Disclaimer: I am not a scientist nor am I a healthcare official. I am not downplaying the Covid-19 situation; I am simply looking at what the markets are saying about the Covid-19 pandemic.

A very strange thing has started happening in the markets.

While the news continues to tell us that there is a global pandemic and that soon millions of people will be dead… the stock markets have begun bottoming.

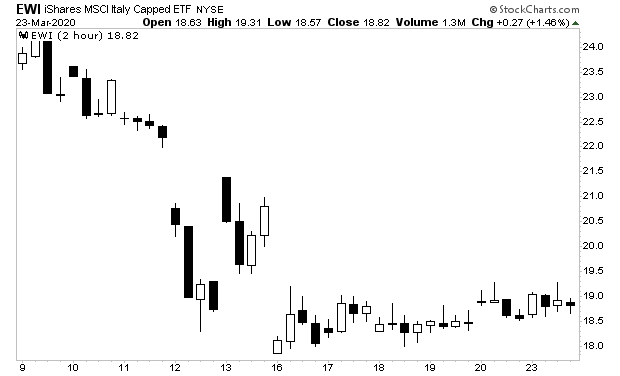

The stock market in Italy, which is supposed to be completely imploding from Covid-19, bottomed on March 16th. It failed to make a new low and has yet to roll over again.

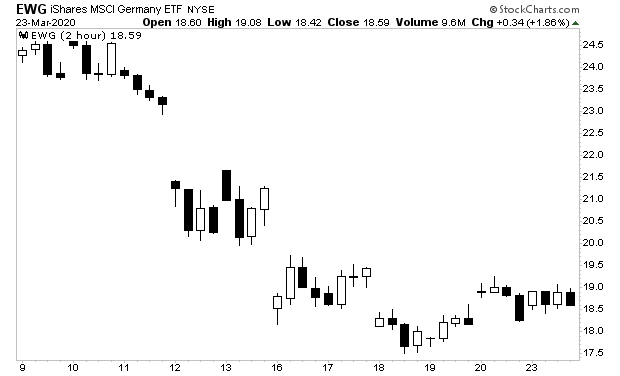

Germany, which is now experiencing its own Covid-19 issues, looks like it bottomed on October 18th. It is still touch and go here, but we have yet to see new lows.

Here in the U.S., multiple economic bellwethers are showing us something similar.

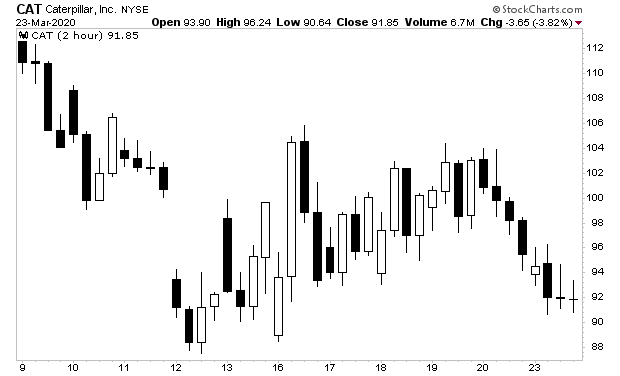

Caterpillar is the largest producer of large machinery in the world. If the world was entering a depression, and things were worsening, CAT’s stock actually bottomed on March 12th and is now putting in a higher low.

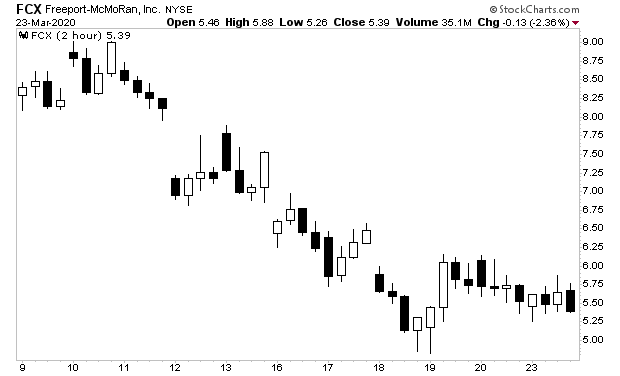

Similarly Freeport McMoran (FCX) is the largest copper producer in the U.S. Copper is a commodity that is closely linked to economic growth. And FCX’s share price looks like it bottomed last week on March 19th. Despite yesterday’s early morning bloodbath, FCX shares never broke to new lows.

Taken together, these charts are suggesting that the the market is in the process of bottoming. The one area of concern that has yet to give us the “all clear” is the credit markets.

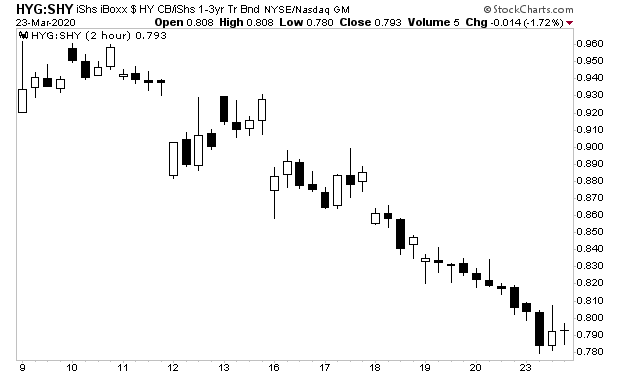

High yield credit spreads DID put in a new low yesterday. They are now attempting to bounce. But unless credit bottoms, any rally in stocks will be short-lived.

Put another way, if that last chart begins to rally in a significant way, stocks could EXPLODE higher.

These charts are suggesting to us that the first round of the crisis, the deflationary collapse, will be ending sometime soon. But the second round, the INFLATIONARY storm triggered, by central banks printing trillions of dollars is just around the corner.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

We are making just 100 copies available to the public.

As I write this there are 55 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research