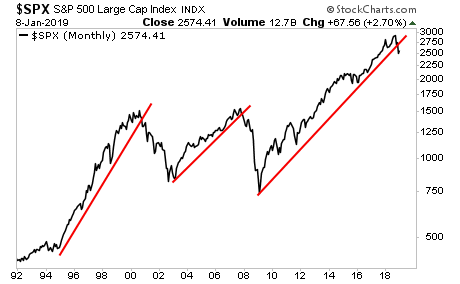

The bounce is just about over.

Multiple interventions, and active buying by the PPT have juiced stocks higher, but the Powers That Be cannot make the Everything Bubble whole again.

The fact is that between higher inflation along with the Fed’s rate hikes/ draining of liquidity has burst the Everything Bubble. It doesn’t mean that we’re moving straight into a systemic crisis right now. But it does mean that debt deflation is appearing again and that eventually it will spread to systemic issues.

That process is already underway.

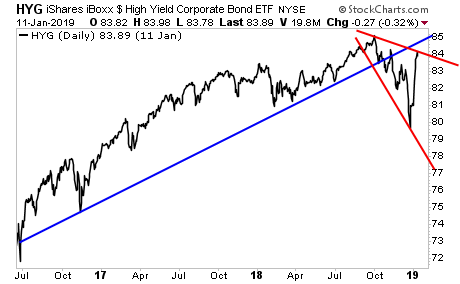

The ramp job in Junk Bonds was impressive, but it DID NOT reclaim its former bull market trendline (blue line). All it’s done is open a descending megaphone pattern that will see it crash to new lows shortly.

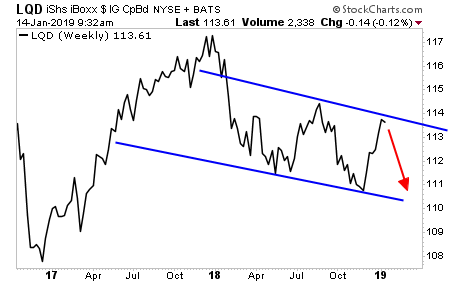

Similarly, Investment Grade bonds, which have been ramped higher, have just slammed into resistance (top blue line). They too suggest we’re going to new lows shortly.

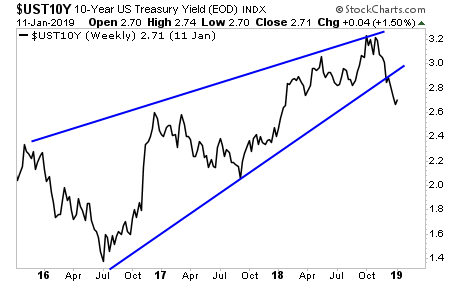

Finally, the 10-Year Treasury yield has broken down from a falling wedge formation. This suggest Treasuries will be rallying HARD, meaning capital is fleeing into them.

What would drive a move into Treasuries?

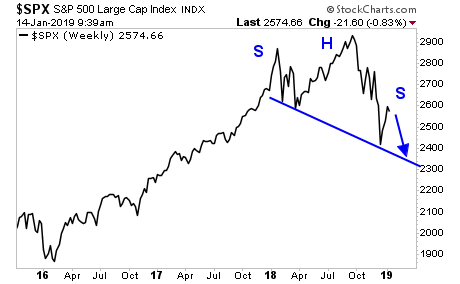

This:

Unfortunately, after that comes the REALLY bad part.

A Crash is coming… and 99% of investors will panic when it hits… but not those who have downloaded our 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on last week’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research