In the last few articles I’ve argued that stocks are in the last bull market of our lifetimes.

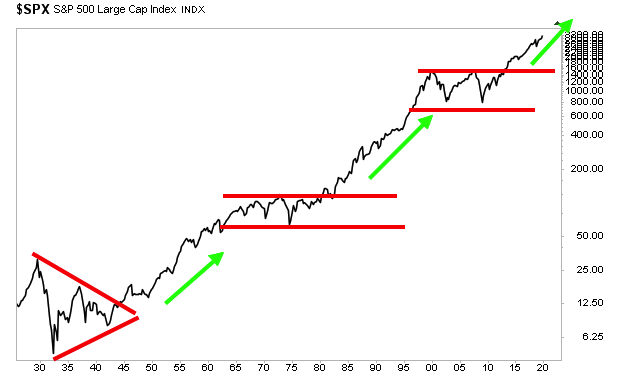

Forget opinions, take a look at the 100-year chart on the S&P 500 and you’ll see what I’m saying.

Many pundits and analysts claim that stocks entered a bull market in 2009. However, when you look at the big picture, it is clear that stocks were in a bear market, or a prolonged period in which they went nowhere from 1997 until mid-2013.

That means we’re six years into this bull market.

This raises the question… what will be the driving force to push stocks to new highs?

The answer is “cash on the sidelines.”

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

We have only 10 remaining slots available for this offer.

To snatch one of them for yourself…

———————————————————–

The fact is that this is the single most hated bull market ever.

During the last three years, investors have pulled $1 trillion out of the stock market and moved it into cash. Yes, we’re taking TRILLION with a “t.”

Things get even crazier when you zoom out to the big picture. Collectively, stock-based mutual funds and exchange-traded funds have seen OUTFLOWS in seven of the last 11 years.

Put another way, at a time when stocks have been rising almost non-stop (2008-2019) investors have PULLED MONEY OUT OF THE MARKET nearly two thirds of the time.

As a result of this, currently investors are sitting on $3.4 trillion in cash… an amount of money almost equal to the GDP of Germany.

Again, this is literally the most hated bull market in history. And it tells us that we’re nowhere near a market top. Market tops occur during market manias in which investors are “all in” on stocks .

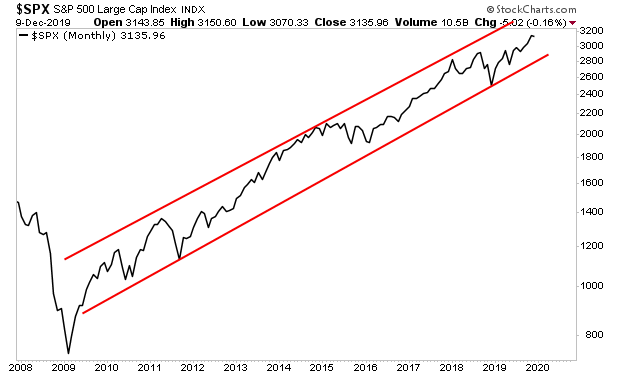

That is NOT the case now. It will be however, when the S&P 500 hits 5,000 in the coming months. The long-term bull market channel is open to this happening within the next 18 months.

If you’re looking for a means to profit from this, we just published a new investment report titled The Last Bull Market.

In it we outline how the bull market will unfold… which investments will perform best… and a unique play that more than TRIPLES the return of the broader stock market (its already up over 1,400% since the market bottom).

We are giving away just 99 copies of this report for FREE to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/TLBM.html

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital research