Ignore the doom and gloom crowd, they’re trying to scare you into missing out on one of the greatest investing environments in history.

That investing environment is based on the coming U.S. economic boom. The U.S. is the largest economy in the world by a considerable margin (it’s roughly the size of the 2nd, 3rd, and 4th, largest economies combined).

If the U.S. enters an economic boom, the rest of the world will follow. The reason so few investors understand this is because it’s been decades since the U.S. has a real economic boom.

Beyond the internet, what major innovation of the last 20 years can we point to? Social media hasn’t increased productivity in any meaningful way. Crypto currencies are just another investing fad driven by excess liquidity. Sure, computers are faster and there are electric cars, … but has anything truly revolutionary occurred?

Not yet. But it’s going to over the next five years.

The reason for this is that President Trump is going to win the 2020 election in a landslide. And without another election looming, his administration is going to cut regulations and business limiting legislation at a pace not seen since the Reagan administration.

This, combined with the Fed easing monetary conditions, is going to induce an economic miracle in the U.S. We’re going to see GDP growth of 3%, 4%, possibly even 5%.

And the markets knows it. Indeed, if the global economy is falling off a cliff, the markets didn’t get the memo.

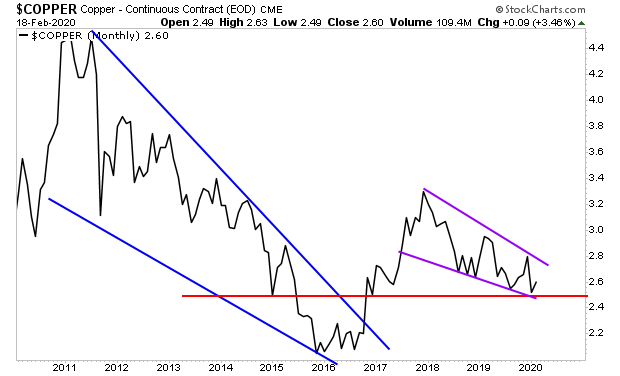

Consider copper. The industrial metal has so many uses that it’s often called “the commodity with a PhD in economics” because it so accurately predicts economic activity.

A supposed coronavirus epidemic, the trade war, the so-called recession (it’s not), impeachment, etc. Despite all of that negative stuff, copper didn’t even break below support (red line). And it remains WELL above its 2016 low. In fact, if anything, it is forming a clear bull flag (purple lines) and is preparing for what looks to be a MAJOR bull market.

Let me ask you, if the below chart was a stock, would you be bullish or bearish?

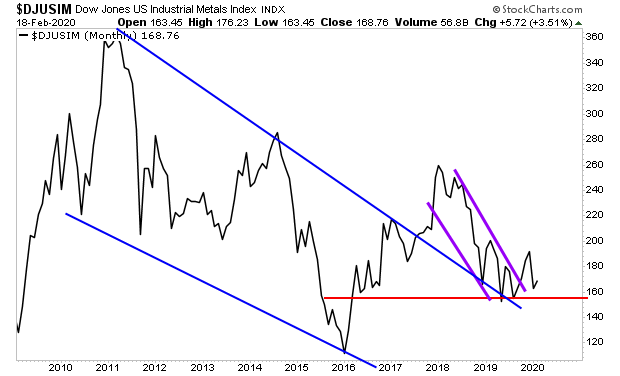

But what about industrial commodities in general? Surely, they’re showing signs of trouble, right? There’s NO WAY they’re predicting an economic boom!

Nope. Here again we see a near decade long bear market ending (blue lines). More recently a two year downtrend has been broken (purple lines) and support (red line) has held.

Again, if this chart was a stock, would you be a buyer or a seller? Personally, I know I’d be backing up the truck.

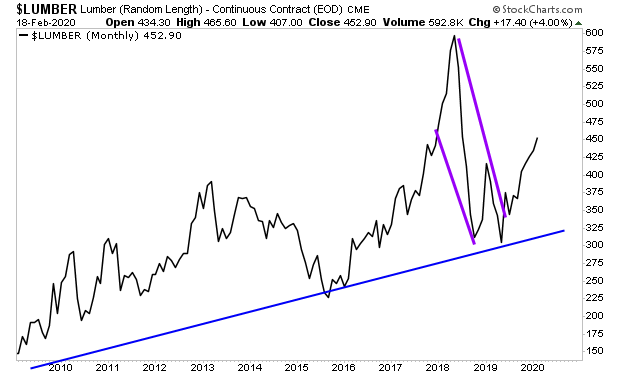

What about lumber? All that industrial metals demand is probably just China hoarding commodities to control prices. Surely, lumber, which is more closely aligned with the U.S. economy is showing signs of trouble?

I’ve got three words for you: Raging. Bull. Market.

The two-year downtrend (purple lines) is broken. And the next leg up in a MAJOR bull market is here.

Look, I don’t care about what various gurus or talking heads are predicting… I’d rather listen to the markets.

After all, they’re what’s going to make you rich…

And the markets are telling us… no, they’re SCREAMING that the U.S. economy is about to explode higher as President Trump wins the 2020 election in a landslide.

I want to be clear here…

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research